Crane Size

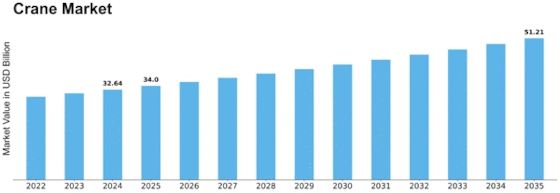

Crane Market Growth Projections and Opportunities

The global crane market is influenced by several factors, including government support for construction and the expansion of the mining industry. However, the market might face challenges due to fluctuating raw material prices. The global crane market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.96% during the forecast period. The market is categorized based on type, application, and region. In terms of type, it includes industrial cranes, offshore cranes, port cranes, and others. The industrial cranes segment held the largest market share of 64.01% in 2018, with a value of USD 20,177.0 million. It is anticipated to grow at a CAGR of 5.21% during the forecast period. The industrial cranes segment is further divided into mobile cranes, all-terrain cranes, rough terrain cranes, crawler cranes, telescopic cranes, and others. Among these, the mobile cranes segment dominated the market with a share of 27.01% in 2018, valued at USD 5,449.6 million, and is expected to grow at a CAGR of 6.80% during the forecast period.

In terms of application, the market is segmented into construction, mining, oil & gas, shipping & port, and others. The construction segment held the largest market share of 34.82% in 2018, with a market value of USD 10,975.3 million, and is projected to grow at a CAGR of 5.49% during the forecast period. Geographically, Asia-Pacific accounted for the largest market share of 36.45% in 2018, with a value of USD 11,489.4 million. The region is expected to grow at a CAGR of 5.83% during the forecast period. The global crane market's growth is driven by the demand for construction activities and the expansion of the mining industry. Government initiatives supporting infrastructure development contribute to the market's positive outlook. However, the market may face challenges due to the unpredictable prices of raw materials, impacting overall growth during the forecast period. The industrial cranes segment, especially mobile cranes, is a significant contributor to the market, driven by its versatile applications. The construction sector, being a major user of cranes, holds a substantial market share, with a positive growth projection. Asia-Pacific, with its robust construction and industrial activities, leads the global crane market and is expected to maintain its dominance in the coming years.

Leave a Comment