Market Trends

Key Emerging Trends in the Data Center Infrastructure Market

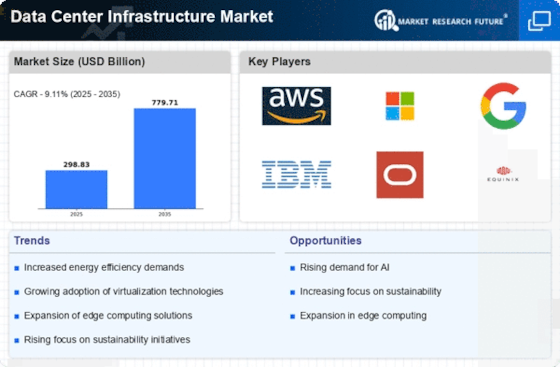

The Data Center Infrastructure market is influenced by various factors that drive its growth and evolution, catering to the increasing demand for robust and scalable data storage and processing solutions. One of the primary drivers propelling the expansion of this market is the exponential growth of data generated by businesses and consumers alike. With the proliferation of digital technologies, social media platforms, e-commerce transactions, and Internet of Things (IoT) devices, the volume of data being generated and processed continues to grow at an unprecedented rate. This surge in data creation underscores the need for data center infrastructure that can accommodate the scalability, reliability, and performance requirements of modern digital enterprises.

Moreover, the ongoing digital transformation initiatives across industries are driving the demand for data center infrastructure solutions. As businesses embrace cloud computing, big data analytics, artificial intelligence (AI), and other emerging technologies, they require robust and agile data center infrastructure to support their evolving IT workloads. Modern data centers are expected to provide high-speed connectivity, low-latency performance, and seamless integration with cloud services, enabling organizations to leverage the power of data-driven insights and innovation to gain a competitive edge in their respective markets.

Additionally, the increasing adoption of edge computing is reshaping the data center infrastructure landscape. Edge computing brings processing power closer to the point of data generation, enabling real-time data processing and analysis at the network edge. This distributed approach to computing is particularly relevant in scenarios where low latency and high responsiveness are critical, such as in autonomous vehicles, industrial automation, and Internet of Things (IoT) deployments. As organizations deploy edge computing solutions, they require edge data centers equipped with compact, energy-efficient infrastructure capable of supporting compute-intensive workloads in remote or resource-constrained environments.

Furthermore, the growing focus on sustainability and energy efficiency is driving innovation in data center infrastructure design and operations. Traditional data centers are notorious for their high energy consumption and environmental impact, leading to concerns about carbon emissions, resource depletion, and climate change. In response, data center operators are investing in energy-efficient cooling systems, renewable energy sources, and green building designs to minimize their carbon footprint and reduce operating costs. Moreover, advances in hardware efficiency, such as the adoption of solid-state drives (SSDs), liquid cooling solutions, and modular server architectures, are enabling data center operators to achieve higher levels of performance while consuming less power and space.

The competitive landscape of the data center infrastructure market is characterized by a diverse array of vendors, including hardware manufacturers, software providers, and managed service providers. Established players such as Dell Technologies, Hewlett Packard Enterprise (HPE), and Cisco Systems have long dominated the market with their comprehensive portfolios of servers, storage systems, networking equipment, and management software. However, they face increasing competition from agile startups and hyperscale cloud providers that offer innovative solutions tailored to the unique needs of modern data center environments.

Moreover, strategic partnerships and collaborations are becoming increasingly prevalent in the data center infrastructure market as vendors seek to expand their capabilities and reach new customer segments. By partnering with cloud service providers, telecommunications companies, and colocation providers, data center infrastructure vendors can offer more comprehensive solutions that address the end-to-end needs of their customers. These partnerships also enable vendors to leverage their combined expertise and resources to innovate faster and stay ahead of evolving market trends.

Leave a Comment