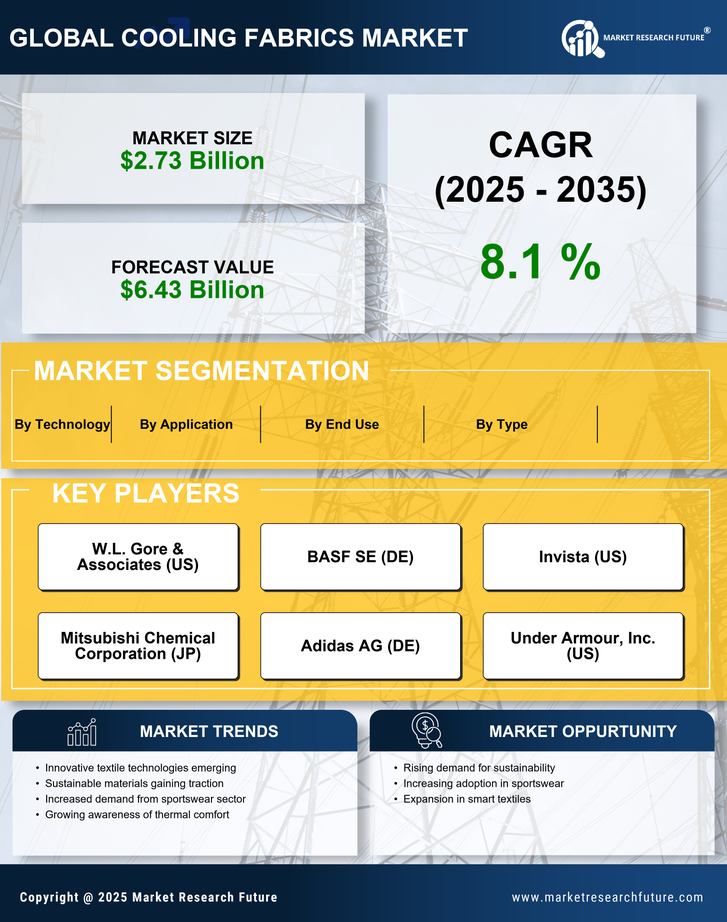

Rising Demand for Performance Apparel

The Cooling Fabrics Market experiences a notable surge in demand for performance apparel, driven by the increasing awareness of health and fitness. Consumers are increasingly seeking clothing that enhances comfort during physical activities, particularly in warm climates. This trend is reflected in the projected growth of the activewear segment, which is expected to reach a valuation of approximately 400 billion dollars by 2026. As athletes and fitness enthusiasts prioritize moisture-wicking and temperature-regulating properties, manufacturers are compelled to innovate and incorporate advanced cooling technologies into their products. This shift not only caters to consumer preferences but also positions brands favorably in a competitive landscape, thereby propelling the Cooling Fabrics Market forward.

Expansion of Outdoor and Sports Activities

The Cooling Fabrics Market benefits from the expansion of outdoor and sports activities, which have gained popularity in recent years. As more individuals engage in outdoor sports and recreational activities, the demand for specialized clothing that provides cooling benefits is on the rise. This trend is particularly evident in regions with warm climates, where consumers seek apparel that can enhance their performance while keeping them comfortable. The market is projected to grow as brands respond to this demand by developing innovative cooling fabrics tailored for outdoor enthusiasts. This expansion not only drives sales but also encourages further investment in the Cooling Fabrics Market, as companies strive to meet the needs of an active consumer base.

Sustainability Trends in Textile Manufacturing

Sustainability trends are increasingly shaping the Cooling Fabrics Market, as consumers become more environmentally conscious. The demand for eco-friendly materials and sustainable manufacturing processes is prompting companies to explore innovative solutions that minimize environmental impact. This shift is reflected in the growing popularity of recycled and organic fibers in the production of cooling fabrics. As brands adopt sustainable practices, they not only appeal to a broader audience but also contribute to the overall growth of the Cooling Fabrics Market. The integration of sustainability into product development is likely to become a key differentiator in a competitive market, influencing consumer purchasing decisions and driving future growth.

Technological Innovations in Fabric Production

Technological advancements play a pivotal role in shaping the Cooling Fabrics Market. Innovations in fabric production techniques, such as the development of phase change materials and advanced fiber technologies, enhance the cooling properties of textiles. These innovations allow for the creation of fabrics that can effectively manage heat and moisture, providing superior comfort to the wearer. The market is witnessing a rise in investments directed towards research and development, with companies striving to create more efficient and sustainable cooling fabrics. As a result, the industry is likely to see a proliferation of new products that meet the evolving demands of consumers, thereby driving growth in the Cooling Fabrics Market.

Increased Awareness of Heat-Related Health Issues

The Cooling Fabrics Market is significantly influenced by the growing awareness of heat-related health issues among consumers. As temperatures rise globally, individuals are becoming more conscious of the risks associated with heat exposure, such as heat exhaustion and heat stroke. This heightened awareness is prompting consumers to seek out clothing that offers enhanced cooling properties. The market for cooling fabrics is projected to expand as more people recognize the importance of protective clothing in mitigating heat-related health risks. Furthermore, industries such as sports, outdoor recreation, and healthcare are increasingly adopting cooling fabrics to ensure safety and comfort, thereby contributing to the overall growth of the Cooling Fabrics Market.