Market Trends

Key Emerging Trends in the Complete Nutrition Products Market

The marketplace of comprehensive food items has seen dramatic developments in the past few years, indicating consumers' rising knowledge of and dedication to total wellness and good health. Another notable development includes the rising popularity of individualized dietary options. As people grow more cognizant about their distinct nutritional demands and tastes, they look for items that address particular requirements including their years of age, gender, as well as wellness objectives. It caused firms in every aspect of food and beverage sector to develop and provide customized choices, which range from customized diet strategies to specialized supplementation.

A different approach notable movement is an increase in based on plants as well as sustainable food solutions. Considering a growing worldwide consciousness about ecological issues along with a trend favoring plant-based diets, people are looking for nutritional alternatives that reflect their moral along with ecological beliefs. As a consequence, firms are launching organic comprehensive food supplements to meet the need for replacements for conventional animal derivated nutrients. Sustainable is rapidly playing an important role in defining marketplace tastes, impacting merchandise composition as well as packaging options.

The internet-based shopping explosion has had a tremendous influence upon shipment and availability of comprehensive meals solutions. Websites give individuals easy ways to find a variety of items, allowing them to shop for alternatives, research evaluations, and come to knowledgeable selections. This movement has altered the shopping scene, causing conventional physical shops to change and build a digital presence. The convenience of internet buying additionally contributed to the rise of specialized items, enabling startups to access an international customer base while competing with bigger, more reputable companies.

Healthy customers are increasingly demanding upfront and open branding. People are analyzing the packaging to learn about the components and their importance to nutrition. The following has resulted in a move favoring greener formulas that are without synthetic components, preservation agents, as well as additional sugar. Corporations who promote openness and give specific details concerning the origin and manufacturing procedures of the items they sell enhance their customer trust and confidence.

Multifunctional additives and novel compositions contribute to differentiated goods throughout the whole nutritional sector. Customers want goods which not solely satisfy their fundamental dietary needs, yet provide extra health advantages. This has resulted into the use of antibiotics, omega-3 fats, plus adaptive agents within nutritional products. Businesses are making investments within R&D to keep up with the competition by providing researched formulas which tackle specific medical issues including immunological assistance, mental clarity, and digestion.

Governmental regulations and guidelines have a critical part in influencing the whole complete nutrition products market or business. As public knowledge of nutritional as well as health issues develops, authorities are establishing rules to assure the security and effectiveness of such products. It has resulted in increasing examination of branding assertions and calorie counts, requiring producers to meet high quality requirements. The changing regulatory environment has an impact on item development plus advertising tactics, as businesses attempt to meet new requirements whilst satisfying client demands.

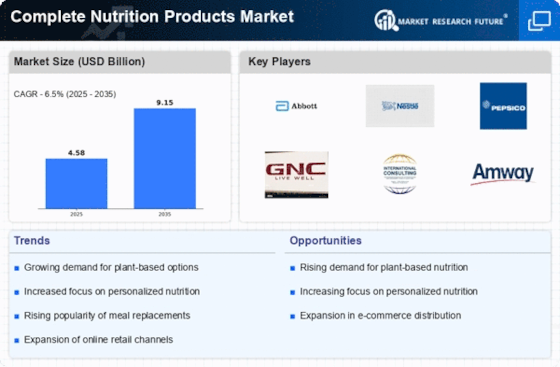

To summarize, market trends within complete nutrition products show that the marketplace is shaped by customer choices, technology breakthroughs, plus modifications to regulation. The sector is evolving as firms embrace an appetite for tailored, financially viable, and truthful nutritional services. Considering an ongoing focus upon well-being as well as wellness, an overall complete nutrition products market or industry is expected to see more creativity and expansion in the future decades.

Leave a Comment