Construction Worker Safety Size

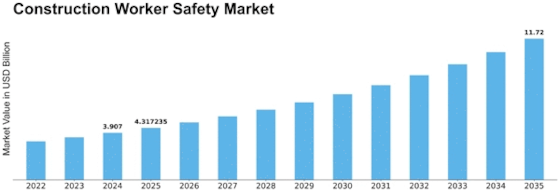

Construction Worker Safety Market Growth Projections and Opportunities

The building industry is an important part of the economy, constructing infrastructure and buildings which are essential for social development. In a rapidly changing construction sector, the safety of workers is always paramount. One of the key market factors that determine how safe employees can be in construction is regulatory compliance. Governments and other regulatory entities globally have created safety standards to protect construction workers. Specific rules require personal protective equipment (PPE), appropriate training, and adherence to specific construction practices, which are some of these regulations. Hence, the governments recognize workers' lives as important; thus, companies in such sectors as buildings have to spend money on safety measures and technologies. Technological advancements significantly influence the Construction Worker Safety Market. The employment of wearable devices, IoT sensors, and data analytics in the construction industry has helped improve its ability to oversee potential risks to health and safety. An example is wearable technology that monitors physical health indicators, allowing supervisors access to real-time data about critical conditions so that immediate interventions may be provided whenever necessary during emergencies like accidents at workplaces, for instance. The economic environment also greatly affects construction worker safety initiatives. Economic fluctuations may lead to budget cuts resulting in reduced allocations towards safety programs, while periods of economic boom often increase construction activities, thereby necessitating more emphasis on safety priorities. This shows, therefore, that the construction worker safety market has a close relationship with the economic cycle, determining the extent of investments made and the attention paid to welfare issues concerning these workers. Public awareness and perception equally shape market dynamics in regard to the Construction Worker Safety Market. Awareness levels regarding the necessity to put up appropriate structures had influenced many companies to start indicating their commitment towards their employees' rights, especially when it comes to issues regarding health and security while they are at their working places since this was not a common thing across most sites sometimes back when employers used ignorant employees who did not know even basics concerning team member protection measures within working areas respectively. Availability plus cost aspecting for security equipment will further direct the nature or type of Construction Worker Safety Market. As technology advances and becomes more accessible, the expenses linked to safety net measures also drop. This includes not only larger construction companies but even smaller ones within this field since their availability has increased; therefore, they can now access advanced methods of securing on-site workers. Furthermore, competition amongst vendors dealing with such products has the potential to encourage improvement and cost-effectiveness in terms of adopting up-to-date security measures for building firms.

Leave a Comment