- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

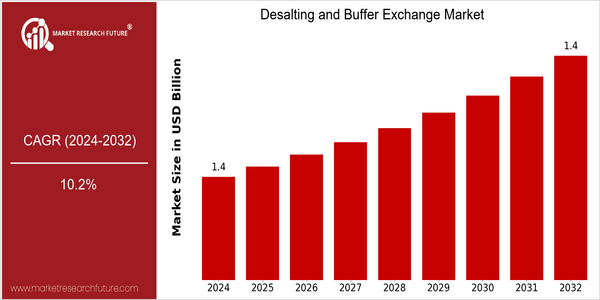

Desalting and Buffer Exchange Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 1.4 Billion |

| 2032 | USD 1.4 Billion |

| CAGR (2023-2032) | 10.2 % |

Note – Market size depicts the revenue generated over the financial year

The Desalination and Buffer Exchange Market is a market with a promising future. Its current size is $1.4 billion in 2024 and is projected to be valued at the same amount in 2032. This stability, coupled with a high CAGR of 10.2% from 2023 to 2032, indicates a market that is growing steadily, driven by technological advancements and a wide range of applications. It is largely driven by the increasing demand for efficient purification processes in biopharmaceuticals, the growing emphasis on high-quality recombinant proteins and formulation development. Also driving the market are advances in desalination and buffer exchange technology, such as the development of more efficient membrane systems and automatic buffer exchange solutions. The leading companies in the desalination and buffer exchange market, including GE Health, Thermo Fisher Scientific, and Merck KGaA, are investing heavily in research and development to enhance their product offerings. Also notable are the strategic alliances between companies to integrate newer technology and expand product offerings. The latest strategic alliances, for example, focus on developing more cost-effective and user-friendly solutions to meet the growing demand for high-throughput applications in laboratories and production sites. These developments will play a major role in shaping the future of the desalination and buffer exchange market.

Regional Deep Dive

Desalting and buffering exchange market is experiencing significant growth across the globe, owing to the rising demand for purified water and the advancements in biopharmaceutical manufacturing processes. In North America, the market is characterized by the strong presence of leading biotechnology companies and a robust regulatory framework that encourages innovation. In Europe, the market is characterized by the growing emphasis on sustainable practices and the emergence of stringent regulatory frameworks. The Asia-Pacific region is growing rapidly, owing to the increasing urbanization and industrialization. The Middle East and Africa region is focusing on desalination technology to address the water scarcity issues. Latin America is adopting these technologies, owing to the increasing need for effective healthcare solutions and the growing economies.

North America

- The U.S. Food and Drug Administration has recently published new guidelines for the production of biological drugs, indicating that buffer exchange processes are important. This is expected to drive the demand for desalination technology.

- Companies such as Thermo Fisher Scientific and GE Healthcare are investing heavily in the development of new desalting solutions, thus improving the efficiency and effectiveness of buffer exchange processes in biopharmaceutical applications.

- California is also a state where sustainable water use is in focus, and where desalination projects are advancing, which is expected to create new opportunities in the market.

Europe

- The Green Deal is pushing for a shift towards more sustainable production practices, and this has led to an increased investment in desalting technology to reduce waste and energy consumption.

- European Molecular Biology Laboratories such as the European Molecular Biology Laboratory (EMBL) are conducting research which emphasizes the importance of buffer exchange in the purification of the proteins, thereby influencing the market.

- In Germany, the pharmaceutical industry is now required to use the most modern desalting methods. This is expected to lead to improved product quality and safety.

Asia-Pacific

- China's rapid industrialization and urbanization are driving the demand for desalination technology, especially in the pharmaceutical industry, where the need for pure water is extremely urgent.

- India is a country that is seeing a number of government initiatives for the improvement of the health care system. One of these initiatives is the use of advanced ion exchange technology in biopharmaceutical manufacturing.

- The presence of the big companies Merck and Sartorius in the region, which encourages innovation and competition, has led to the development of more efficient desalination solutions.

MEA

- The Gulf Cooperation Council, to meet the problem of the water supply, is investing in the desalination of sea water. The pioneers in this field are the Spanish firms Abengoa and Acciona.

- The National Water and Energy Plan of the United Arab Emirates promotes the use of advanced desalination techniques, which will increase the efficiency of water use in various sectors, including health.

- Among the countries where the pharmaceutical industry is developing, the Kingdom of Saudi Arabia is an important center. The regulations in this country are now largely in favor of the use of desalination in the manufacture of medicines.

Latin America

- Brazil has begun to apply desalination in its pharmaceutical industry, because of the need for pure water for the manufacture of medicines.

- In Argentina, where access to health care is a priority, the use of buffer exchangers is a way of improving the quality of biopharmaceutical products.

- The region's economic problems are causing a shift towards more cost-effective desalination solutions, which is driving innovation and growth.

Did You Know?

“Desalination techniques can reduce by up to 90% the time needed for buffer exchange, which can make a considerable difference in the efficiency of biopharmaceutical production.” — Biotechnology Innovation Organization (BIO)

Segmental Market Size

The Desalination and Buffer Exchange market is playing a key role in water purification and biopharmaceutical processes, and is currently undergoing strong growth. The main drivers are the increasing demand for clean water due to growing population and urbanization, as well as stricter regulations on water quality. Furthermore, technological advances, such as reverse osmosis and electrodialysis, are increasing the efficiency and reducing the cost of desalination, which is also driving market demand.

It is a matter of record that the industry is now in a state of maturity. The leaders in this field are IDE and Veolia, which have already built a large number of desalination plants in regions such as the Middle East and California. These plants are used primarily for the treatment of municipal water supplies and for buffer exchange in the biopharmaceutical industry. For example, GE Health Care is using these processes for the purification of therapeutic proteins. The current trends are accelerating the growth of the industry, such as the growing concern for the environment and the demand for water conservation, while innovations in membrane technology and automation are shaping the future of the industry.

Future Outlook

Desalination and Buffer Exchange Market is expected to show significant growth between 2024 and 2032 with a CAGR of 10.2%. This growth is expected to be driven by the increasing demand for pure water in various industries such as pharmaceuticals, biotechnology and food & beverages. Desalination and buffer exchange technology has gained momentum with the growing need for pure water in these industries. As the demand for pure water is growing, the market is expected to reach $ 1,409,215,261 by 2032. The penetration of desalination solutions in emerging economies, especially in regions where water shortages are severe, will also support market growth, with a significant increase in the use of water-dependent industries.

It is expected that the desalination of seawater by osmosis and electrodialysis will be facilitated by certain technical developments. Moreover, the establishment of a policy of sustainable water management will play a decisive role in the development of the market. Also, the integration of desalination in the use of renewable energy and the development of smart water management are expected to create new opportunities for market players. The evolution of the industry will require the agility and responsiveness of the different players to take advantage of the growing demand for desalination and salt-exchange solutions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 10.2% |

Desalting and Buffer Exchange Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.