- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

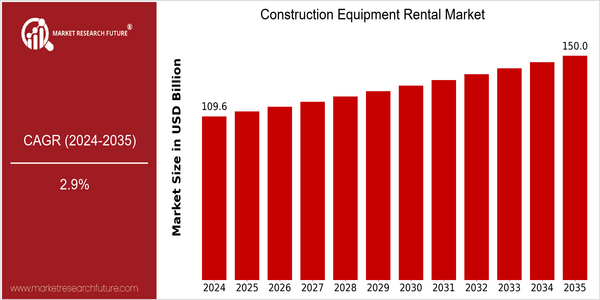

Construction Equipment Rental Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 109.6 Billion |

| 2035 | USD 150.0 Billion |

| CAGR (2025-2035) | 2.9 % |

Note – Market size depicts the revenue generated over the financial year

- The global rental of construction equipment is expected to grow steadily, with a current value of $109.6 billion in 2024, projected to reach $150,000,000,000 in 2035. This growth represents a CAGR of 2.9% from 2025 to 2035. The market is expanding for several reasons, including the growing demand for construction activity, the development of urbanization and the construction of the network, the trend towards renting over buying, which offers savings and flexibility to construction companies. In addition, technological developments such as the integration of telematics and the Internet of Things in construction equipment are enhancing the efficiency and safety of operations and thus encouraging more companies to use rental services. The main market players, including United Rentals, Sunbelt Rentals and Herc Rentals, are pursuing their strategies of alliances and technological investments to enhance their services and market share. These developments suggest that the market for rental of construction equipment is a robust one, able to adapt to evolving needs and technological developments.

Regional Deep Dive

The Construction Equipment Leasing Market is growing significantly across the globe, driven by increasing urbanization, growing construction activities, and a shift towards cost-effective leasing solutions. The North American market is characterized by a mature rental industry with a strong presence of leading players and a focus on technological advancements. Europe is characterized by a rise in sustainable building practices, while the Asia-Pacific region is expanding rapidly due to growing construction activities and government initiatives. The Middle East and Africa region is experiencing a rise in investments in the field of infrastructural development, while the Latin American market is slowly adopting leasing solutions, owing to a gradual improvement in economic conditions.

North America

- Among the companies which have led the way in the telematics and digital solutions are United Rentals and Sunbelt Rentals.

- With the EPA's initiatives, rental companies are investing in equipment that is more environmentally friendly.

- The gradual recovery from the COVID pandemic has led to an increased demand for rented construction equipment, especially in the residential and commercial sectors.

Europe

- The European Green Deal is pushing rental companies to adopt a more sustainable approach, and companies such as Loxam are investing in electric and hybrid vehicles.

- The innovations in prefabricated construction have redoubled the demand for special rental equipment, and the rental companies are modifying their equipment to meet the new needs.

- The post-pandemic construction industry, supported by government stimulus packages in various countries, has a good chance of growth.

Asia-Pacific

- The Belt and Road Initiative has given a significant boost to construction projects, and the rental of construction machinery has become an important business in the region.

- The development of smart cities in India and other countries offers rental companies the opportunity to supply high-tech equipment and solutions.

- The Government’s policy of promoting public-private associations has also facilitated the development of large-scale construction.

MEA

- Al-Futtaim and Al-Bahar are expanding their rental fleets in order to meet the demands of the market.

- With the National Plan for Industrial Development and Logistics, the construction sector is undergoing a transformation that is causing a growing demand for rental equipment.

- A regulatory framework is evolving which favours foreign investment in construction, and which makes the rental market more attractive to international players.

Latin America

- Brazil's National Plan for the Development of its National Territory is giving a new lease of life to the construction industry, and with it a new demand for equipment on hire, as the companies seek to save on costs.

- In recent years, the use of information technology in rental has increased significantly, with many local companies adopting digital platforms for managing equipment and customer relations.

- The recovery of the post-pandemic economy has led to a revival of construction, and governments in the region have pushed public works projects to promote growth.

Did You Know?

“In the United States, about half of the contractors are now renting their equipment instead of buying it, a trend that is bringing about a major change in industry practices.” — American Rental Association (ARA)

Segmental Market Size

The Construction Machines Rental Market is a vital segment of the overall construction industry, and is currently growing at a healthy rate. The demand for these machines is mainly driven by the increasing need for cost-effective solutions from construction companies, and the growing trend of urbanization, which necessitates the use of specialized equipment for various construction projects. In addition, government regulations encouraging sustainable construction practices have pushed companies to rent machines instead of purchasing them, which is also boosting the growth of the market.

At the present time, the rental market is in a mature state, with such large players as United Rentals and Sunbelt Rentals leading the way in North America. In this market, the most important areas of application are in the fields of civil engineering, construction, and commercial projects, where the most frequently used equipment is excavators, bulldozers, and cranes. Among the main growth drivers are trends such as the drive for sustainability, which has been accompanied by government initiatives in the field of green building, and the development of the Internet of Things, which has improved the management and efficiency of equipment. These developments will continue to shape the future of the rental market, enabling it to become more responsive to the changing requirements of the construction industry.

Future Outlook

The world market for rental of construction machinery is a growing market, and it is expected to increase from $109.6 billion in 2024 to $149.8 billion by 2035, a CAGR of 2.9%. This growth is mainly driven by the need for flexible and cost-effective construction solutions, especially for the development of global infrastructure projects. The trend of urbanization and the need for sustainable construction will also drive the rental market, which allows companies to reduce investment and access the latest equipment.

The rental market will be further boosted by the growing use of IoT and telematics, which will increase the efficiency and safety of construction operations. Moreover, government initiatives to promote the construction of new roads and buildings, as well as green building, will create a favorable environment for the rental market. The rental business model is an excellent way to reduce waste and optimize resource use, which is becoming more and more important for companies. Furthermore, the increasing use of digital platforms will facilitate the access of contractors to a wide range of machines on demand and thus further increase the market penetration.

Moreover, the trend towards the use of electric and hybrid construction equipment will have a significant influence on the market. If the regulations become more and more strict, the companies that adapt to these changes and offer greener equipment will be the ones who will win the competition. The penetration of the rental market is expected to exceed 30 percent in some countries by 2035. The preference for renting among small and medium-sized enterprises and large contractors will also increase. In general, the rental of construction equipment will change significantly in the next twenty years, mainly due to technological innovation, government support and changes in customer preferences.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 95.1 billion |

| Growth Rate | 4.74% (2024-2032) |

Construction Equipment Rental Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.