Market Trends

Key Emerging Trends in the Construction Utility Vehicles Market

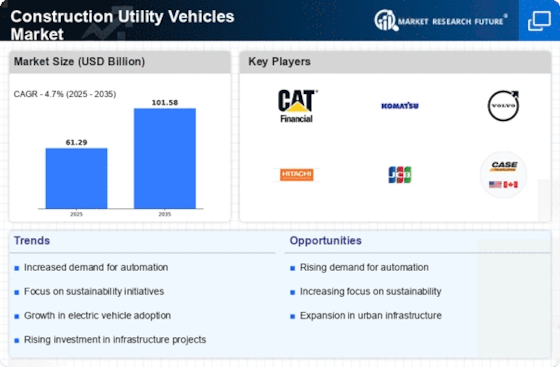

Critical patterns are emerging in the Construction Utility Vehicles (CUV) sector. As urbanization and foundation development flood the world, construction utility trucks are in demand. These versatile equipment, from tractors to telehandlers, boost construction efficiency and proficiency.

One notable trend in Construction Utility Vehicles is manageability. Construction companies are looking for eco-friendly hardware as environmental concerns grow. This led to the acceptance of electric and hybrid construction utility vehicles. These vehicles reduce fossil fuel byproducts and save money over time by using less gasoline and maintaining them.

Another tendency is construction utility vehicle innovation combining trend-setting innovation. Computers, telematics, and networks are essential for providing constant information and improving machine appearance. Telematics allows fleet administrators to track vehicle use, location, and condition, improving maintenance planning and efficiency.

The market is also moving toward conservative and adaptable construction utility vehicles. As cities become increasingly congested, smaller, flexible gear is needed. Conservative tractors, slide steer loaders, and small loaders are popular for their efficiency and ability to navigate tight places. In urban building projects, hired workers are increasingly appreciating these conservative tools.

Additionally, rental agencies are seeing a construction utility vehicle boom. Due to cost, adaptability, and support weight, construction companies are leasing equipment instead of owning it. Construction utility vehicle rental companies are growing due to this pattern.

Territory-wise, emerging economies are seeing a surge in construction, driving the CUV market. China and India are investing heavily on infrastructure in Asia-Pacific. This territorial onslaught is pushing local and global manufacturers to expand and capitalize on construction utility vehicle demand.

In construction utility vehicle planning and assembly, security features are improving. Manufacturers are integrating collision evasion systems, reinforcement cameras, and administrator readiness monitoring to reduce accidents and protect managers. These components boost construction skill and workplace safety.

Leave a Comment