Research Methodology on Construction Equipment Rental Market

Introduction

The research methodology used in this study focuses on both qualitative as well as quantitative research to gain an in-depth understanding of the global construction equipment rental market. To compile this market report accurately, the primary data used is obtained from interviews with industry experts and key insights collected from market players. This is represented in form of tables, charts, and figures to present an in-depth analysis of the market. Additionally, secondary data has also been collected from reliable sources such as national databases, industry journals, and magazines. These sources include both published and unpublished data.

Research Methodology

The research study adopts both primary and secondary research methodologies. For the primary research, industry experts, manufacturers, and suppliers of construction equipment rental services were directly interviewed. During the primary research, in-depth and structured interviews were conducted with vendors and industry experts to gain insights into the market. Details related to the company's recent developments, products and services are also been obtained from secondary sources.

For quantitative research, the data is triangulated based on the bottom-up and top-down approaches. To validate the information obtained from secondary sources and authenticate the market estimation process, a comprehensive market study is conducted.

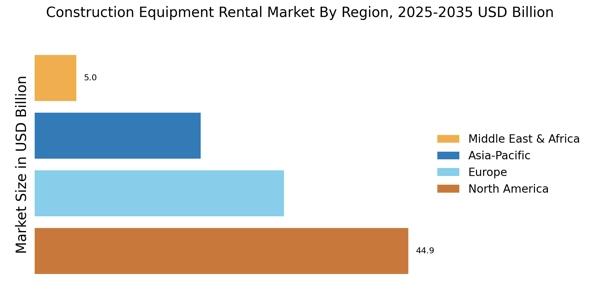

The market numbers are determined after analysing the data collected from both primary and secondary sources. The scope of the market relies on the both demand-side and supply-side. On the demand side, the research is conducted to analyze the market segmentation such as applications, end-user, etc. On the supply side, market dynamics are considered while forecasting the size of the construction equipment rental market. The data gets tested and triangulated multiple times to eliminate errors, and inconsistencies and provide suitable inputs for the analysis and graphical representation of the market.

Research Assumptions and Limitations

The below-mentioned assumptions have been made for the purpose of this project.

Assumption 1:

All data is obtained from reliable sources and is believed to be true and accurate.

Assumption 2:

All methods, processes and tools used for the analysis and graphical representation are up to date and are internationally recognized and accepted.

Conclusion

The research methodology used in this report provides a detailed description of the research approach and techniques used to prepare this market report. This report provides an accurate understanding of the global construction equipment rental market with the help of structured interviews, single and multiuser primary research and analysis of secondary sources. The research methodology and assumptions made in this report ensure that the data and figures provided are up-to-date and relevant.