Market Share

Dental Infection Treatment Market Share Analysis

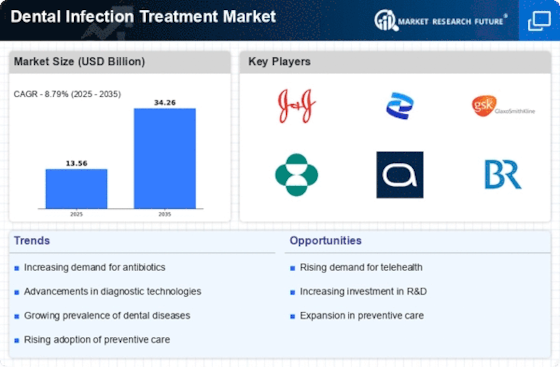

The Dental Infection Treatment Market, a vital segment within the wider healthcare industry, is undergoing rapid changes in terms of market share positioning strategies. This is because in this sector, players try to maneuver around advancements in dental technology, increasing prevalence of dental infections and growing emphasis on oral health. Differentiation through innovative product offerings, as one popular strategy involves research and development investment by companies thus enabling them come up with advanced dental infection treatment solutions that not only fight infections effectively but also take care of patients’ pain and recovery issues.

Moreover, there is an important strategy involving strategic alliances and collaborations among market players competing for market shares. They appreciate that dentistry is an interdisciplinary field; hence they form alliances with other stakeholders such as dental practitioners or research institutions to increase their product development capabilities. This does not only enhance knowledge exchange but also allow for the development of comprehensive treatment approaches thereby giving these involved firms competitive advantage.

Also notable is geographic expansion combined with market penetration. With globalization in healthcare industry, providers of dental infection treatments are seeking new markets and extending their foothold into untapped regions. These involve adjusting products and tactics to suit diverse needs according to various regulations set by the different markets. The idea behind this move is for companies to have different regions where they will be controlling the largest proportion of the market while being responsive to global demand for effective dental infection treatment options.

This trend towards customer-centric strategies becomes evident in shaping how firms position themselves in terms of market share within Dental Infection Treatment Market. As mentioned previously, it means focusing on know-how about what both dentists and patients prefer most when choosing or during usage process so as remain unique from others operating within Dental Infection Treatment Market due to constantly delivering useful products that are more than just doing the job right; they must include long term supports such as educational resources plus user friendly interfaces which can be accessed at any time by users themselves. By prioritizing customer satisfaction and building strong relationships with dental practitioners, companies aim to gain loyalty and differentiate themselves in a competitive market.

In response to the growing importance of sustainability as well as environmental awareness, some market participants are embracing eco-friendly practices and promoting responsible manufacturing. For this reason, it aligns perfectly with consumers’ heightened eco-consciousness, thereby enhancing the reputation of firms within Dental Infection Treatment Market. These initiatives ranging from sustainable packaging to development of ecofriendly treatment options contribute towards positive market positioning that appeals to larger numbers thus widening consumer target group.

Furthermore, pricing strategies greatly determine how players position themselves in attracting Dental Infection Treatment Market shares. To strike a balance between affordability and perceived value of their products, these organizations have gone for flexible pricing models. This can involve providing bundled services, volume-based discounts or even innovative financing approaches among others. They not only help companies in capturing larger proportions of the markets but also ensure they consider the financial implications for health care providers as well as end users by strategically setting their prices.

Leave a Comment