Increasing Cyber Threats

The Cyber Liability Insurance Market is experiencing a surge in demand due to the escalating frequency and sophistication of cyber threats. Organizations across various sectors are increasingly targeted by cybercriminals, leading to significant financial losses and reputational damage. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually. This alarming trend compels companies to seek robust insurance solutions to mitigate potential risks. As a result, the Cyber Liability Insurance Market is witnessing a notable uptick in policy purchases, as businesses recognize the necessity of safeguarding their digital assets against evolving threats.

Growing Regulatory Requirements

The Cyber Liability Insurance Market is significantly influenced by the tightening of regulatory frameworks surrounding data protection and cybersecurity. Governments and regulatory bodies are implementing stringent laws that mandate organizations to adopt comprehensive cybersecurity measures. For instance, the introduction of regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) has heightened awareness regarding data breaches and their implications. Consequently, businesses are increasingly turning to cyber liability insurance as a means to comply with these regulations and protect themselves from potential legal liabilities. This trend is expected to drive growth in the Cyber Liability Insurance Market as organizations prioritize compliance and risk management.

Rising Awareness of Cyber Risks

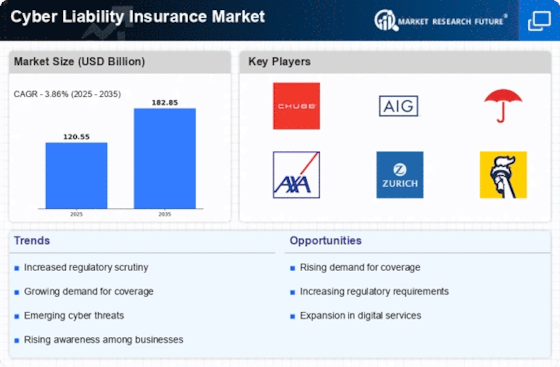

The Cyber Liability Insurance Market is benefiting from a growing awareness of cyber risks among businesses and consumers alike. As high-profile data breaches and cyberattacks make headlines, organizations are becoming more cognizant of the vulnerabilities they face in the digital landscape. This heightened awareness is prompting companies to invest in cyber liability insurance as a proactive measure to safeguard their operations. In 2025, it is projected that the market for cyber liability insurance will reach approximately 20 billion dollars, reflecting the increasing recognition of the importance of risk management in the face of cyber threats. This trend underscores the evolving landscape of the Cyber Liability Insurance Market.

Technological Advancements in Cybersecurity

The Cyber Liability Insurance Market is being shaped by rapid technological advancements in cybersecurity solutions. Innovations such as artificial intelligence, machine learning, and blockchain technology are enhancing the ability of organizations to detect and respond to cyber threats effectively. As businesses adopt these advanced technologies, they are also recognizing the need for insurance coverage to complement their cybersecurity measures. The integration of technology into insurance solutions is likely to create new opportunities within the Cyber Liability Insurance Market, as insurers develop tailored policies that align with the evolving needs of businesses in a technology-driven environment.

Expansion of Digital Transformation Initiatives

The Cyber Liability Insurance Market is experiencing growth driven by the widespread adoption of digital transformation initiatives across various sectors. As organizations increasingly migrate to digital platforms and cloud-based services, they expose themselves to new cyber risks. This shift necessitates a reevaluation of risk management strategies, leading many businesses to seek cyber liability insurance as a safeguard against potential breaches. In 2025, the market is expected to expand significantly, with estimates suggesting a compound annual growth rate of over 15%. This trend highlights the critical role of cyber liability insurance in supporting organizations as they navigate the complexities of digital transformation within the Cyber Liability Insurance Market.