Curing Adhesives Size

Curing Adhesives Market Growth Projections and Opportunities

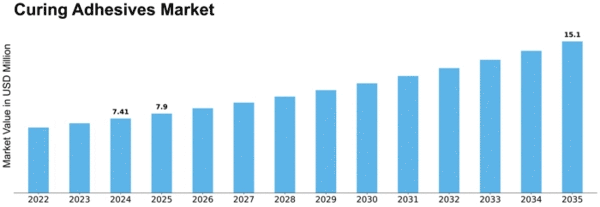

Different factors shape the Curing Adhesives Market's development and elements. The widespread usage of curing adhesives in manufacturing, development, vehicle, and hardware is a key driver. Curing adhesives hold materials together and preserve them from environmental factors. These flexible adhesives are useful for gathering pieces in electronic devices and holding underlying components in development projects. Curing Adhesives Market is expected to reach USD 10795.82 million by 2028, growing 7.76% annually.

The car industry also drives curing adhesives market growth. Auto assembly cycles use curing adhesives to retain body boards, glass, and interior items. Modern curing adhesives that are strong and efficient while reducing vehicle weight are in demand due to the car industry's ongoing pursuit of lightweight, sustainability, and safety.

Development is another major player in the curing adhesives market, where they find use in cement, wood, and metal. Curing adhesives increase material holding strength, making structures more reliable and robust. Global development projects fueled by framework improvement and urbanization increase interest in curing adhesives.

For gathering and typifying electronic parts, the electronics industry uses curing adhesives. Curing adhesives are used in hardware manufacturing due to the shrinking of electronic devices and the need for reliable holding arrangements in harsh working conditions. The increasing hardware sector, including cell phones, wearables, and other consumer electronics, drives need for high-performance curing adhesives.

Mechanical advances in curing cement details also drive market growth. Manufacturers invest in curing adhesives with faster curing times, better holding qualities, and substrate compatibility. The development of light-treatable, UV-reparable, and other high-level adhesives meets project needs and improves curing adhesives in many applications.

The curing adhesives industry is heavily influenced by topographical distribution of assembly and development projects. Curing adhesives are more common in Asia-Pacific and North America, where development is strong. Car manufacturing, hardware production, and framework development in clear districts boost market aspects.

However, strict administrative requirements, competition from alternative holding methods, and the need for customization may impact the curing adhesives market. Administrative consistency affects curing adhesive details and use, especially with unstable natural mixes (VOCs) and other harmful ingredients. Mechanical affixing and elective cement advancements compete with the company, needing constant development to stay ahead. Companies with unique holding needs may seek modified curing glue solutions, expecting manufacturers to adapt.

Leave a Comment