Construction Nails Size

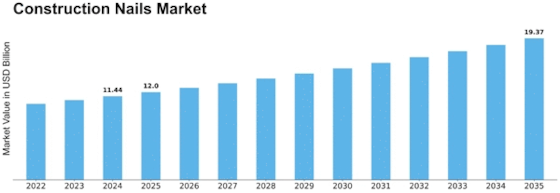

Construction Nails Market Growth Projections and Opportunities

The Construction Nails market is influenced by a myriad of factors that significantly shape its growth and trajectory. To understand the dynamics of this industry, it's crucial to explore the critical market factors shaping the Construction Nails market. Here are key factors presented in a clear and concise pointer format: Construction Industry Growth: The demand for construction nails is intricately linked to the growth of the construction industry. As construction activities expand globally, the need for nails for various applications, including framing, roofing, and carpentry, experiences a parallel surge. Residential and Commercial Building Trends: Trends in residential and commercial building construction directly impact the construction nails market. The type and quantity of nails required vary based on architectural styles, building materials, and construction methods, reflecting the evolving demands of the construction sector. Infrastructure Development Projects: Large-scale infrastructure projects, such as bridges, highways, and tunnels, contribute to the demand for construction nails. The scale and complexity of these projects necessitate a diverse range of nails for structural support, securing materials, and various construction applications. Housing Market Trends: The health of the housing market influences the construction nails market. Fluctuations in housing demand, driven by factors like interest rates, economic conditions, and demographic trends, impact the overall consumption of construction nails in residential construction. Innovations in Nail Design and Materials: Ongoing innovations in nail design and materials impact market dynamics. Manufacturers introducing nails with enhanced durability, corrosion resistance, and application-specific features cater to the evolving needs of the construction industry, influencing purchasing decisions. Regulatory Standards and Building Codes: Compliance with regulatory standards and building codes is a critical factor in the construction nails market. Nails must meet specific quality and safety standards, and adherence to building codes influences the types of nails used in construction projects. Technological Advancements in Nail Manufacturing: Technological advancements in nail manufacturing processes contribute to market evolution. Automation, precision engineering, and the use of advanced materials enhance the efficiency of nail production, affecting both cost and product performance. Sustainability and Environmental Concerns: Growing awareness of environmental sustainability influences purchasing decisions in the construction industry, including the selection of construction nails. Nails made from eco-friendly materials or those designed for easy recycling align with sustainability goals and gain traction in the market. Economic Conditions and Consumer Spending: Economic conditions, including consumer spending and disposable income, impact the construction nails market. During periods of economic growth, increased construction activity and home improvement projects contribute to higher demand for construction nails. Globalization and Supply Chain Dynamics: The globalization of supply chains in the construction industry affects the availability and pricing of construction nails. Companies operating in the market must navigate international trade dynamics, addressing factors such as tariffs, logistics, and regional variations in demand.

Leave a Comment