Rising Cybersecurity Threats

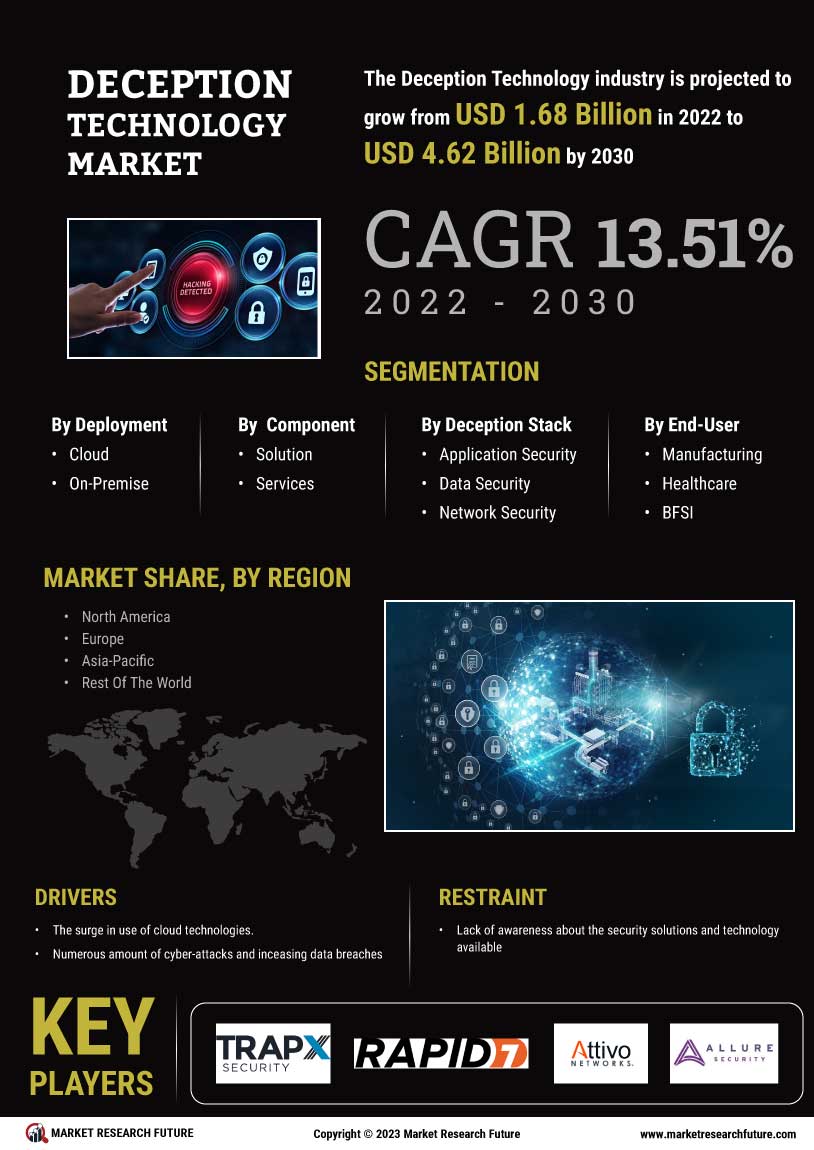

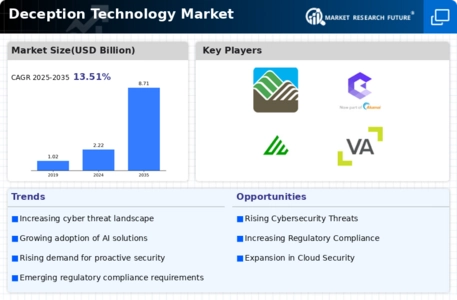

The Deception Technology Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are facing a myriad of attacks, including ransomware, phishing, and advanced persistent threats. As a result, businesses are compelled to adopt innovative security measures to protect sensitive data and maintain operational integrity. The Deception Technology is projected to reach USD 345.4 billion by 2026, indicating a robust growth trajectory. This escalation in cyber threats has led to a heightened awareness of deception technology, which offers proactive defense mechanisms by creating decoys and traps for potential attackers. Consequently, the Deception Technology Market is likely to expand as organizations seek to enhance their security posture against evolving threats.

Evolving Regulatory Landscape

The evolving regulatory landscape is significantly influencing the Deception Technology Market. Governments and regulatory bodies are implementing stringent data protection laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations mandate organizations to adopt robust security measures to safeguard personal data and ensure compliance. As a result, businesses are increasingly turning to deception technology as a means to enhance their security frameworks and mitigate risks associated with data breaches. The Deception Technology Market is likely to see growth as organizations seek solutions that not only protect sensitive information but also demonstrate compliance with regulatory requirements. This trend underscores the critical role of deception technology in modern cybersecurity strategies.

Growing Awareness of Insider Threats

The Deception Technology Market is also being driven by the growing awareness of insider threats. Organizations are recognizing that threats can originate from within, whether through malicious intent or unintentional actions by employees. This realization has prompted businesses to seek advanced security solutions that can detect and mitigate insider threats effectively. Deception technology offers a unique approach by creating deceptive environments that can identify suspicious behavior and alert security teams. As the potential impact of insider threats becomes more apparent, the demand for deception technology is likely to increase. This trend highlights the importance of comprehensive security strategies that address both external and internal threats, positioning the Deception Technology Market for continued growth.

Increased Investment in Cybersecurity Solutions

Investment in cybersecurity solutions is a key driver for the Deception Technology Market. Organizations are allocating substantial budgets to fortify their defenses against cyber threats, with spending expected to exceed USD 200 billion annually by 2024. This trend reflects a growing recognition of the importance of advanced security measures, including deception technology, which can effectively mislead attackers and provide valuable insights into their tactics. As businesses strive to comply with stringent regulations and protect their reputations, the demand for innovative solutions like deception technology is likely to rise. The Deception Technology Market stands to benefit from this influx of investment, as organizations increasingly prioritize comprehensive security strategies that incorporate deception techniques.

Technological Advancements in Deception Techniques

Technological advancements in deception techniques are propelling the Deception Technology Market forward. Innovations in artificial intelligence and machine learning are enhancing the effectiveness of deception technologies, enabling organizations to create more sophisticated decoys and traps. These advancements allow for real-time analysis of attacker behavior, providing valuable insights that can inform security strategies. As organizations seek to stay ahead of cybercriminals, the integration of cutting-edge technologies into deception solutions is becoming increasingly important. The Deception Technology Market is poised for growth as businesses adopt these advanced techniques to bolster their cybersecurity defenses. This trend underscores the dynamic nature of the industry and the ongoing need for innovative solutions in the face of evolving cyber threats.

Leave a Comment