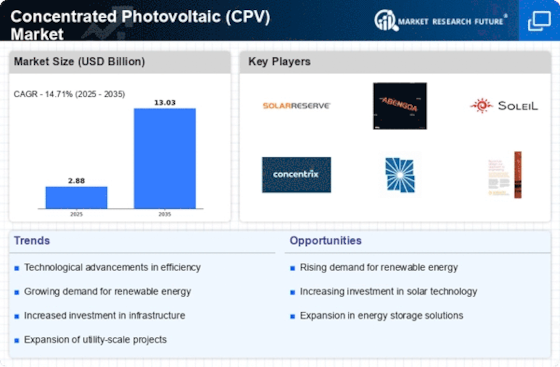

Market Trends

Introduction

CIGS is a field which has a long future ahead of it. It is a field which is going to be transformed by the coming together of three great macro-factors, namely, rapid development of the technology, a growing pressure of regulations and a change in the habit of consumers. The technology is developing rapidly, and this will increase the efficiency and reduce the cost of the system, and thus make it more accessible and attractive. Then, with the growing pressure of regulations, governments are going to be able to give a much higher priority to the development of the production of electricity from clean sources. This will encourage the development of CIGS. Also, a growing preference among consumers for sustainable energy solutions is changing the market and forcing companies to adapt and invent. These three macro-factors are essential to understand for industry players. They are both challenges and opportunities, and they are influencing their strategic decision-making and their long-term survival in the market.

Top Trends

-

Increased Efficiency of CPV Systems

CPV cells have recently been developed that can reach efficiencies of more than 40 per cent. Multijunction cells are being developed by companies like SolAero. Efficiency is the most important thing. It reduces the area required for solar cells. This means that more projects can be approved in the city. This is changing the market. And there may be more developments in cell materials and designs. -

Integration with Energy Storage Solutions

The combination of photovoltaic systems with storage devices is increasingly common. Among other things, there are now close links between the manufacturers of concentrating photovoltaics and companies that produce batteries for the storage of energy. This symbiosis enables a more efficient management of energy production, especially during peak periods. This has a major practical effect, as it makes concentrating photovoltaics more viable in terms of grid applications. In the future, it is likely that there will be more hybrid systems that combine different kinds of energy from various sources. -

Government Incentives and Policies

The government of the United States is promoting the development of a broader range of energy sources, including concentrated photovoltaics. For example, it has extended tax credits for solar energy, thus encouraging the investment in CPV technology. These tax incentives help to reduce the high initial cost of a CPV system. The business impact is obvious. More projects are underway, and the market is becoming more competitive. And if policy changes take place in the future, CPV solutions could become even more attractive. -

Emergence of Hybrid CPV Systems

A new trend is the hybrid concentrating photovoltaic system, which combines the traditional photovoltaic with concentrating photovoltaic. The company Morgan Solar is developing such a solution, which combines both technologies to optimize energy production. This allows better performance in bad weather and greater reliability. The operational impact is a wider range of applications, especially in regions with diverse climates. Future developments may focus on the optimization of hybrid systems for a specific environment. -

Focus on Sustainability and Recycling

The CPV market is now focusing on sustainability, and companies are exploring the possibility of reusing materials. Sanan Optoelectronics, for example, is trying to reduce waste and increase the life cycle of CPV systems. The trend is driven by an increasing number of regulations and by consumers’ demands for sustainable solutions. Business drivers include cost savings and improved brand reputation. Future developments could see a unified approach to the industry’s waste management. -

Advancements in Tracking Systems

CPV systems have been further improved by the development of advanced pointing systems. Companies are investing in two-axis trackers to optimize the collection of solar radiation throughout the day. This can lead to an increase in energy production of up to 30%, which makes CPV even more competitive. The effect on production is considerable, enabling more efficient use of the land and increased energy yields. Artificial intelligence may be used to optimize pointing in real time. -

Expansion into Emerging Markets

Because of the high solar potential in emerging markets, concentrating photovoltaics are increasingly used there. In Africa and Southeast Asia, the initiation of concentrating photovoltaic projects is driven by the initiatives of national governments and international organizations. The growth of this industry is essential for the supply of energy in these regions. The economic consequences are new opportunities for concentrating photovoltaic manufacturers. And future developments may well be adapted to the special needs of these markets. -

Collaboration with Research Institutions

The collaboration between manufacturers and research institutes is the engine of innovation in this industry. It aims at developing new materials and new technologies to improve performance. Universities, for example, are working on new silicon materials for concentrating photovoltaic cells. The practical consequences are considerable, because they speed up innovation and commercialization. These collaborations may lead to future discoveries that will change the capabilities of concentrating photovoltaics. -

Digitalization and Smart Technologies

The integration of digital technology into CPV systems is transforming their operation and maintenance. Smart monitoring is being developed to optimize performance and predict the need for maintenance. The reliability of the system can be improved by the use of the Internet of Things and artificial intelligence. Business benefits include lower operating costs and higher energy yields. The use of digital twins for real-time control may become the norm in the future. -

Increased Competition and Market Consolidation

Competition is growing in the CPV market, which is likely to lead to the emergence of a few dominant companies. The smaller companies will also seek to establish themselves through alliances or takeovers. The trend to scale is driven by the need to reduce costs and improve efficiencies. The result is a more efficient supply chain and greater innovation capability. In the future, it is possible that the CPV market will be dominated by a few players.

Conclusion: Navigating the CPV Market Landscape

Concentrated photovoltaics (CPV) will be characterized by a high degree of competition and fragmentation in 2024. Among the major players will be established and new players. The trends will be dominated by innovation and the development of sustainable concepts, especially in regions with high solar insolation, where CPV technology is particularly effective. The suppliers will be strategically positioned with the help of intelligent tools such as artificial intelligence for predictive analytics, automation for operational efficiency and flexibility to meet the energy needs of different customers. In the changing market, leadership will increasingly depend on the ability to combine these strengths in a way that not only meets current needs but also anticipates future changes in customer preferences and the regulatory environment. In this environment, the decision-makers must focus on strengthening their relationships and investing in research and development.

Leave a Comment