Market Trends

Key Emerging Trends in the Contact Center Analytics Market

The Contact Center Analytics market is influenced by various factors that shape its growth and evolution, catering to the needs of businesses and their customer service operations. One of the primary drivers propelling the expansion of this market is the increasing importance of customer experience (CX) in today's competitive landscape. Companies across industries recognize the pivotal role of customer service in fostering loyalty and satisfaction among consumers. Contact center analytics solutions provide valuable insights into customer interactions, allowing businesses to optimize their service delivery and address pain points effectively.

Moreover, the exponential growth of data generated through customer interactions is driving the demand for analytics tools capable of processing and analyzing large volumes of information in real-time. With the advent of omnichannel communication channels such as social media, email, chat, and voice, businesses are faced with the challenge of managing diverse data streams to gain a comprehensive understanding of customer behavior and preferences. Contact center analytics solutions offer advanced analytics capabilities, including sentiment analysis, speech recognition, and predictive analytics, enabling organizations to derive actionable insights from this wealth of data.

Additionally, the growing adoption of cloud-based contact center solutions is fueling the demand for analytics capabilities integrated into these platforms. Cloud-based contact center solutions offer scalability, flexibility, and cost-effectiveness, making them an attractive option for businesses of all sizes. By incorporating analytics functionality into these cloud-based platforms, organizations can harness the power of data-driven insights without the need for extensive IT infrastructure or specialized expertise, thereby democratizing access to advanced analytics tools.

Furthermore, regulatory compliance and risk management considerations are driving the adoption of contact center analytics solutions among enterprises. Industries such as finance, healthcare, and telecommunications are subject to stringent regulations governing customer data privacy and security. Contact center analytics solutions provide features such as encryption, access controls, and audit trails to help businesses comply with regulatory mandates and mitigate the risk of data breaches or non-compliance penalties.

Moreover, the increasing focus on workforce optimization and performance management is driving the adoption of analytics solutions within contact centers. By analyzing agent performance metrics, call volumes, and customer feedback data, organizations can identify training needs, improve resource allocation, and enhance overall operational efficiency. Contact center analytics solutions also enable businesses to monitor service level agreements (SLAs), identify trends and patterns in customer inquiries, and proactively address potential issues before they escalate, thereby improving the quality of service and driving customer satisfaction.

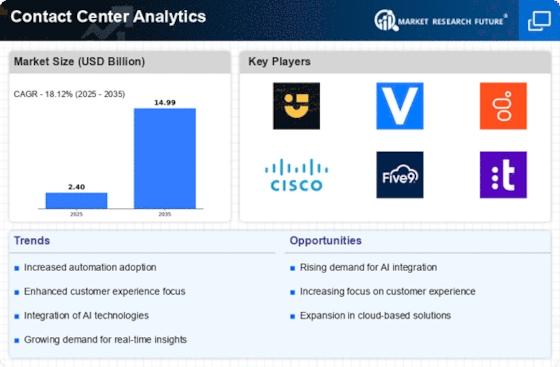

The competitive landscape of the contact center analytics market is characterized by a diverse array of vendors offering a wide range of solutions tailored to different industry verticals and use cases. Established players such as Cisco, Genesys, and Avaya have long dominated the market with their comprehensive contact center suites, which include analytics capabilities as part of their integrated offerings. However, they face increasing competition from agile startups and niche players that specialize in specific analytics functionalities or target niche markets with unique requirements.

Furthermore, strategic partnerships and alliances are becoming increasingly prevalent in the contact center analytics market as vendors seek to broaden their product portfolios and reach new customer segments. By partnering with complementary technology providers or industry incumbents, contact center analytics vendors can offer more comprehensive solutions that address the end-to-end needs of their customers, from customer engagement to analytics and insights generation. These partnerships also enable vendors to leverage their combined expertise and resources to innovate faster and stay ahead of evolving market trends.

Leave a Comment