Corrugated Packaging Market Summary

As per Market Research Future analysis, the Corrugated Packaging Market Size was estimated at 265.7 USD Billion in 2024. The Corrugated Packaging industry is projected to grow from 275.8 USD Billion in 2025 to 400.5 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Corrugated Packaging Market is experiencing robust growth driven by sustainability and e-commerce trends.

- The market is increasingly prioritizing sustainability, with a notable shift towards eco-friendly packaging solutions.

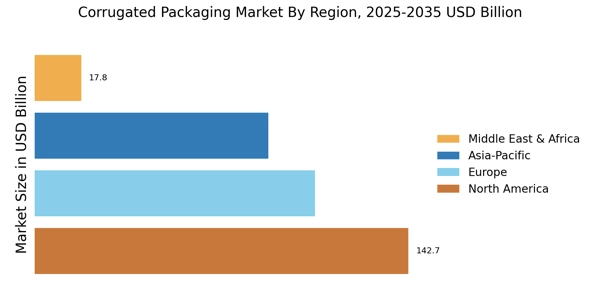

- E-commerce growth is propelling demand for corrugated packaging, particularly in North America, the largest market.

- Slotted boxes remain the dominant segment, while rigid boxes are emerging as the fastest-growing category.

- Sustainability initiatives and e-commerce expansion are key drivers influencing market dynamics.

Market Size & Forecast

| 2024 Market Size | 265.7(USD Billion) |

| 2035 Market Size | 400.5(USD Billion) |

| CAGR (2025 - 2035) | 3.8% |

Major Players

International Paper Company, Smurfit WestRock Company, DS Smith Plc, Mondi Group, Nine Dragons Paper (Holdings) Ltd, Oji Holdings Corporation, Packaging Corporation of America, Georgia‑Pacific LLC, Lee & Man Paper Manufacturing Ltd., Rengo Co., Ltd.