Customization and Scalability

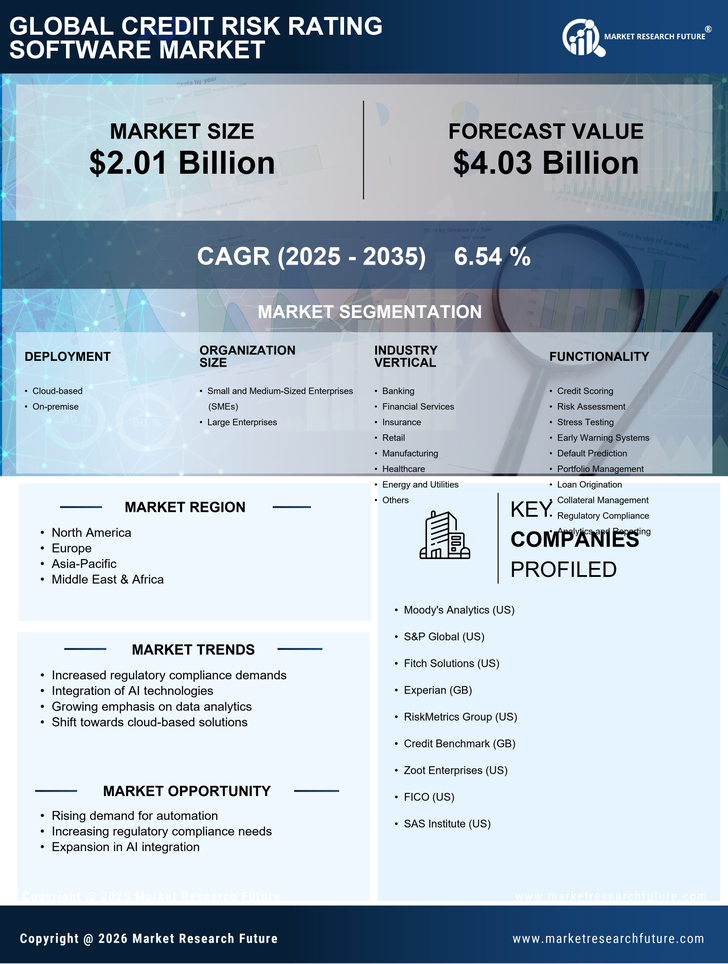

Customization and scalability are pivotal drivers in the Credit Risk Rating Software Market. Financial institutions are increasingly seeking solutions that can be tailored to their specific needs, allowing for more precise risk assessments. The ability to scale these solutions according to the size and complexity of the organization is equally crucial. Recent market analysis suggests that approximately 60% of institutions prioritize customizable software to align with their unique risk profiles. This demand for tailored solutions is fostering innovation among software providers, who are now focusing on developing flexible platforms that can adapt to varying regulatory requirements and business models. Consequently, this trend is likely to propel growth within the Credit Risk Rating Software Market.

Increased Focus on Data Analytics

The Credit Risk Rating Software Market is witnessing an increased focus on data analytics as organizations strive to leverage data for better risk assessment. The ability to analyze historical data and predict future trends is becoming essential for financial institutions. Enhanced data analytics capabilities enable organizations to identify patterns and anomalies that may indicate potential credit risks. Recent findings suggest that institutions utilizing advanced analytics tools have seen a 20% improvement in their risk assessment accuracy. This trend underscores the importance of integrating sophisticated data analytics into credit risk rating software, thereby driving growth in the Credit Risk Rating Software Market.

Integration of Advanced Technologies

The Credit Risk Rating Software Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the accuracy and efficiency of credit risk assessments, allowing financial institutions to process vast amounts of data swiftly. As a result, organizations can identify potential risks more effectively, leading to improved decision-making. According to recent data, the adoption of AI-driven solutions in credit risk management has increased by approximately 30% over the past year. This trend indicates a growing recognition of the importance of technology in mitigating credit risk, thereby driving demand for sophisticated software solutions in the Credit Risk Rating Software Market.

Regulatory Compliance and Risk Management

Regulatory compliance remains a significant driver in the Credit Risk Rating Software Market. As financial regulations become increasingly stringent, institutions are compelled to adopt robust credit risk management solutions to ensure compliance. The implementation of software that can automate compliance processes not only reduces the risk of penalties but also enhances operational efficiency. Recent statistics indicate that compliance-related costs have risen by 25% over the last two years, prompting organizations to invest in software that can streamline these processes. This growing emphasis on compliance is likely to sustain demand for credit risk rating solutions, as institutions seek to navigate the complex regulatory landscape effectively.

Rising Demand for Real-Time Risk Assessment

The demand for real-time risk assessment is emerging as a crucial driver in the Credit Risk Rating Software Market. Financial institutions are increasingly recognizing the need for immediate insights into credit risk to make timely decisions. The ability to assess risk in real-time allows organizations to respond swiftly to changing market conditions and borrower behaviors. Recent data indicates that approximately 70% of financial institutions are prioritizing real-time capabilities in their credit risk management strategies. This shift towards real-time assessment is likely to propel the development of innovative software solutions, further stimulating growth in the Credit Risk Rating Software Market.