Increased Regulatory Scrutiny

The Credit Rating Software Market is significantly influenced by the increasing regulatory scrutiny faced by financial institutions. Regulatory bodies are imposing stricter guidelines to ensure transparency and accountability in credit assessments. This has led to a growing need for robust credit rating software that can comply with these regulations while providing accurate and reliable credit evaluations. Financial institutions are compelled to adopt advanced software solutions that not only meet regulatory requirements but also enhance their risk management frameworks. As a result, the demand for credit rating software is expected to rise, as organizations seek to navigate the complexities of compliance while maintaining their competitive edge. This trend underscores the critical role of the Credit Rating Software Market in supporting financial institutions in their regulatory endeavors.

Growing Importance of Data Analytics

The growing importance of data analytics in financial decision-making is a key driver for the Credit Rating Software Market. Organizations are increasingly recognizing the value of data-driven insights in assessing credit risk and making informed lending decisions. The ability to analyze historical data, market trends, and borrower behavior is essential for accurate credit evaluations. Consequently, financial institutions are investing in credit rating software that incorporates advanced data analytics capabilities. This trend is expected to propel the growth of the Credit Rating Software Market, as firms seek to leverage data to enhance their credit risk assessment processes. The integration of data analytics into credit rating software not only improves accuracy but also enables organizations to respond swiftly to changing market conditions.

Expansion of Financial Services Sector

The expansion of the financial services sector is a significant driver for the Credit Rating Software Market. As new financial products and services emerge, the need for effective credit rating solutions becomes increasingly critical. Financial institutions are expanding their offerings to include a diverse range of lending options, necessitating robust credit assessment tools to evaluate borrower creditworthiness. This trend is further fueled by the rise of fintech companies that are disrupting traditional lending practices. As these companies enter the market, they require sophisticated credit rating software to ensure sound risk management. The growth of the financial services sector is likely to continue driving demand for innovative solutions within the Credit Rating Software Market, as organizations strive to adapt to evolving consumer needs and preferences.

Rising Demand for Credit Risk Assessment

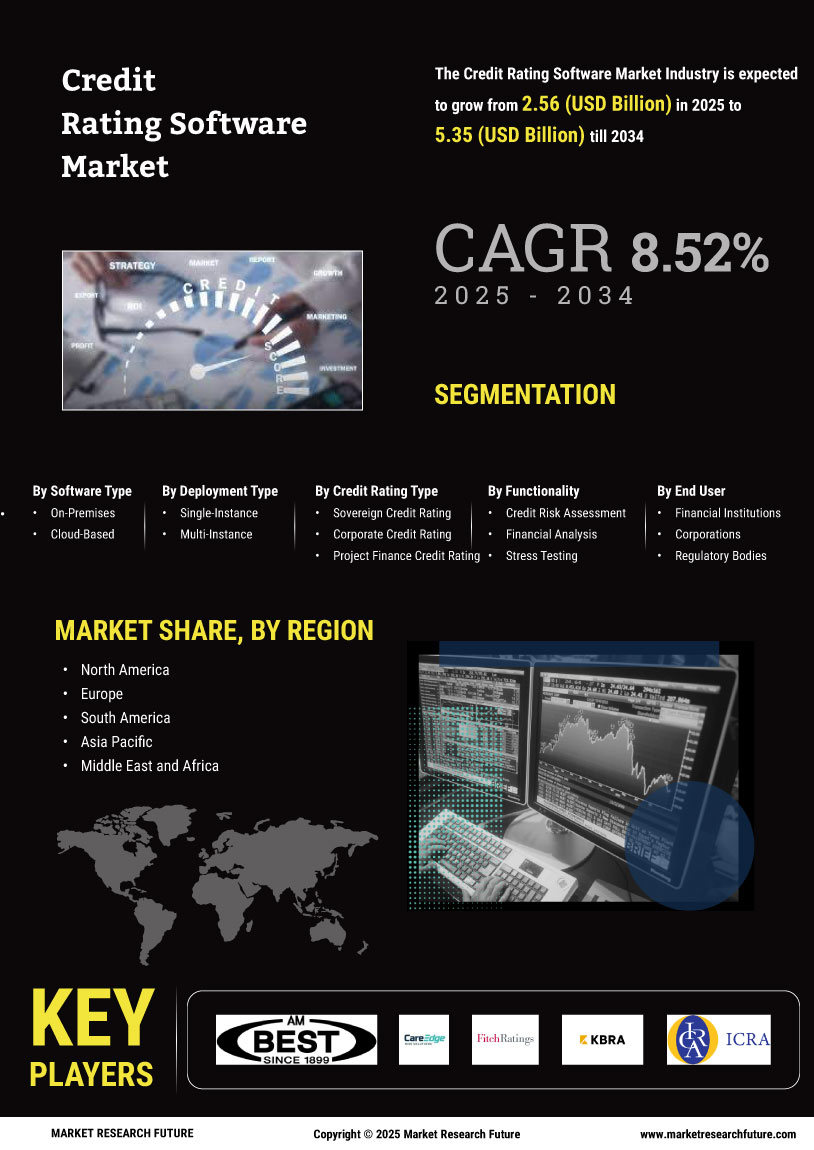

The increasing complexity of financial markets has led to a heightened demand for accurate credit risk assessment tools. As organizations seek to mitigate risks associated with lending and investment, the Credit Rating Software Market is experiencing significant growth. According to recent data, the market is projected to expand at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for real-time analytics and predictive modeling capabilities that enhance decision-making processes. Financial institutions are increasingly adopting sophisticated credit rating software to evaluate borrower creditworthiness, thereby reducing default rates and improving overall portfolio performance. Consequently, the demand for innovative solutions within the Credit Rating Software Market is likely to continue its upward trajectory.

Technological Advancements in Software Solutions

Technological advancements are playing a pivotal role in shaping the Credit Rating Software Market. The integration of advanced analytics, artificial intelligence, and machine learning algorithms into credit rating software has revolutionized the way credit assessments are conducted. These technologies enable organizations to process vast amounts of data efficiently, leading to more accurate and timely credit evaluations. As a result, financial institutions are increasingly investing in these innovative solutions to enhance their credit risk management strategies. The market for credit rating software is expected to witness a surge in demand as organizations recognize the value of leveraging technology to improve operational efficiency and reduce costs. This trend indicates a promising future for the Credit Rating Software Market, as firms strive to stay competitive in an evolving financial landscape.