Dental Chain Market Overview

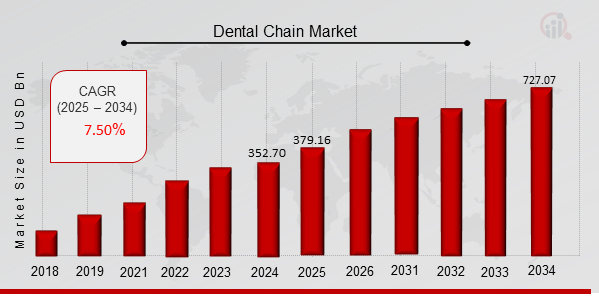

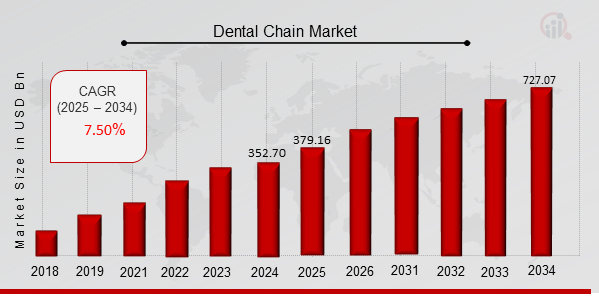

As per MRFR analysis, the Dental Chain Market Size was estimated at 352.70 (USD Billion) in 2024. The Dental Chain Market Industry is expected to grow from 379.16 (USD Billion) in 2025 to 727.07 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 7.50% during the forecast period (2025 - 2034). The growing senior population and the spike in demand for preventative and restorative dental care, combined with the ever-expanding teledentistry profession and development in dental operations, are the market drivers driving the dental chain market.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Dental Chain Market Trends

-

Rising demand for cosmetic procedures is driving the market growth

Cosmetic dentistry procedures include all dental operations that enhance the look of teeth, gums, and/or bites with a primary focus on enhancing dental aesthetics in terms of shape, size, location, alignment, color, and overall smile appearance. Porcelain veneers, teeth whitening, dental bonding, smile makeovers, full mouth reconstruction, gum lift and contouring, and other common cosmetic operations are just a few examples. A growing need for medical aesthetics, including cosmetic dentistry, is being caused by an increase in the prevalence of tooth-related disorders among the aging population. In the United States, there were approximately 59.6 million persons 65 years of age or older in 2022, and this number is projected to double to 74.7 million in 2040, according to the United Nations' World Ageing Population, published in July 2022. Additionally, over the course of the projection period, the introduction of new services is anticipated to fuel this segment's growth. For instance, Westlake Hills Dental Arts introduced its Smile Makeover service in November 2021. In order to improve the overall appearance of the teeth and smile, a smile makeover service combines restorative and aesthetic dentistry operations.

The burden of the aging population, which is more prone to dental disorders, is anticipated to drive demand for dental care and eventually enhance market growth over the course of the forecast period. For instance, periodontal disease and dental caries, particularly root caries, are very common in older persons, according to an article that appeared in the September 2021 issue of the Geriatric Journal. Periodontal disease, tooth loss, xerostomia, dental caries, and oral precancerous and cancerous diseases are among the dental issues that the elderly population frequently experiences. Additionally, the United States Census Bureau (USCB) foresees that by 2060, there will be 98 million Americans aged 65 and older, or 24% of the population. Thus, over the course of the forecast period, this is anticipated to fuel market expansion. Thus, driving the dental chain market revenue.

Dental Chain Market Segment Insights

Dental Chain Type Insights

The dental chain market segmentation, based on type includes Dental Consumables and Dental Equipment. The dental consumables segment dominated the market. The increasing occurrence of malocclusion along with the high demand for invisible orthodontics, particularly among teenagers and females, is related to the segmental growth. As clear aligners become more popular, market participants are introducing new products.

Figure 1: Dental Chain Market, by Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Dental Chain End-User Insights

The dental chain market segmentation, based on end-user, includes Solo Practices, DSO/Group Practices and Others. The solo practices category generated the most income. The increase can be attributed to the increased number of dentists who work in solo clinics. Furthermore, due to the large number of patients receiving treatment in these settings around the world, the expanding number of dentists is likely to fuel segmental expansion during the projection period.

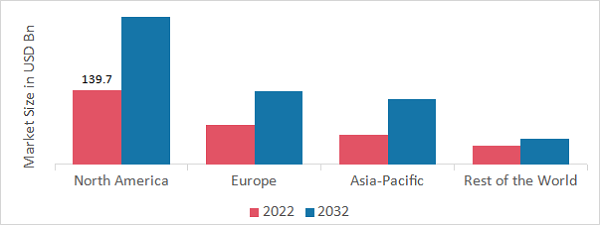

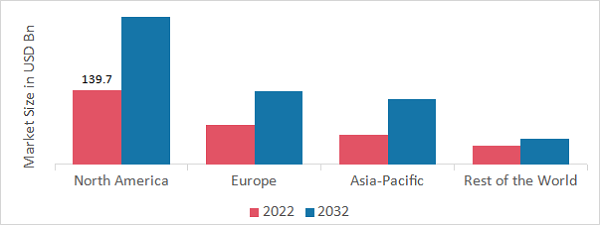

Dental Chain Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American dental chain market area will dominate this market. The region is expected to lead the market as a result of the widespread use of cutting-edge goods like transparent aligners and a surge in the release of new solutions by market competitors. Additionally, a large population with periodontitis and an increase in patient visits for treatment are expected to support regional growth. The existence of established firms will advance the local market.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: DENTAL CHAIN MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe dental chain market accounts for the second-largest market share. It is anticipated that the region's high rate of malocclusion and rise in the number of adults and teenagers having orthodontic treatment and other operations will drive market growth. Additionally, it is projected that rising service spending would result in increased demand for products related to consumables and equipment. Further, the German dental chain market held the largest market share, and the UK dental chain market was the fastest growing market in the European region

The Asia-Pacific Dental Chain Market is expected to grow at the fastest CAGR from 2023 to 2032. Due to the growing popularity of orthodontics and implants, as well as increased public awareness of oral health. Additionally, it is anticipated that rising investments by important regional firms would fuel the industry's expansion. Moreover, China’s dental chain market held the largest market share, and the Indian dental chain market was the fastest growing market in the Asia-Pacific region.

Dental Chain Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the dental chain market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, dental chain industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the dental chain industry to benefit clients and increase the market sector. In recent years, the dental chain industry has offered some of the most significant advantages to medicine. Major players in the dental chain market are attempting to increase market demand by investing in research and development operations includes 3M (U.S.), Institut Straumann AG (Switzerland), Henry Schein, Inc. (U.S.), Angelalign Technology Inc. (China), SHOFU INC. (Japan), Dentsply Sirona (U.S.), Align Technology, Inc. (U.S.), ZImvie (Zimmer Biomet) (U.S.), Coltene (Switzerland), A.B. Dental (Israel), BIOLASE, Inc. (U.S.), 3Shape A/S (Denmark), ENVISTA HOLDINGS CORPORATION (U.S.) and VATECH (South Korea).

The largest producer of professional dentistry supplies and technologies, Dentsply Sirona enables dental professionals to deliver better, safer, and quicker dental care. Leading positions and platforms across consumables, machinery, technology, and specialized goods are among products and solutions. Dentsply Sirona is a single team that develops the best in each member of the organization, lives and breathes high performance and personal accountability, acts with unwavering integrity, advances dental care through an unwavering dedication to the clients, and exhibits a passion for innovation that shapes the dental sector.

Envista is a collection of more than 30 reputable dental companies with a presence that share the goal of partnering with experts to enhance lives. Through market-leading products, solutions, and technology, Envista supports its partners in providing the highest quality patient care. In terms of detecting, treating, and preventing dental diseases as well as enhancing smiles, its broad portfolio—which includes dental implants and treatment alternatives, orthodontics, and digital imaging technologies—covers an estimated 90% of dentists' clinical demands.

Key Companies in the dental chain market include

Dental Chain Industry Developments

February 2022: Smile Brands has announced a new partnership with G's Dental Studio in Cedar Park and Leander, Texas, with the intention of increasing the studio's purchasing power and streamlining administrative support through payroll, purchasing, and accounting services.

February 2022: Across all of Dental Care Alliance's national sites, the customer communication platform from Weave has been effectively implemented.

January 2022: The dental supply company Spark Clear Aligner System was added to Pacific Dental Services' connection with Envista as part of an expansion of their existing relationship.

Dental Chain Market Segmentation

Dental Chain Type Outlook (USD Billion, 2018-2032)

Dental Chain End-User Outlook (USD Billion, 2018-2032)

Dental Chain Regional Outlook (USD Billion, 2018-2032)

North America

Europe

Asia-Pacific

Rest of the World

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

352.70 (USD Billion)

|

|

Market Size 2025

|

379.16 (USD Billion)

|

|

Market Size 2034

|

727.07 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

7.50 % (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2020 - 2024

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, End-User and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

3M (U.S.), Institut Straumann AG (Switzerland), Henry Schein, Inc. (U.S.), Angelalign Technology Inc. (China), SHOFU INC. (Japan), Dentsply Sirona (U.S.), Align Technology, Inc. (U.S.), ZImvie (Zimmer Biomet) (U.S.), Coltene (Switzerland), A.B. Dental (Israel), BIOLASE, Inc. (U.S.), 3Shape A/S (Denmark), ENVISTA HOLDINGS CORPORATION (U.S.) and VATECH (South Korea) |

| Key Market Opportunities |

Growing Teledentistry Demand and Development in Dental Procedures |

| Key Market Dynamics |

Growing Adoption for Preventive and Restorative Dental Care Due to Rising Geriatric Population |

Frequently Asked Questions (FAQ) :

The dental chain market size was valued at USD 305.2 Billion in 2022.

The market is projected to grow at a CAGR of 7.50% during the forecast period, 2025-2034.

North America had the largest share in the market

The key players in the market are 3M (U.S.), Institut Straumann AG (Switzerland), Henry Schein, Inc. (U.S.), Angelalign Technology Inc. (China), SHOFU INC. (Japan), Dentsply Sirona (U.S.), Align Technology, Inc. (U.S.), ZImvie (Zimmer Biomet) (U.S.), Coltene (Switzerland), A.B. Dental (Israel), BIOLASE, Inc. (U.S.), 3Shape A/S (Denmark), ENVISTA HOLDINGS CORPORATION (U.S.) and VATECH (South Korea).

The dental consumables category dominated the market in 2022.

The solo practices category had the largest share in the market.