Construction Lasers Size

Construction Lasers Market Growth Projections and Opportunities

The Construction Lasers Market is an arena in which a lot of different factors are involved that in the end serve only one purpose of influencing its trends of the market and later of its growth. The crucial aspect here is the growing phenomenon of the building industry all around the globe. Along with the upshot of urbanization and construction of related infrastructures, the demand for lasers increases for construction industries. These lasers have priority tasks in high-precision works, such as marking the level, grading, and planes. The expansion in the construction sector which constantly shows the increasing level of investments levied on the residential, commercial, and construction projects, is among the main drivers of the market’s growth.

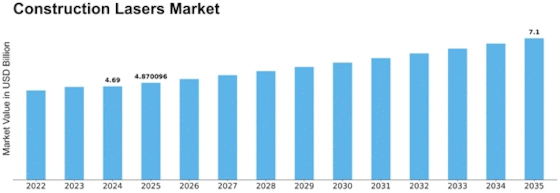

Construction Lasers Market by the Value was quite a bit over USD 4.3 billion in 2022. The future of the Construction Laser industry looks very promising as it is expected to increase its sales by increasing 4.4% from 2023 to 2032 to reach the sum of 6.3 billion dollars by 2032.

Technological progress being another crucial demand factor influences the market negatively. The replacement of conventional survey or layout devices by construction lasers due to the continuous innovations in laser technology has led to a development of more sophisticated and efficient production laser. Now companies are using the modified laser diodes and wireless connectivity together with enhanced durability to fulfill users’ needs what designing and actually performing of the construction is concerned. The integration of these BET technologies are what make these lasers perform better than their older version lasers, which has subsequently made them more appealing to customers who are seeking to use more advanced tools for their projects.

As for the government regulations as well, they also significantly influence the Construction Lasers Market. However, stricter safety and quality measures regulated by a wide range of authorities will only be expectations for these manufacturers in their attempts to conform to some guidelines in the design and production of construction lasers. Conforming to the listed ordinances not only protects the employees of construction sufficiently but also bolsters the market's reputation. Not only that but the government initiatives that support innovative construction methods and the latest technology increase the market development by making a way for avoiding use of construction lasers.

Market competition and vendor landscape along with definite shaping are extremely important within the construction lasers market. The presence of multiple eyes on the necessary to stay competitive and to create the newest product or better the offered, the firms engaged in fierce competition. Manufacturers believe in growing their share of the market through innovation. They have unique features and compete on price in this industry, this develops the sector. The competition on the field drives a good deal for buyers, where they can shop around for real estate lasers whose different levels of specification and price tags can match their exact needs.

Leave a Comment