Top Industry Leaders in the Data Center Outsourcing Infrastructure Utility Services Market

Competitive Landscape of Data Center Outsourcing & Infrastructure Utility Services Market

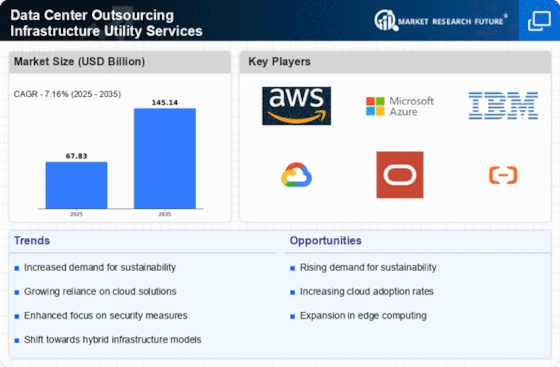

The Data Center Outsourcing & Infrastructure Utility Services market is undergoing a dynamic transformation, driven by relentless advancements in technology and burgeoning digitalization. Organizations are increasingly opting for flexible, agile, and cost-effective IT solutions, propelling the demand for outsourced data center management and infrastructure as a service (IaaS). This landscape harbors a diverse set of players, each implementing distinct strategies to capture market share and establish a competitive edge.

Key Players:

-

Atos (France)

-

Accenture Plc (Ireland)

-

Capgemini SE (France)

-

Cognizant (U.S.)

-

Fujitsu Ltd (Japan)

-

HCL Technologies Limited (India)

-

IBM (U.S.)

-

Infosys Limited (India)

-

Tata Consultancy Services Limited (India)

-

Tech Mahindra Limited (India)

Strategies for Market Share Gain:

-

Differentiation: Companies are building unique value propositions through specialization in security, sustainability, edge computing, or specific industry expertise. This attracts clients seeking tailored solutions beyond commoditized offerings.

-

Cost Leadership: Optimizing operational efficiency and leveraging economies of scale allow companies to provide cost-effective solutions, appealing to value-conscious clients.

-

Market Segmentation: Companies are tailoring their services to specific industries or company sizes to cater to diverse needs and capture a broader client base.

-

Technology Innovation: Continuous investment in cloud-native technologies, automation, and artificial intelligence (AI) enables companies to offer advanced solutions and enhance operational efficiency.

-

Strategic Partnerships: Collaborations with technology providers, system integrators, and other industry players allow companies to expand their service portfolios and reach new markets.

Factors for Market Share Analysis:

-

Geographic Footprint: Global reach and presence in key markets allow companies to cater to geographically dispersed clients.

-

Service Portfolio Breadth and Depth: Offering a comprehensive range of data center services and infrastructure utility options attracts clients with diverse needs.

-

Security and Compliance: Robust security measures and adherence to data privacy regulations are crucial for building trust and attracting clients in highly regulated industries.

-

Technology Adoption: Early adoption of cutting-edge technologies like cloud, AI, and automation provides a competitive edge.

-

Client Relationships and Support: Strong customer service and long-term partnerships foster loyalty and client retention.

New and Emerging Companies:

Several startups and smaller players are making their mark in the DC O&I market with innovative offerings and disruptive business models. Some notable examples include:

-

Edge computing specialists: Companies like Vapor IO and Edgevana offer localized micro data centers to address latency and bandwidth challenges in distributed edge computing environments.

-

Sustainability-focused players: Companies like Green Servers and ServerCentral prioritize energy efficiency and renewable energy integration in their data centers, catering to the growing demand for clean IT solutions.

-

Security-as-a-service providers: Companies like Lacework and Deepwatch offer cloud-based security platforms and managed security services for data centers, addressing the critical need for enhanced cybersecurity defense.

Current Company Investment Trends:

-

Hybrid and Multi-Cloud Adoption: Companies are investing in solutions that enable seamless integration and workload portability across different cloud platforms.

-

Software-Defined Data Centers (SDDC): The adoption of SDDC technologies is increasing as companies seek automation, agility, and resource optimization in their data centers.

-

Artificial Intelligence and Machine Learning (AI/ML): Integrating AI/ML for predictive maintenance, automated operations, and security threat detection is a major investment focus.

-

Edge Computing Infrastructure: Expanding edge computing infrastructure and service offerings is a significant area of investment as organizations look to process data closer to its source.

-

Sustainability Initiatives: Investments in renewable energy sources, energy-efficient data center designs, and carbon neutrality initiatives are gaining traction due to growing environmental concerns.

Latest Company Updates:

-

December 18, 2023: TCS was recognized as a Leader in Datacenter Outsourcing and Infrastructure Utility Services by NelsonHall.

-

January 12, 2024: Equinix announces plans to build a new data center in Mumbai, India, to meet the growing demand for cloud and digital services in the region.

-

January 10, 2024: Google Cloud expands its data center footprint in Europe with new facilities in Sweden and Finland.