Condom Size

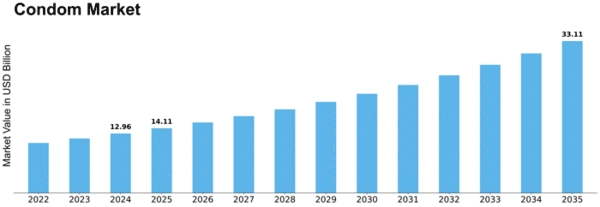

Condom Market Growth Projections and Opportunities

The condom market is influenced by a combination of factors that collectively contribute to its growth and evolution. Global efforts to promote safe sex practices and raise knowledge of sexual health issues are major motivators. The increasing demand for condoms as a dependable and easily accessible method of barrier contraception is a result of public health campaigns and educational programs stressing the need of contraception and protection against sexually transmitted infections (STIs). Changes in society and culture have a significant impact on the condom business. The normalization of condom usage is facilitated by shifting perspectives on sexuality, an emphasis on personal empowerment, and destigmatization initiatives. Demand is being driven by the growing perception of condom usage as a proactive and responsible sexual health decision as cultural standards change. The condom industry is expanding as a result of technological developments in the production process. Constant material innovation, such as the development of ultra-thin latex and non-latex substitutes, improves user comfort and attractiveness of condoms. Innovative elements that appeal to a range of customer preferences, such as textured surfaces and creative packaging, help brands stand out from the competition and grow their markets. The adoption of condoms varies by area and is influenced by accessibility and economic reasons. The demand for various condom kinds and the prevalence of condom usage are influenced by differences in healthcare availability, cultural acceptance, and economic situations. Market participants need to maneuver across these varied terrains to guarantee that their merchandise meets the distinct obstacles presented by various marketplaces. The regulatory environment around items related to sexual health is a significant determinant of market dynamics. Strict legal requirements guarantee the quality, safety, and effectiveness of condoms, which affects their distribution, commercialization, and approval. Adherence to these laws is crucial for entering the market and fostering confidence among customers, healthcare providers, and regulatory bodies. One important factor in the condom business is the patient-centric approach to sexual health. Condoms that put the comfort, sensitivity, and safety of the user first are more popular. The creation of condoms that cater to particular issues, including allergies to latex, and provide a satisfying user experience is consistent with the patient-centered paradigm in sexual health.

Leave a Comment