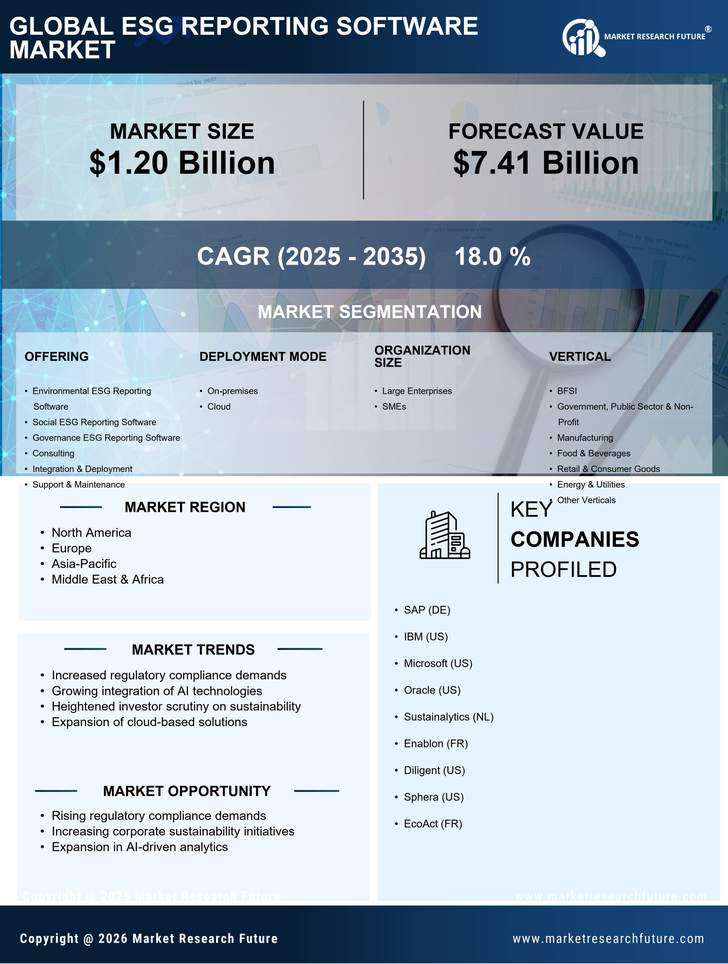

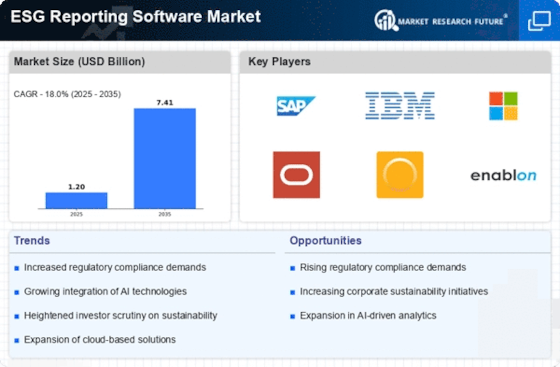

Leading market players are investing heavily in research and development to expand their product lines, which will help the ESG Reporting Software Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the ESG Reporting Software industry must offer cost-effective items. Leading ESG software companies are investing heavily in AI-driven analytics and automated compliance solutions.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global ESG Reporting Software industry to benefit clients and increase the market sector. In recent years, the ESG Reporting Software industry has offered some of the most significant advantages to the global corporate landscape. Major players in the ESG Reporting Software Market, including Wolters Kluwer (Netherlands), Nasdaq (US), PWC (UK), Workiva (US), LSEG(UK), Greenstone (UK), Diligent (US), Sphera (US), Cority (Canada), and Intelex (Canada) are attempting to increase market demand by investing in research and development operations.

Wolters Kluwer NV is a company specializing in information services and publishing. It provides a range of services, including education, research, practice management, transactional support,

risk management, and compliance. Its solutions assist customers in making crucial daily decisions across diverse sectors such as healthcare, tax, accounting, audit, risk, compliance, corporate services, financial services, legal, and regulatory affairs. Headquartered in Alphen aan den Rijn, the Netherlands, Wolters Kluwer operates globally, serving markets in North America, Europe, Asia Pacific, and Latin America.

In December Wolters Kluwer collaborated with Caixa Geral de Depósitos (CGD), a Portuguese state-owned banking corporation.

This partnership led to CGD adopting Wolters Kluwer's OneSumX software for regulatory reporting, ensuring compliance with directives for central registration depository and capital requirements.

Nasdaq Inc (Nasdaq) is a global technology company specializing in capital markets, offering platforms and services essential for

financial operations. The company provides a comprehensive range of solutions, including data, analytics, software, exchange services, and client-centric offerings to support business strategies. Its portfolio encompasses trade management, data products, trading, and clearing services across various asset classes and financial indexes. Nasdaq also delivers corporate solutions, capital formation services, and market technology solutions. The company enhances trading efficiencies with market-agnostic smart routing and improved connectivity to dark pools, ensuring optimal execution for clients.

Operating in North America, Asia-Pacific, Europe, and the Middle East, Nasdaq is headquartered in New York City, New York, USA.

In February Nasdaq expanded its collaboration with Notified, a business segment of Intrado Corporation specializing in technology-enabled services. This partnership empowers Notified customers to streamline the management and reporting of Environmental, Social, and Governance (ESG) efforts, simplifying processes for tracking, gathering, approving, and disclosing ESG data.