Dairy Packaging Size

Market Size Snapshot

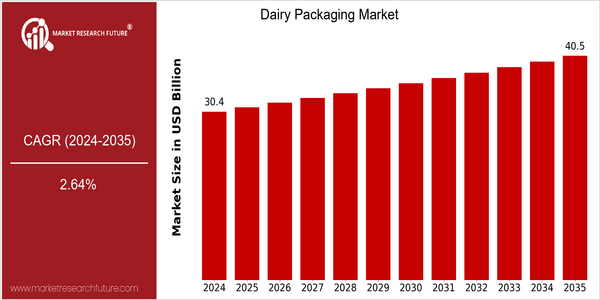

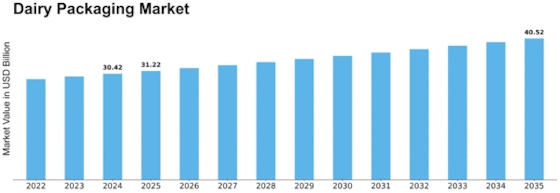

| Year | Value |

|---|---|

| 2024 | USD 30.42 Billion |

| 2035 | USD 40.5 Billion |

| CAGR (2025-2035) | 2.64 % |

Note – Market size depicts the revenue generated over the financial year

During the next eight years, the world dairy packaging market is expected to grow at a steady rate, with a current market value of about $ 30 billion in 2024, and is expected to reach $ 40 billion by 2035. The average annual growth rate from 2025 to 2035 is 2.6%. The main reasons for this are the increasing demand for dairy products due to the rising health awareness of consumers, and the popularity of dairy products with health functions. In addition, the development of new packaging materials such as sustainable and eco-friendly materials has increased the shelf life of products and the market value. Tetra Pak, Amcor and Sealed Air are the major dairy packaging companies. The industry is constantly investing in new packaging solutions and establishing strategic alliances to expand their market share. Tetra Pak, for example, has been focusing on sustainable packaging and has made great strides in this field. , in line with the trend of consumers to choose more eco-friendly products. Strategic moves, not only improve the competition of the company, but also contribute to the overall growth of the dairy packaging market.

Regional Market Size

Regional Deep Dive

The dairy packaging market is experiencing significant growth across various regions, with the rising demand for dairy products, the increasing trend towards sustainable packaging, and the development of advanced packaging technology. North America is characterized by convenience and eco-friendly packaging, while Europe is characterized by regulatory compliance and sustainable development. The Asia-Pacific region is characterized by rapid urbanization, changing dietary habits, and innovation in dairy consumption and packaging. Middle East and Africa are characterized by rising population and income, and Latin America is characterized by rising demand for dairy products and dairy packaging. Each region has its own characteristics and the market is shaped by the preferences of consumers, economic conditions, and regulations.

Europe

- The European Union's stringent regulations on food safety and packaging waste are driving innovation in the Dairy Packaging Market, prompting companies like SIG Combibloc to develop recyclable and biodegradable packaging solutions.

- There is a growing trend towards plant-based and alternative dairy products, leading to increased investment in packaging that caters to these new product lines, with companies like Danone exploring innovative packaging formats.

Asia Pacific

- Rapid urbanization and a shift towards modern retail formats in countries like China and India are driving demand for convenient and attractive dairy packaging, with local companies like Huishan Dairy investing in advanced packaging technologies.

- The region is witnessing a surge in health-conscious consumers, leading to increased demand for functional dairy products, which in turn is influencing packaging designs to highlight health benefits and nutritional information.

Latin America

- The increasing demand for packaged dairy products in Latin America is being met by local companies like Lala, which are focusing on developing packaging that enhances product freshness and extends shelf life.

- Cultural preferences for traditional dairy products are influencing packaging designs, with a trend towards more artisanal and locally-sourced packaging solutions that resonate with consumers' values.

North America

- The rise of e-commerce has led to increased demand for innovative packaging solutions that ensure product safety and extend shelf life, with companies like Tetra Pak and Amcor leading the charge in developing advanced packaging technologies.

- Sustainability is a key focus, with many dairy brands, such as Organic Valley, adopting eco-friendly packaging materials and practices in response to consumer demand for environmentally responsible products.

Middle East And Africa

- The growing population and rising disposable incomes in the Middle East are leading to increased consumption of dairy products, prompting companies like Almarai to invest in innovative packaging solutions that cater to local preferences.

- Regulatory changes aimed at improving food safety standards are pushing dairy producers to adopt more sophisticated packaging technologies, ensuring product integrity and compliance with health regulations.

Did You Know?

“Approximately 30% of all dairy products are sold in flexible packaging formats, which are increasingly favored for their lightweight and space-saving characteristics.” — Flexible Packaging Association

Segmental Market Size

The Dairy Packaging Market is growing steadily, driven by an increasing demand for convenience and sustainability. The main growth drivers of the market are the growing preference for eco-friendly packaging solutions and the stringent regulatory policies to reduce plastic waste. The companies are focusing on developing sustainable and biodegradable packaging materials and designs. At present, the sustainable dairy packaging is in the stage of commercialization. Some of the examples are Tetra Pak’s launch of plant-based cartons and SIG Combibloc’s commitment to introduce a fully recyclable packaging by 2025. The major applications of the dairy packaging are for milk, yogurt, and cheese. The companies such as Danone and Nestlé are taking the lead in adopting sustainable practices. The macro-level trends driving the market are the increasing emphasis on sustainable practices and the growing awareness of consumers about the impact of packaging on the environment. The advancements in materials science and digital printing are enabling the companies to offer more sustainable and digitally printed dairy packages.

Future Outlook

The dairy packaging market will grow steadily from 2024 to 2035, with a projected CAGR of 2.64%. This growth is due to the increase in consumption of dairy products, especially in emerging economies where urbanization and changes in diet are increasing consumption. The use of sustainable packaging materials is expected to grow significantly and is expected to account for more than 60% of dairy products by 2035. This will be in line with the goals of the world's sustainable development and the preferences of consumers for eco-friendly products. Also, smart packaging and improved barrier materials will play a significant role in shaping the market landscape. These innovations not only extend the shelf life of dairy products but also increase food safety and traceability, which are increasingly important for consumers. Moreover, the regulatory framework for the packaging industry will promote the use of biodegradable and recyclate materials. The companies that invest in research and development to develop efficient and sustainable packaging materials will have a significant advantage in this market.

Leave a Comment