Growing Investor Interest

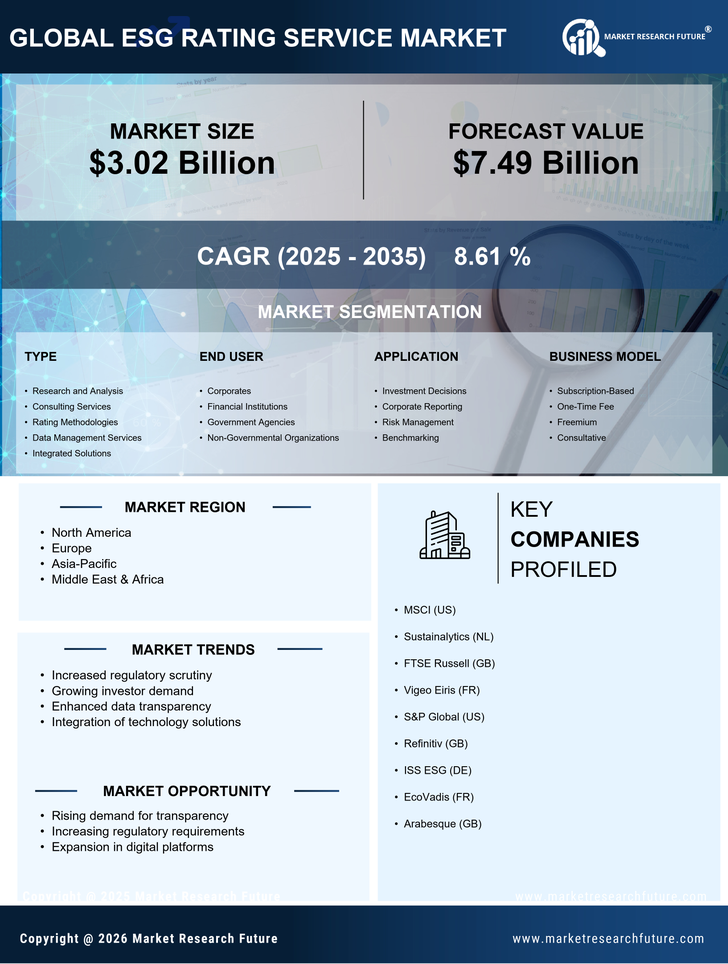

The ESG Rating Service Market is experiencing a notable surge in investor interest, as stakeholders increasingly prioritize sustainable and responsible investment strategies. This trend is evidenced by a significant rise in assets under management in ESG-focused funds, which reached approximately 35 trillion USD in 2025. Investors are now more inclined to seek out companies with robust ESG ratings, as these ratings serve as indicators of long-term viability and risk management. Consequently, firms are compelled to enhance their ESG performance to attract capital, thereby driving demand for ESG rating services. This shift in investor behavior not only influences corporate strategies but also shapes the overall landscape of the ESG Rating Service Market, as organizations strive to align with evolving investor expectations.

Technological Advancements

The ESG Rating Service Market is being transformed by technological advancements that facilitate the collection, analysis, and dissemination of ESG data. Innovations in data analytics, artificial intelligence, and machine learning are enabling rating agencies to assess companies' ESG performance with greater accuracy and efficiency. These technologies allow for the integration of diverse data sources, providing a more comprehensive view of a company's sustainability practices. As a result, the ESG Rating Service Market is likely to expand, as organizations increasingly rely on sophisticated tools to evaluate their ESG performance. Furthermore, the ability to leverage technology for real-time monitoring and reporting may enhance the credibility of ESG ratings, thereby attracting more clients to rating services.

Enhanced Regulatory Frameworks

The ESG Rating Service Market is being shaped by the implementation of enhanced regulatory frameworks that mandate greater transparency and accountability in corporate sustainability practices. Governments and regulatory bodies are increasingly establishing guidelines that require companies to disclose their ESG performance metrics. For instance, regulations in various jurisdictions now necessitate that firms provide detailed reports on their environmental impact, social responsibility initiatives, and governance structures. This regulatory push is likely to bolster the demand for ESG rating services, as companies seek to comply with these requirements and improve their ratings. As a result, the ESG Rating Service Market is poised for growth, driven by the need for organizations to navigate complex regulatory landscapes while demonstrating their commitment to sustainable practices.

Corporate Sustainability Initiatives

The ESG Rating Service Market is witnessing a rise in corporate sustainability initiatives, as organizations recognize the importance of integrating ESG factors into their business models. Companies are increasingly adopting sustainable practices to enhance their reputations and mitigate risks associated with environmental and social issues. This trend is reflected in the growing number of firms that are actively seeking ESG ratings to benchmark their performance against industry standards. In 2025, it is estimated that over 60% of large corporations will have implemented formal sustainability strategies, thereby driving demand for ESG rating services. This proactive approach not only aids in attracting investment but also fosters a culture of accountability and transparency within organizations, further propelling the growth of the ESG Rating Service Market.

Consumer Demand for Ethical Practices

The ESG Rating Service Market is influenced by rising consumer demand for ethical business practices, as consumers become more conscious of the social and environmental impacts of their purchasing decisions. This shift in consumer behavior is prompting companies to prioritize ESG factors in their operations and supply chains. In 2025, it is projected that nearly 70% of consumers will consider a company's ESG performance when making purchasing decisions. This trend is driving organizations to seek ESG ratings to validate their commitment to ethical practices and enhance their market positioning. Consequently, the ESG Rating Service Market is likely to benefit from this growing consumer awareness, as businesses strive to align their practices with the values of their customers.