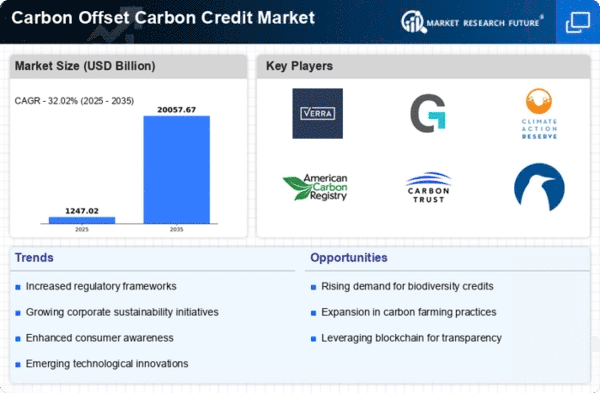

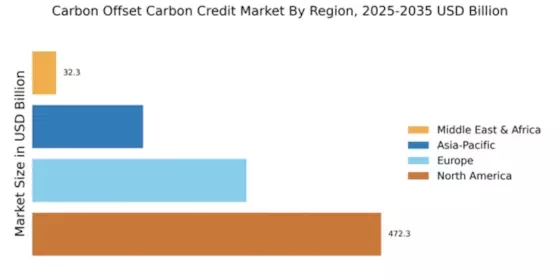

The Carbon Offset Carbon Credit Market is currently characterized by a dynamic competitive landscape, driven by increasing regulatory pressures and a growing emphasis on sustainability. Key players are actively positioning themselves through innovative strategies, partnerships, and regional expansions. For instance, Verra (US) has focused on enhancing its certification processes to ensure transparency and credibility in carbon credits, which appears to resonate well with stakeholders seeking reliable offset solutions. Similarly, Gold Standard (CH) emphasizes the integration of sustainable development goals (SDGs) into its projects, thereby appealing to a broader audience concerned with environmental and social impacts. These strategic orientations collectively shape a competitive environment that is increasingly focused on quality and integrity rather than mere volume. In terms of business tactics, companies are localizing their operations and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This fragmentation allows for niche players to emerge, but the collective strength of established firms like Climate Action Reserve (US) and American Carbon Registry (US) ensures that they maintain a significant foothold in the market. In November 2025, South Pole (CH) announced a strategic partnership with a leading technology firm to develop a blockchain-based platform for tracking carbon credits. This initiative is likely to enhance transparency and traceability in carbon transactions, addressing a critical concern among buyers regarding the authenticity of credits. Such technological advancements may set a new standard in the industry, compelling other players to adopt similar innovations to remain competitive. In October 2025, Carbon Trust (GB) launched a new initiative aimed at supporting small and medium-sized enterprises (SMEs) in their carbon offsetting efforts. This move not only broadens their market reach but also positions them as a leader in promoting sustainable practices among smaller businesses, which are often overlooked in the carbon credit space. By facilitating access to carbon credits for SMEs, Carbon Trust (GB) is likely to foster a more inclusive market environment. In September 2025, EcoAct (FR) expanded its operations into the Asia-Pacific region, targeting emerging markets with high carbon offset potential. This expansion reflects a strategic focus on geographical diversification, which may mitigate risks associated with market fluctuations in established regions. By tapping into new markets, EcoAct (FR) could enhance its growth trajectory and solidify its position as a global player in the carbon credit arena. As of December 2025, the competitive trends in the Carbon Offset Carbon Credit Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) in operations. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing their service offerings and market reach. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, suggesting a transformative shift in how companies engage with the market.