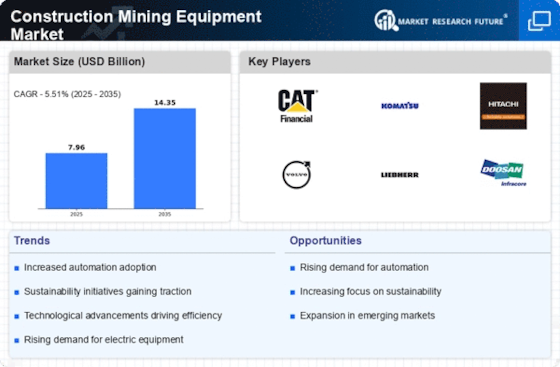

Top Industry Leaders in the Construction Mining Equipment Market

The construction and mining equipment market, the backbone of building infrastructure and extracting valuable resources, is From earthmovers carving landscapes to drilling rigs unearthing minerals, this market is a vital component of global development. However, beneath the surface lies a fiercely competitive landscape where established players battle it out with agile newcomers.

Strategies Shaping the Terrain:

-

Industry Giants: Caterpillar, Komatsu, Hitachi, and JCB maintain dominance through their global reach, extensive equipment portfolios, and robust service networks. Their strategies focus on R&D for advanced technologies, strategic acquisitions, and expanding into high-growth regions like Asia. -

Regional Champions: Regional players like Zoomlion (China), Doosan (South Korea), and SANY (China) hold strong positions in their respective markets. They offer competitive pricing, cater to regional demands, and build strong local distribution networks. -

Technology Pioneers: Emerging players like Trimble and Topcon are carving niches with data-driven solutions like telematics, automation, and remote diagnostics. They capitalize on digital innovations and cater to customers seeking increased efficiency and safety.

Factors Dictating Market Share:

-

Product Portfolio and Innovation: Offering a diverse range of technologically advanced equipment catering to various applications like earthmoving, excavation, and material handling attracts a wider customer base and increases market share. Continuous innovation is crucial for staying ahead of the curve. -

Production Efficiency and Cost Optimization: Optimizing manufacturing processes, streamlining supply chains, and offering competitive pricing are essential for gaining market share, particularly in price-sensitive regions. -

Sustainability and Environmental Impact: Developing fuel-efficient equipment, adopting cleaner technologies, and offering solutions for recycling and waste management address environmental concerns and open doors to emerging markets. -

After-Sales Service and Support: Providing excellent customer service, readily available spare parts, and comprehensive maintenance programs builds trust and fosters repeat business, leading to market share consolidation. -

Digitalization and Connectivity: Integrating telematics, remote diagnostics, and data analytics into equipment offerings enhances uptime, improves efficiency, and attracts tech-savvy customers.

Key Players:

-

Liebherr-International AG

-

Zoomlion Heavy Industry Science & Technology Development Co.

-

Terex Corporation

-

CNH Industrial N.V.

-

Joy Inc.

-

Hitachi Construction Machinery Co. Ltd.

-

Atlas Copco AB

-

Volvo Group

-

Caterpillar Inc.

-

Komatsu Ltd.

Recent Developments :

-

September 2023: Doosan acquires a leading manufacturer of electric drivetrain systems for construction equipment, accelerating its electrification strategy. -

October 2023: Trimble launches a cloud-based platform for managing construction fleets, offering real-time data and analytics for improved efficiency and productivity. -

November 2023: Topcon partners with a startup developing augmented reality solutions for construction projects, enabling visualization and real-time guidance for workers. -

December 2023: JCB announces plans to build a new manufacturing facility in India, targeting the rapidly growing Indian construction market.