Top Industry Leaders in the Data Protection Recovery Solution Market

Navigating the Data Protection and Recovery Maze: A Deep Dive into the Competitive Landscape

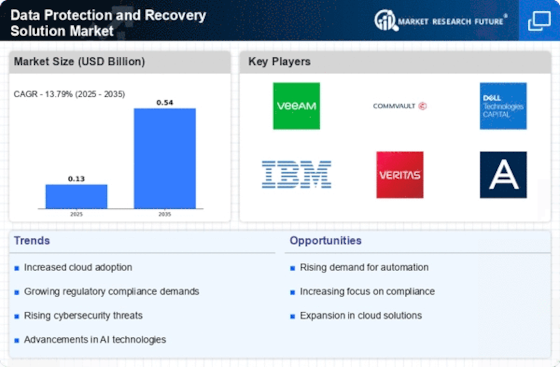

The Data Protection and Recovery Market is surging, fueled by the exponential growth of data, rampant cyber threats, and increasingly stringent regulations. It's a battleground for established giants and nimble startups vying for dominance. Understanding the competitive landscape is crucial for businesses seeking the right solutions to safeguard their critical data.

Key Players:

- IBM (U.S)

- Oracle (U.S)

- Hewlett Packard (U.S)

- Veeam Software (U.S)

- Commvault (U.S)

- McAfee (U.S)

- Symantec (U.S)

- CA Technologies (U.S)

- Acronis International GmbH (Switzerland)

- NetApp (U.S)

Strategies for Market Share Growth:

-

Product Innovation: Players compete on the sophistication of backup and recovery technologies, integration with cloud platforms, automation capabilities, and ransomware mitigation features. Advanced functionalities like AI-powered data analytics and disaster orchestration become key differentiators.

-

Strategic Partnerships: Partnerships with system integrators, managed service providers (MSPs), and cybersecurity vendors expand reach and offer bundled solutions catering to specific customer needs. Acquisitions of smaller players provide access to niche technologies and talent.

-

Compliance Focus: Integrating solutions with data privacy regulations like GDPR and HIPAA fosters customer trust and market penetration. Compliance-driven feature development attracts organizations in regulated industries.

-

Subscription Focus: Cloud-based subscription models with flexible pricing structures are gaining traction, especially among cost-conscious SMBs, challenging traditional perpetual licensing models.

Factors for Market Share Analysis:

-

Product Portfolio Breadth: The extent and diversity of data protection and recovery solutions offered, including backup, recovery, disaster recovery, and cloud integration, contribute to market share.

-

Customer Base Demographics: The number and type of customers served (enterprise, SMB, government, cloud-based) indicate a company's reach and market penetration.

-

Regional Presence: Global reach and presence in high-growth markets like Asia Pacific are crucial for larger players seeking wider market access.

-

Technological Advancement: Continuous investment in R&D, adoption of cutting-edge technologies like AI and automation, and development of innovative features drive long-term competitiveness.

Current Investment Trends:

-

Cloud Focus: Investment in building secure and scalable cloud-based DPR solutions is accelerating, catering to the increasing adoption of cloud infrastructure.

-

AI and Automation: Integrating AI-powered data analytics, anomaly detection, and automated recovery processes is a major area of investment, aiming to enhance solution efficiency and reduce human error.

-

Cybersecurity Integration: Deepening integration with cybersecurity platforms and threat intelligence providers allows for comprehensive data protection strategies that address both internal and external threats.

The DPR market is complex and constantly evolving. Understanding the competitive landscape, including key players, strategies, and emerging trends, empowers businesses to choose the right solutions to safeguard their data assets and ensure business continuity in today's data-driven landscape.

Latest Company Updates:

-

January 10, 2024: Acronis announces the release of its new Cyber Protect Cloud solution, which combines backup, disaster recovery, anti-malware, and endpoint protection in a single platform. -

December 15, 2023: Veeam launches its new Availability Suite v12, which includes enhanced data protection, disaster recovery, and cloud capabilities. -

November 30, 2023: Commvault announces the acquisition of Metallic, a leading cloud data protection provider, to expand its cloud offerings.