Dairy Desserts Size

Market Size Snapshot

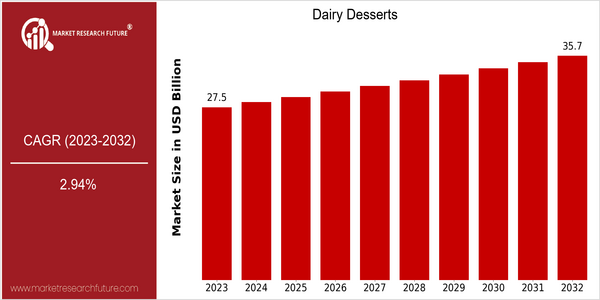

| Year | Value |

|---|---|

| 2023 | USD 27.51 Billion |

| 2032 | USD 35.7 Billion |

| CAGR (2024-2032) | 2.94 % |

Note – Market size depicts the revenue generated over the financial year

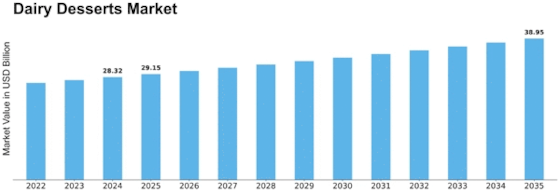

- The global dairy desserts market is expected to reach $27.5 billion in 2023 and will reach $34.3 billion by 2032, at a CAGR of 2.94% from 2024 to 2032. The steady growth of the market is largely due to the rising demand for dairy desserts, mainly due to the growing trend of consumers towards convenient and palatable food. The market is also driven by the increasing popularity of artisanal and premium dairy desserts and the growing demand for natural and low-sugar dairy desserts. Technological innovations in food processing and preservation are also expected to enhance product quality and shelf life, thus attracting a wider customer base. The major dairy dessert manufacturers, such as Danone, Nestlé and General Mills, are actively pursuing strategic alliances and product innovation to seize emerging opportunities. The launch of plant-based dairy alternatives and the development of high-tech, pro-health dairy desserts are examples of how companies can adapt to the new needs of consumers and lead the market to develop.

Regional Market Size

Regional Deep Dive

The Dairy Desserts Market is experiencing a dynamic growth in various regions, mainly due to changing consumer preferences, the rising health consciousness, and the increasing demand for a nourishing yet satisfying food. In North America, the market is characterized by the strong presence of established brands and the presence of innovative products. Europe, on the other hand, is characterized by a combination of old and new dairy desserts. The Asia-Pacific region is experiencing rapid growth due to urbanization and the rising middle class, whereas the Middle East and Africa are experiencing an increase in the demand for premium dairy desserts, influenced by cultural preferences. Latin America is also emerging as a significant market, with local flavors and ingredients gaining popularity. The Dairy Desserts Market will continue to grow, influenced by the preferences of the various regions.

Europe

- The European market is witnessing a trend towards organic and sustainably sourced dairy desserts, with brands like Alpro and Yoplait focusing on eco-friendly practices and ingredient transparency.

- Innovations in flavor profiles, such as the introduction of exotic fruits and spices, are gaining traction, driven by consumer demand for unique and gourmet dessert experiences.

Asia Pacific

- The growing popularity of traditional desserts, such as Japanese mochi ice cream and Indian kulfi, is driving innovation in the Dairy Desserts Market, with local companies like Häagen-Dazs and Amul expanding their product lines.

- E-commerce platforms are becoming increasingly important for distribution, allowing consumers in urban areas to access a wider variety of dairy desserts, thus boosting market growth.

Latin America

- The introduction of local flavors, such as dulce de leche and coconut, is becoming a significant trend in the Dairy Desserts Market, with companies like La Serenissima and Nestlé launching products that resonate with regional tastes.

- Increased disposable income and urbanization are driving demand for premium dairy desserts, leading to a rise in artisanal and gourmet offerings in the market.

North America

- The rise of plant-based alternatives is reshaping the Dairy Desserts Market, with companies like Danone and Nestlé launching innovative dairy-free dessert options to cater to health-conscious consumers.

- Regulatory changes in labeling and health claims are prompting manufacturers to reformulate products, leading to a surge in low-sugar and probiotic-rich dairy desserts, enhancing their appeal among health-focused consumers.

Middle East And Africa

- Cultural preferences for rich and creamy desserts are leading to a rise in demand for traditional dairy desserts like kunafa and basbousa, with local brands capitalizing on these tastes.

- Government initiatives promoting dairy farming and production are enhancing the supply chain for dairy desserts, encouraging local manufacturers to innovate and expand their offerings.

Did You Know?

“In 2022, the global consumption of yogurt, a key segment of the dairy desserts market, reached over 14 million metric tons, highlighting the growing popularity of dairy-based indulgences.” — FAO (Food and Agriculture Organization)

Segmental Market Size

The Dairy Desserts market is a dynamic segment of the dairy industry and is currently experiencing stable growth. This is due to changing consumer preferences for indulgent and healthier desserts. The growing popularity of plant-based alternatives and the increasing focus on clean label products are key drivers of demand. Also, innovations in flavour profiles and textures are making the products more appealing, especially to younger consumers. The market is currently in a mature stage of development. The North American and European regions are the most developed in terms of dairy desserts. They offer a wide range of dairy desserts, from yogurt-based desserts to premium ice creams. The main application is in retail, especially in hypermarkets and grocery stores, and in e-commerce. The dairy desserts market is also influenced by trends such as health and the concept of sustainable development. Companies are increasingly using eco-friendly packaging and highlighting the probiotic benefits of their products. The use of new fermentation processes and the development of flavour-enriching methods is also determining the evolution of the market and the relevance of dairy desserts.

Future Outlook

From 2023 to 2032, the dairy desserts market is expected to grow steadily, from $27,51 million to $35,701,000,000. The annual growth rate is 2.94%. The market is driven by the growing demand for healthy but indulgent desserts and the growing popularity of dairy products among health-conscious consumers. As the market matures, penetration is expected to increase, with an estimated 15% of households regularly consuming dairy desserts in 2032, up from an estimated 10% in 2023. The growing awareness of the nutritional benefits of dairy products, such as their high content of probiotics and their high protein content, is also a key driver. However, technological developments and regulatory drivers will also play a significant role in shaping the dairy desserts market. The development of new products, such as low-sugar and lactose-free products, is expected to attract a wider audience, including those with dietary restrictions. Also, the drive for sustainable development and the clean-label trend are influencing the way products are manufactured, as companies are adopting more sustainable sourcing and packaging solutions. As consumers become more demanding regarding the transparency of the ingredients in the products they consume, brands that focus on quality and sustainability will be the ones that will stand out. In short, the dairy desserts market will evolve, driven by changing consumer preferences, technological innovations, and the drive for health and sustainability.

Leave a Comment