Global Credit Scoring Market Overview:

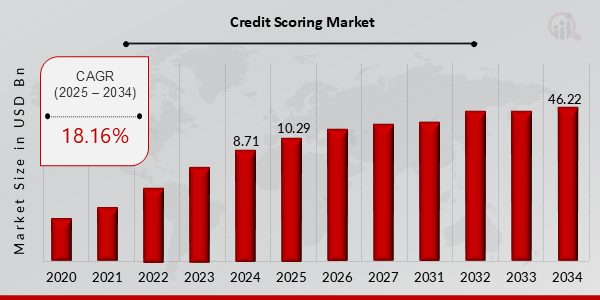

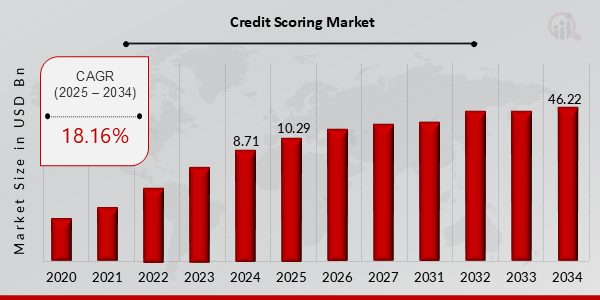

Credit Scoring Market Size was estimated at 8.71 (USD Billion) in 2024. The Credit Scoring Market Industry is expected to grow from 10.29 (USD Billion) in 2025 to 46.22 (USD Billion) till 2034, exhibiting a compound annual growth rate (CAGR) of 18.16% during the forecast period (2025 - 2034).

Key Credit Scoring Market Trends Highlighted

Rapid advancements in financial technology and data analytics have significantly shaped the Credit Scoring Market. The proliferation of alternative data sources, such as social media activity and telco data, is enabling lenders to evaluate borrowers' creditworthiness more comprehensively. Furthermore, the adoption of AI-powered scoring models is enhancing the accuracy and efficiency of credit assessments. These developments have expanded the scope of credit scoring beyond traditional parameters, creating opportunities for financial inclusion and credit access for underserved populations.

The increasing demand for credit, particularly in emerging markets, is driving the growth of the Credit Scoring Market. The need for personalized and tailored lending solutions has fueled the adoption of specialized credit scoring models that consider factors relevant to specific industries or demographics. Additionally, the trend toward digital banking and online lending has accelerated the demand for automated and real-time credit scoring systems, enabling lenders to make quick and informed decisions.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Credit Scoring Market Drivers

Increase in Credit Applications

The global growth of the credit scoring market is mainly due to the rising number of persons applying for credit. More and more people who need credits are applying for it, making it challenging to use conventional methods of credit scoring. Evaluating creditworthiness can be a laborious and time-consuming process. Henceforth, adoption of appropriate solutions becomes mandatory. Credit scoring helps financial institutions find out if a potential customer is likely to be their customer or too risky in terms of non-payment, which defines it as "a statistical risk management tool.

There will likely be higher future demand for credit due to the inflation that will have taken place in 2020s, and currently, backward markets will also rise. Generally, the industry of credit scoring has a chance to gain significant extension by 2024.

Advancements in Technology

Advancements in technology have also played a significant role in the growth of the credit-scoring market. New technologies, such as artificial intelligence (AI) and machine learning (ML), have made it possible to develop more sophisticated and accurate credit scoring models. These models can take into account a wider range of data points and more complex relationships between different factors, leading to more accurate assessments of creditworthiness.

Regulatory Changes in Credit Scoring Market Industry

The growth of the credit-scoring market was also facilitated by changes in regulation. Regulations in many countries have been designed to protect consumers’ rights from unfair practices related to loans. In turn, this led to the need for scoring their creditworthiness, so there was an increase in demand for these services.

Credit Scoring Market Segment Insights:

Credit Scoring Market Credit Scoring Model Type Insights

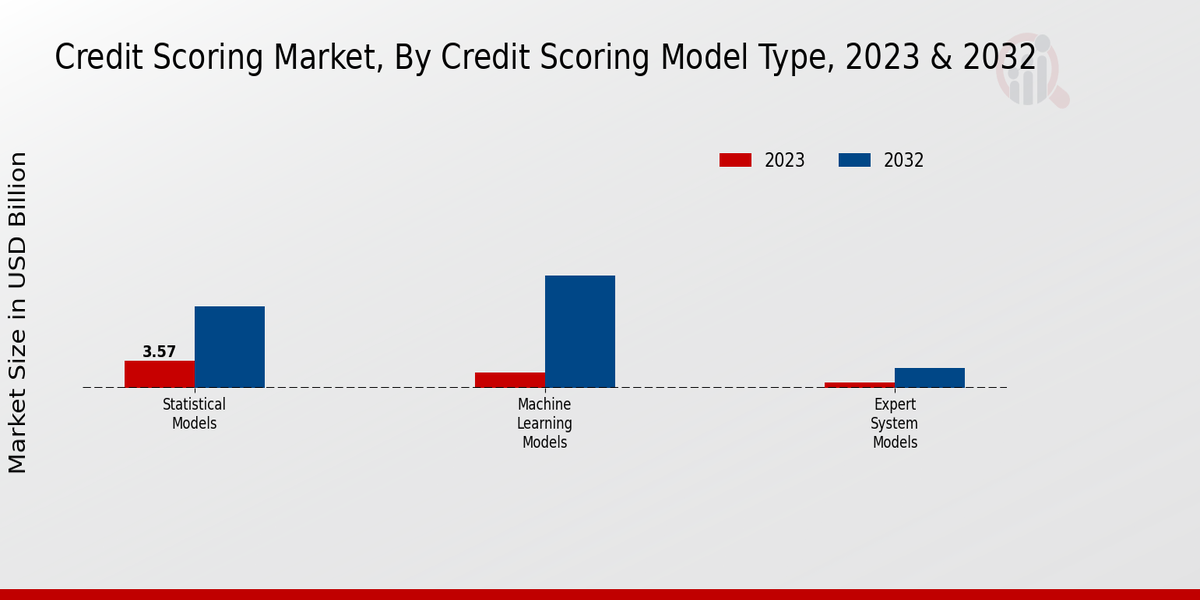

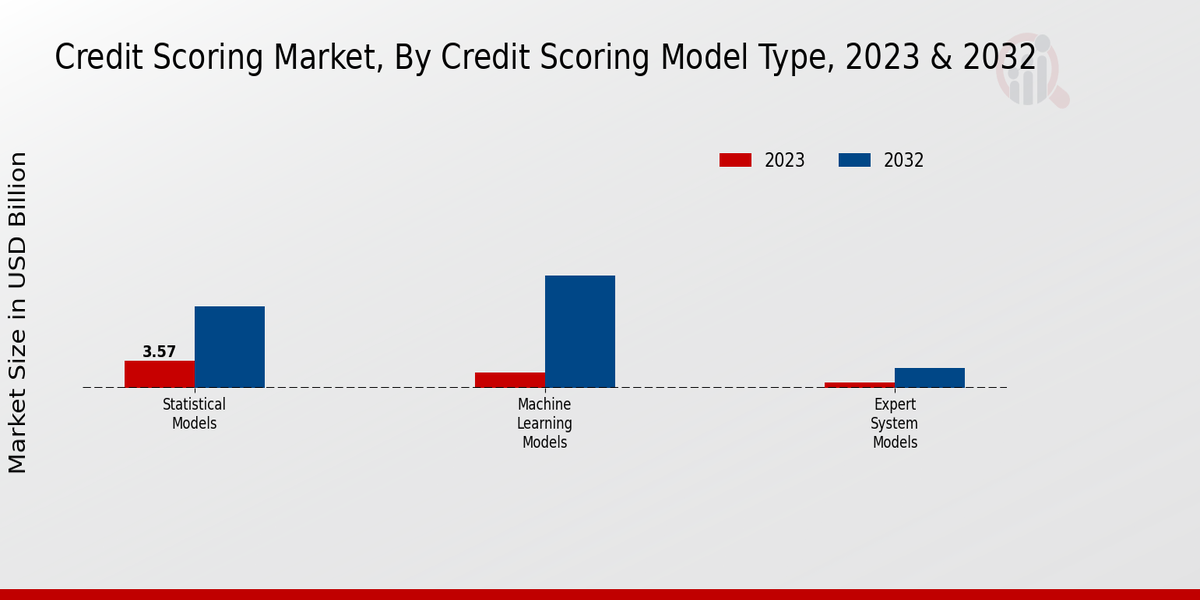

The Credit Scoring Model Type segment plays a crucial role in shaping the Credit Scoring Market landscape. Statistical Models have traditionally been the cornerstone of credit scoring, leveraging historical data and statistical techniques to assess creditworthiness. However, Machine Learning Models are gaining traction, utilizing advanced algorithms and data mining to identify complex patterns and improve predictive accuracy. Expert System Models, on the other hand, incorporate domain expertise and rules-based reasoning to make credit decisions, offering transparency and explainability.

In 2023, the Credit Scoring Market revenue for Statistical Models was estimated at USD 3.2 billion, while Machine Learning Models accounted for USD 1.8 billion. Expert System Models held a relatively smaller market share, contributing USD 0.6 billion. By 2032, the market dynamics are projected to shift significantly. Statistical Models are anticipated to maintain a substantial market share of USD 9.2 billion, exhibiting a CAGR of 14.3%. Machine Learning Models are poised for exponential growth, reaching a valuation of USD 12.6 billion with a CAGR of 22.1%.

Expert System Models are expected to witness a steady rise, reaching USD 2.2 billion by 2032, driven by the need for explainable and transparent decision-making.

The increasing adoption of advanced analytics and the proliferation of big data are major growth drivers for Machine Learning Models in credit scoring. These models can handle large volumes of data, uncover hidden patterns, and make more accurate predictions, leading to improved risk assessment and reduced defaults. Statistical Models, while still widely used, may face limitations in capturing complex relationships and adapting to rapidly changing market conditions.

Expert System Models, with their focus on explainability and adherence to specific rules, may find niche applications in industries with stringent regulatory requirements or where transparency is paramount. Overall, the Credit Scoring Model Type segment presents a diverse landscape, with each type catering to specific needs and offering varying levels of accuracy, efficiency, and explainability. As the market continues to evolve, the choice of model type will depend on factors such as data availability, model complexity, and the specific requirements of different industries and institutions.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Credit Scoring Market Credit Scoring Purpose Insights

The Credit Scoring Market segmentation by purpose provides valuable insights into the specific applications of credit scoring solutions. Consumer Lending is projected to hold a significant market share, driven by the rising demand for personal loans, credit cards, and other forms of consumer financing. Business Lending is another key segment, with businesses increasingly relying on credit scoring to assess the creditworthiness of potential borrowers.

Mortgage Financing is a crucial segment, as credit scoring plays a vital role in determining loan eligibility and interest rates for homebuyers. Fraud Detection is a growing segment, with credit scoring being leveraged to identify and mitigate fraudulent activities.

Credit Scoring Market Data Source Insights

Data Source is a crucial market segment in the Credit Scoring Market, influencing market growth and industry dynamics. Internal Data, sourced within organizations, provides a comprehensive view of customer behavior, transaction history, and financial performance. This data enables lenders to assess creditworthiness accurately and make informed lending decisions. External Data obtained from credit bureaus and financial institutions offers external perspectives on credit history, payment patterns, and other relevant information. By leveraging external data, lenders can supplement internal data and gain deeper insights into borrower profiles.

Alternative Data, including social media activity, transaction data, and other non-traditional sources, is gaining prominence in credit scoring. This data provides valuable insights into borrowers' financial behavior, spending habits, and lifestyle preferences. By incorporating alternative data, lenders can expand their risk assessment capabilities and reach a broader range of borrowers. The integration of multiple data sources enables lenders to develop more robust and comprehensive credit scoring models.

This, in turn, enhances the accuracy of credit assessments, reduces risk, and facilitates financial inclusion. As a result, the Data Source segment is poised for significant growth in the Credit Scoring Market in the coming years.

Credit Scoring Market End-User Industry Insights

The end-user industry segment of the Credit Scoring Market is categorized into Banking, Non-Banking Financial Institutions (NBFIs), Telecommunications, and Retail. Banking held the largest revenue share in 2023, accounting for around 45.0%, due to the increasing adoption of credit scoring solutions by banks to assess the creditworthiness of loan applicants and manage risk. NBFIs are projected to witness significant growth over the forecast period, owing to the rising demand for credit scoring services from non-traditional lenders such as microfinance institutions and fintech companies.

Telecommunications and Retail are also expected to contribute to the market growth, driven by the need for effective customer profiling and fraud prevention. The Credit Scoring Market revenue for Banking is projected to reach USD 7.4 billion by 2024, while NBFIs, Telecommunications, and Retail are expected to generate revenues of USD 2.8 billion, USD 1.5 billion, and USD 1.2 billion, respectively.

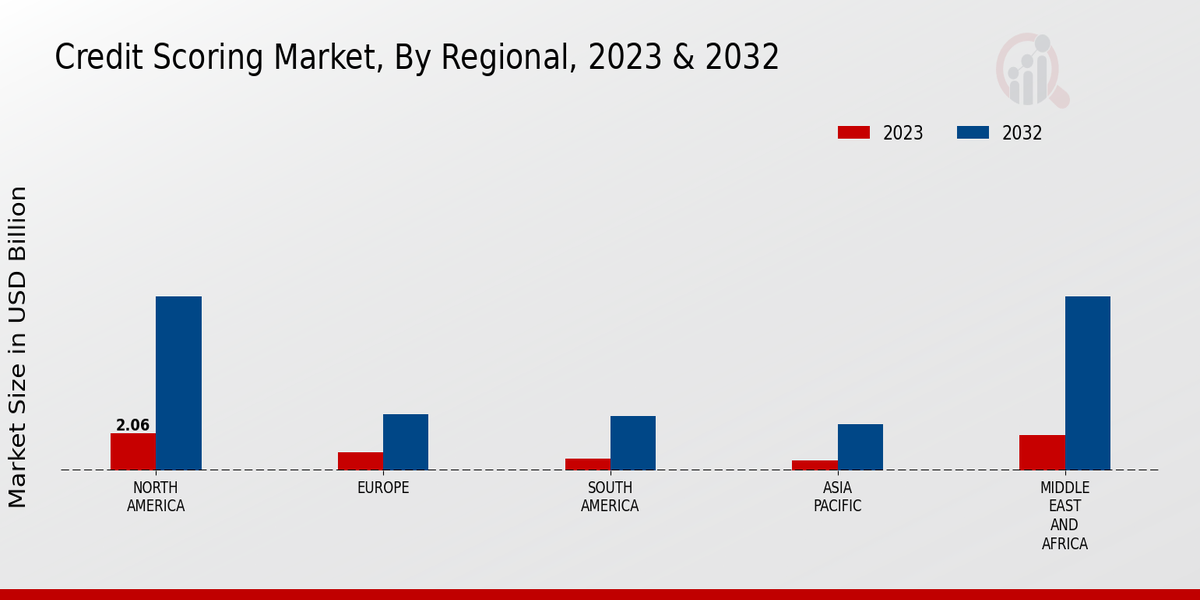

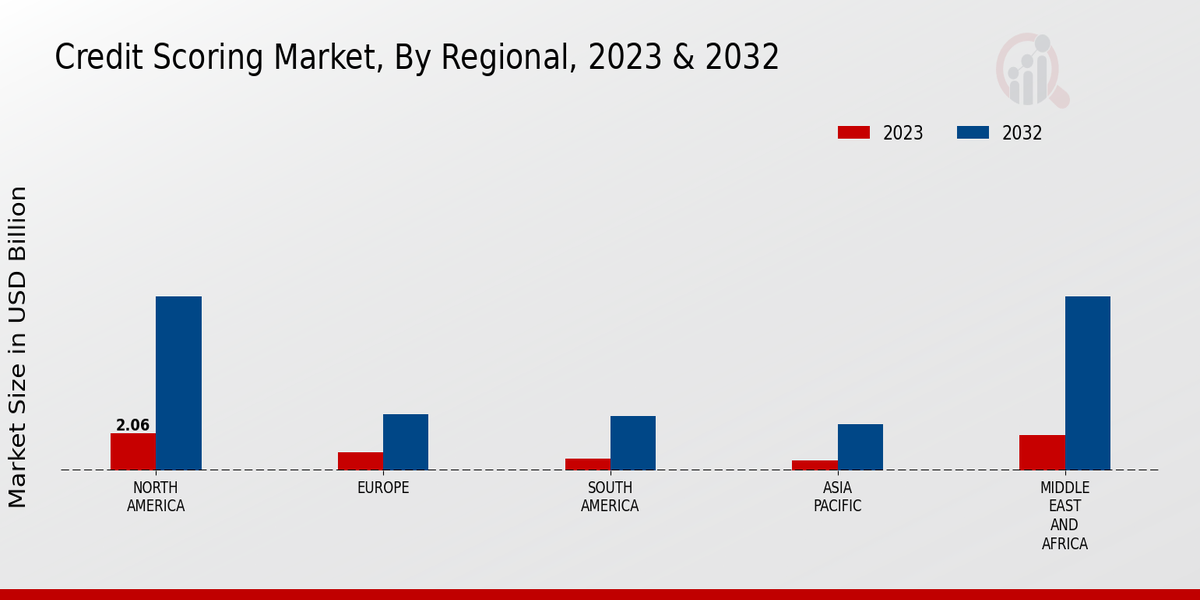

Credit Scoring Market Regional Insights

The regional segmentation of the Credit Scoring Market offers valuable insights into the market's dynamics. North America is expected to dominate the market with a significant share, driven by factors such as the presence of established financial institutions and a high adoption rate of credit-scoring solutions. Europe is anticipated to follow closely, with a growing demand for credit-scoring services in sectors such as banking and lending. The APAC region is projected to witness substantial growth due to the increasing penetration of smartphones and the expansion of the fintech industry.

South America and MEA are also expected to contribute to the overall market growth, as businesses in these regions seek to improve credit risk management and enhance financial inclusion. The Credit Scoring Market revenue is estimated to reach USD 8.24 billion in 2024, indicating robust growth potential across all regions.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Credit Scoring Market Key Players And Competitive Insights:

Major players in Credit Scoring Market are constantly assessing their competitive landscape to improve their market position and gain an advantage over their rivals. Leading Credit Scoring Market players are focusing on developing innovative products and services, enhancing their distribution channels, and expanding their geographical reach. Partnerships and acquisitions are also a key strategy for Credit Scoring Market growth and development. The Credit Scoring Market industry is characterized by intense competition, and companies are leveraging advanced technologies and analytics to improve their credit risk assessment models.

They are also investing in customer service and support to enhance customer satisfaction and loyalty.

Experian is a leading global information services company that provides data and analytical tools to businesses and consumers. In the Credit Scoring Market, Experian offers a range of solutions, including credit reports, scores, and analytics. The company's expertise in data management and analytics enables it to provide accurate and reliable credit information to its customers. Experian has a strong global presence, with operations in over 30 countries, and is well-positioned to meet the growing demand for credit scoring services.

Equifax is another major player in the Credit Scoring Market. The company provides a range of credit and information services to businesses and consumers, including credit reports, scores, and identity protection. Equifax's focus on innovation and technology has enabled it to develop advanced credit risk assessment models that are widely used by lenders. The company has a large customer base and a strong brand reputation, making it a trusted provider of credit scoring services.

Key Companies in the Credit Scoring Market Include:

Credit Scoring Industry Developments

The Credit Scoring Market is projected to reach USD 28.0 billion by 2032, exhibiting a CAGR of 18.16% during the forecast period. Increasing adoption of digital lending platforms, growing demand for credit risk assessment, and rising consumer awareness about financial management are driving the market growth. Key industry participants include Experian, Equifax, TransUnion, FICO, and LexisNexis Risk Solutions.

Recent news developments include the launch of new AI-powered credit scoring models and partnerships between credit scoring companies and fintech startups. The market is expected to witness significant growth in emerging economies, particularly in Asia-Pacific and Latin America, due to the increasing adoption of digital financial services.

Credit Scoring Market Segmentation Insights

Credit Scoring Market Credit Scoring Model Type Outlook

Credit Scoring Market Credit Scoring Purpose Outlook

Credit Scoring Market Data Source Outlook

Credit Scoring Market End-User Industry Outlook

Credit Scoring Market Regional Outlook

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

USD 8.71 Billion

|

|

Market Size 2025

|

USD 10.29 Billion

|

|

Market Size 2034

|

USD 46.22 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

18.16% (2025-2034)

|

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025-2034

|

|

Historical Data

|

2020-2023

|

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Dun Bradstreet, FICO, Moody’s Analytics, D, Kroll Bond Rating Agency, CRIF, Experian, LexisNexis Risk Solutions, Equifax, TransUnion, Fitch Ratings, A.M. Best, S Global Ratings, Verisk Analytics |

| Segments Covered |

Credit Scoring Model Type, Credit Scoring Purpose, Data Source, End-User Industry, Regional |

| Key Market Opportunities |

Digital Lending ExpansionAlternative Data IntegrationCloud-Based SolutionsCross-Border Credit AssessmentEnhanced Fraud Detection |

| Key Market Dynamics |

Rising adoption of AI and MLIncreasing demand for alternative lendingGrowing financial inclusion initiativesExpanding regulatory compliance requirementsInnovations in digital identity verification |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Credit Scoring Market is expected to reach USD 46.22 billion by 2034, exhibiting a CAGR of 18.16% during the forecast period (2025-2034).

The growth of the Credit Scoring Market is primarily driven by factors such as increasing financial inclusion, rising demand for credit, growing adoption of digital lending platforms, and the need for accurate and timely credit assessments.

North America is expected to account for the largest market share in the Credit Scoring Market, owing to the presence of well-established financial institutions, advanced credit scoring systems, and a high adoption rate of digital lending platforms.

Credit Scoring finds applications in various sectors, including banking and finance, insurance, retail, healthcare, and telecommunications, to assess the creditworthiness of individuals and businesses.

Some of the key competitors in the Credit Scoring Market include Experian, Equifax, TransUnion, FICO, and Fair Isaac Corporation.

The Credit Scoring Market faces challenges such as data privacy and security concerns, regulatory compliance, and the need for continuous innovation to keep pace with evolving financial landscapes.

Growth opportunities for the Credit Scoring Market lie in emerging markets, the adoption of artificial intelligence and machine learning, the development of alternative data sources, and the expansion of digital lending.

Key trends shaping the Credit Scoring Market include the increasing use of alternative data, the adoption of cloud-based solutions, the development of real-time scoring models, and the growing focus on financial inclusion.

The COVID-19 pandemic has had a significant impact on the Credit Scoring Market, leading to increased demand for credit risk assessment and the adoption of digital credit scoring solutions.

The future prospects of the Credit Scoring Market remain positive, driven by the increasing demand for credit, the growing adoption of digital lending platforms, and the continuous innovation in credit scoring technologies.