Market Analysis

In-depth Analysis of Data Encryption Market Industry Landscape

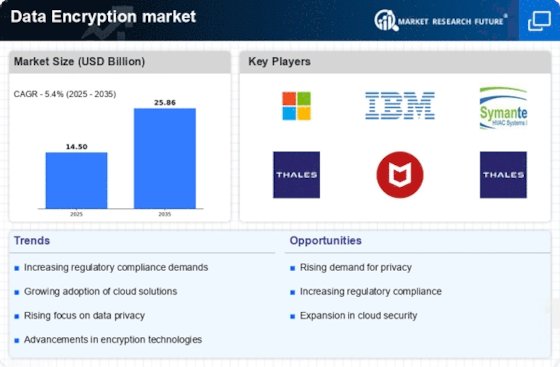

The data encryption marketplace is a dynamic and rapidly evolving region pushed through the ever-growing need to secure sensitive statistics in an interconnected digital international. As corporations across various industries try to protect their information from cyber threats, the marketplace dynamics of data encryption play an important position in shaping the panorama. One of the important things using elements is the rising attention to the significance of records security. With a surge in high-profile information breaches and cyber-assaults, businesses and people are increasingly recognizing the need for strong encryption solutions to shield their personal information.

The non-stop advancements in technology additionally contribute to the dynamic nature of the data encryption market. As cyber threats come to be extra state-of-the-art, encryption solutions need to evolve to offer better safety. The integration of artificial intelligence and system studying into encryption technology is becoming more and more commonplace, enabling proactive danger detection and response. The developing adoption of cloud computing and the extensive use of mobile devices similarly impact the data encryption marketplace. As businesses migrate their facts to the cloud and employees get admission to sensitive statistics on diverse gadgets, the demand for encryption answers that offer seamless and efficient protection throughout extraordinary systems intensifies. This fashion leads to the development of flexible encryption solutions that may adapt to numerous environments, contributing to the marketplace's dynamism.

Additionally, the economic panorama and international geopolitical factors contribute to the fluctuations inside the data encryption marketplace. Economic uncertainties and geopolitical tensions can affect the decision-making procedures of groups, influencing their investments in cybersecurity measures, which include data encryption. Moreover, the evolving nature of cyber threats encouraged by means of geopolitical occasions can cause shifts in market demands and options for specific encryption technologies.

The market dynamics of the data encryption marketplace are fashioned by means of a complicated interaction of things, which includes the growing recognition of statistics security, regulatory necessities, technological improvements, cloud adoption, and worldwide financial situations. As the virtual panorama continues to conform, the data encryption market is predicted to remain dynamic, with companies adapting to emerging demanding situations and possibilities to offer effective and comprehensive solutions for securing sensitive information.

Leave a Comment