Rising Demand for Eco-Friendly Solutions

The corrugated packaging market in Japan is experiencing a notable shift towards eco-friendly solutions. As consumers become increasingly aware of environmental issues, there is a growing preference for sustainable packaging options. This trend is reflected in the market, where the demand for recyclable and biodegradable materials is on the rise. In 2025, it is estimated that eco-friendly packaging could account for approximately 30% of the total packaging market in Japan. Companies are responding by investing in innovative materials and processes that reduce environmental impact. The corrugated packaging market is thus adapting to these consumer preferences, which may lead to enhanced brand loyalty and market share for companies that prioritize sustainability.

Increased Focus on Supply Chain Efficiency

The corrugated packaging market in Japan is witnessing an increased focus on supply chain efficiency. Companies are recognizing the importance of optimizing their packaging solutions to reduce costs and improve logistics. In 2025, it is projected that efficient packaging could lead to a 10% reduction in overall supply chain expenses. The corrugated packaging market is adapting to this trend by developing lighter and more compact packaging designs that facilitate easier handling and transportation. This focus on efficiency not only enhances operational performance but also contributes to sustainability goals by minimizing material usage.

Technological Innovations in Manufacturing

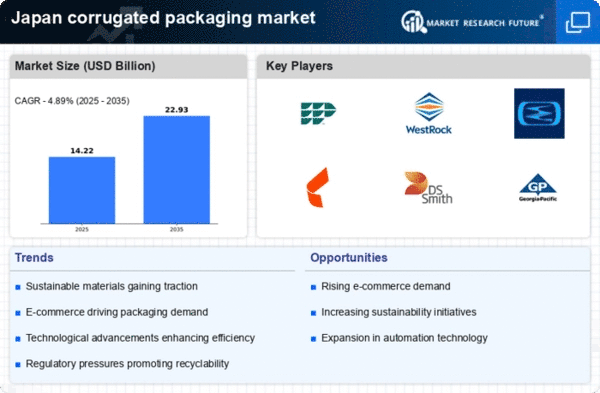

Technological advancements in manufacturing processes are reshaping the corrugated packaging market in Japan. Innovations such as automation, digital printing, and advanced materials are enhancing production efficiency and product quality. In 2025, it is expected that these technologies will lead to a 15% reduction in production costs for corrugated packaging manufacturers. The corrugated packaging market is thus benefiting from these advancements, as companies can produce customized packaging solutions more rapidly and at lower costs, meeting the diverse needs of consumers and businesses alike.

Regulatory Support for Sustainable Practices

Japan's government is increasingly implementing regulations that promote sustainable practices within the packaging sector. These regulations are designed to reduce waste and encourage the use of recyclable materials, which directly influences the corrugated packaging market. By 2025, it is anticipated that compliance with these regulations will drive a 20% increase in the adoption of sustainable packaging solutions among manufacturers. The corrugated packaging market is likely to see a shift in production processes as companies align with these regulatory frameworks, fostering innovation and sustainability in packaging design.

Growth in E-commerce and Home Delivery Services

The surge in e-commerce and home delivery services is significantly impacting the corrugated packaging market in Japan. With online shopping becoming a staple for many consumers, the need for efficient and protective packaging solutions has escalated. In 2025, the e-commerce sector is projected to contribute to over 40% of the total packaging demand in Japan. This growth necessitates the use of corrugated packaging, which offers durability and protection during transit. The corrugated packaging market is thus poised to benefit from this trend, as businesses seek reliable packaging solutions to ensure product safety and customer satisfaction.