- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

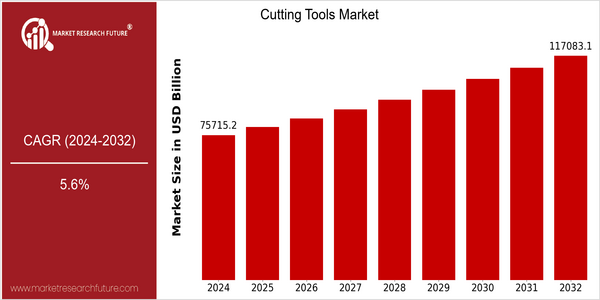

| Year | Value |

|---|---|

| 2024 | USD 75715.2 Billion |

| 2032 | USD 117083.1 Billion |

| CAGR (2024-2032) | 5.6 % |

Note – Market size depicts the revenue generated over the financial year

The global cutting tools market is poised for significant growth, with a current market size of USD 75,715.2 billion in 2024, projected to reach USD 117,083.1 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 5.6% over the forecast period from 2024 to 2032. The increasing demand for precision machining and the rising adoption of advanced manufacturing technologies are key drivers of this market expansion. As industries strive for enhanced efficiency and productivity, the need for high-performance cutting tools becomes paramount, thereby fueling market growth. Technological advancements, such as the development of smart cutting tools and the integration of automation in manufacturing processes, are further propelling the market forward. Companies like Sandvik Coromant, Kennametal, and Mitsubishi Materials are at the forefront of innovation, investing in research and development to create cutting-edge solutions that meet the evolving needs of various sectors, including automotive, aerospace, and metalworking. Strategic initiatives, such as partnerships and product launches, are also instrumental in enhancing market competitiveness and expanding product portfolios, thereby contributing to the overall growth of the cutting tools market.

Regional Market Size

Regional Deep Dive

The Cutting Tools Market is experiencing significant growth across various regions, driven by advancements in manufacturing technologies and increasing demand for precision engineering. In North America, the market is characterized by a strong presence of key players and a focus on innovation, while Europe emphasizes sustainability and efficiency in production processes. The Asia-Pacific region is witnessing rapid industrialization and urbanization, leading to heightened demand for cutting tools in various sectors. Meanwhile, the Middle East and Africa are gradually adopting advanced manufacturing practices, and Latin America is seeing growth due to investments in infrastructure and automotive industries.

Europe

- Europe is witnessing a surge in demand for high-performance cutting tools, particularly in the aerospace and medical sectors, with companies like Walter AG and Seco Tools investing heavily in R&D.

- The European Union's Green Deal is promoting sustainable manufacturing practices, encouraging the development of cutting tools that minimize waste and energy consumption, which is likely to reshape the market landscape.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrial growth, particularly in countries like China and India, where local manufacturers such as Mitsubishi Materials and Kyocera are expanding their product offerings to meet rising demand.

- Government initiatives aimed at boosting manufacturing capabilities, such as 'Make in India,' are fostering innovation in cutting tool technologies, which is expected to enhance competitiveness in the global market.

Latin America

- Latin America is seeing increased investments in the automotive and aerospace sectors, with companies like Emuge-Franken and ISCAR expanding their presence to cater to local demand.

- Economic recovery efforts post-pandemic are leading to a resurgence in manufacturing activities, which is likely to drive the demand for cutting tools in the region.

North America

- The North American market is heavily influenced by the automotive and aerospace industries, with companies like Kennametal and Sandvik Coromant leading the charge in innovation and product development.

- Recent regulatory changes aimed at enhancing workplace safety and environmental sustainability are pushing manufacturers to adopt more efficient and eco-friendly cutting tools, which is expected to drive market growth.

Middle East And Africa

- The Middle East and Africa are gradually adopting advanced manufacturing technologies, with countries like the UAE investing in smart manufacturing initiatives that require high-quality cutting tools.

- Local companies are collaborating with international firms to enhance their technological capabilities, which is expected to improve the quality and efficiency of cutting tools produced in the region.

Did You Know?

“Did you know that the cutting tools market is projected to see a significant shift towards digitalization, with smart cutting tools equipped with IoT technology expected to enhance operational efficiency?” — Industry reports and market analysis studies

Segmental Market Size

The Cutting Tools Market is experiencing stable growth, driven by the increasing demand for precision machining across various industries, including automotive, aerospace, and manufacturing. Key factors propelling this segment include the rising need for high-performance tools that enhance productivity and reduce operational costs, as well as advancements in materials science that lead to the development of more durable cutting tools. Additionally, the push for automation and smart manufacturing practices is further driving demand for innovative cutting solutions. Currently, the adoption of advanced cutting tools is in the scaled deployment stage, with companies like Sandvik Coromant and Kennametal leading the charge in innovation and market penetration. Primary applications include CNC machining, metalworking, and woodworking, where precision and efficiency are paramount. Trends such as sustainability initiatives and the shift towards eco-friendly manufacturing processes are catalyzing growth, as companies seek tools that minimize waste and energy consumption. Technologies such as computer-aided design (CAD) and computer-aided manufacturing (CAM) are shaping the evolution of cutting tools, enabling more precise and efficient production methods.

Future Outlook

The Cutting Tools Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $75,715.2 million to $117,083.1 million, reflecting a robust compound annual growth rate (CAGR) of 5.6%. This growth trajectory is underpinned by the rising demand for precision machining across various industries, including automotive, aerospace, and manufacturing. As industries increasingly adopt advanced manufacturing techniques, the need for high-performance cutting tools that enhance efficiency and reduce production costs will drive market penetration. By 2032, it is anticipated that the adoption rate of advanced cutting tools will reach approximately 60% in key sectors, up from 40% in 2024, indicating a strong shift towards automation and precision engineering. Key technological advancements, such as the development of smart cutting tools integrated with IoT capabilities, are expected to revolutionize the market landscape. These innovations will not only improve operational efficiency but also enable predictive maintenance, thereby reducing downtime and enhancing productivity. Additionally, sustainability initiatives and regulatory policies aimed at reducing waste and energy consumption will further propel the demand for eco-friendly cutting tools. Emerging trends, including the increasing use of additive manufacturing and hybrid machining processes, will also contribute to the market's evolution, creating new opportunities for manufacturers to innovate and differentiate their product offerings. Overall, the Cutting Tools Market is set to experience dynamic growth, driven by technological advancements and evolving industry needs.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 18.8 Billion |

| Market Size Value In 2023 | USD 19.96 Billion |

| Growth Rate | 6.20% (2023-2032) |

Cutting Tools Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.