- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

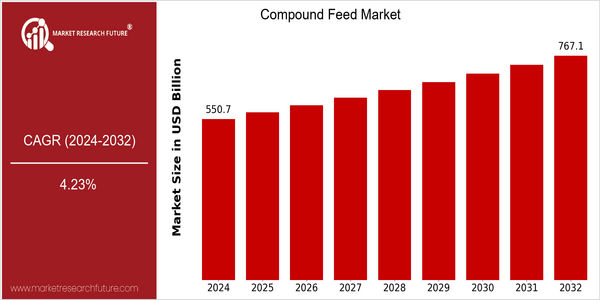

| Year | Value |

|---|---|

| 2024 | USD 550.661715 Billion |

| 2032 | USD 767.12 Billion |

| CAGR (2024-2032) | 4.23 % |

Note – Market size depicts the revenue generated over the financial year

The global compound feed market is poised for significant growth, with a current market size of approximately USD 550.66 billion in 2024, projected to reach USD 767.12 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.23% over the forecast period from 2024 to 2032. The increasing demand for high-quality animal protein, driven by rising global populations and changing dietary preferences, is a primary factor propelling this market forward. Additionally, advancements in feed formulation technologies and a growing emphasis on sustainable and efficient livestock production are further enhancing market dynamics. Key players in the compound feed industry, such as Cargill, Archer Daniels Midland Company, and Nutreco, are actively engaging in strategic initiatives to capitalize on this growth. These companies are investing in research and development to innovate feed products that improve animal health and productivity while minimizing environmental impact. Partnerships and collaborations aimed at enhancing supply chain efficiencies and expanding market reach are also prevalent, indicating a robust competitive landscape. As the industry evolves, the integration of digital technologies and data analytics in feed management is expected to play a crucial role in shaping future market trends.

Regional Market Size

Regional Deep Dive

The Compound Feed Market is experiencing dynamic growth across various regions, driven by increasing demand for livestock products, advancements in feed technology, and a growing focus on sustainable practices. In North America, the market is characterized by a strong emphasis on animal welfare and regulatory compliance, while Europe is witnessing innovations in feed formulations to enhance nutritional value. The Asia-Pacific region is rapidly expanding due to rising meat consumption and population growth, whereas the Middle East and Africa are focusing on improving food security through enhanced feed production. Latin America is leveraging its agricultural strengths to boost feed production, particularly in countries like Brazil and Argentina. Each region presents unique challenges and opportunities that shape the compound feed landscape.

Europe

- In Europe, the compound feed market is undergoing significant transformation due to the European Union's Green Deal, which aims to make food systems more sustainable and reduce the environmental impact of livestock farming.

- The rise of plant-based diets is prompting companies like ForFarmers and De Heus to innovate in feed formulations, focusing on alternative protein sources and enhancing the nutritional profile of animal feed to meet changing consumer preferences.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in demand for compound feed driven by rapid urbanization and increasing disposable incomes, with countries like China and India leading the charge in livestock production.

- Government initiatives, such as China's 'No. 1 Central Document' which emphasizes agricultural modernization, are encouraging investments in feed production technologies and infrastructure, thereby enhancing the overall efficiency of the compound feed market.

Latin America

- Latin America's compound feed market is bolstered by its strong agricultural base, with Brazil and Argentina being key players in the production of soy and corn, which are essential ingredients in animal feed.

- The region is also seeing increased investment in feed technology and research, with companies like BRF and JBS focusing on improving feed efficiency and sustainability to meet both domestic and export demands.

North America

- The North American compound feed market is increasingly influenced by regulatory changes aimed at improving animal health and safety, with organizations like the FDA implementing stricter guidelines on feed additives and contaminants.

- Innovations in feed technology, such as the development of precision nutrition and alternative protein sources, are being spearheaded by companies like Cargill and Archer Daniels Midland, which are adapting to consumer demand for more sustainable and health-conscious products.

Middle East And Africa

- In the Middle East and Africa, the compound feed market is significantly influenced by food security initiatives, with governments investing in local feed production to reduce dependency on imports, as seen in countries like Saudi Arabia and South Africa.

- The region is also experiencing a shift towards more sustainable feed practices, with organizations like the African Union promoting the use of locally sourced ingredients to enhance the nutritional value of animal feed and support local economies.

Did You Know?

“Did you know that approximately 70% of the world's feed production is used for livestock, with a significant portion of that being compound feed designed to optimize growth and health?” — FAO (Food and Agriculture Organization)

Segmental Market Size

The Compound Feed Market is a crucial segment within the broader agricultural sector, currently experiencing stable growth driven by increasing global demand for livestock products. Key factors propelling this demand include the rising population and changing dietary preferences towards protein-rich foods, alongside regulatory policies promoting animal welfare and sustainable farming practices. Additionally, technological advancements in feed formulation and production processes are enhancing feed efficiency and nutritional value. Currently, the market is in a mature adoption stage, with leading companies such as Cargill and Archer Daniels Midland (ADM) implementing innovative feed solutions across regions like North America and Europe. Primary applications include poultry, swine, and ruminant feeds, where tailored formulations improve growth rates and health outcomes. Trends such as the push for sustainability and the impact of pandemics on supply chains are catalyzing shifts towards more resilient and eco-friendly feed production methods. Technologies like precision nutrition and alternative protein sources are shaping the segment's evolution, ensuring that it meets both consumer demands and regulatory standards.

Future Outlook

The Compound Feed Market is poised for significant growth from 2024 to 2032, with a projected market value increase from approximately $550.66 billion to $767.12 billion, reflecting a compound annual growth rate (CAGR) of 4.23%. This growth trajectory is underpinned by rising global meat consumption, driven by population growth and increasing disposable incomes, particularly in emerging economies. As consumers become more health-conscious, there is a growing demand for high-quality animal protein, which in turn fuels the need for efficient and nutritionally balanced compound feeds. By 2032, it is anticipated that the penetration of compound feed in livestock production will reach upwards of 70%, particularly in regions such as Asia-Pacific and Latin America, where livestock farming is expanding rapidly. Key technological advancements and policy drivers are expected to shape the future landscape of the compound feed market. Innovations in feed formulation, including the use of alternative protein sources and additives that enhance feed efficiency and animal health, will play a crucial role. Additionally, sustainability initiatives and regulatory frameworks aimed at reducing the environmental impact of livestock farming are likely to encourage the adoption of more sustainable feed practices. Emerging trends such as precision nutrition and the integration of digital technologies in feed management will further enhance productivity and profitability for producers. As the market evolves, stakeholders must remain agile to adapt to these changes and capitalize on the opportunities presented by this dynamic sector.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 4.23% (2024-2032) |

Compound Feed Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.