Rising Industrial Demand

The industrial sector's growing demand for high-purity water is a significant driver of the Global Desalting and Buffer Exchange Market Industry. Industries such as pharmaceuticals, electronics, and food processing require water that meets stringent purity standards. Desalination offers a reliable source of high-quality water, essential for these sectors. For example, semiconductor manufacturing relies heavily on ultra-pure water, which can be efficiently produced through desalination processes. As industries expand and regulations tighten, the need for desalinated water is likely to increase, further propelling market growth and enhancing the industry's relevance in meeting industrial water needs.

Increasing Water Scarcity

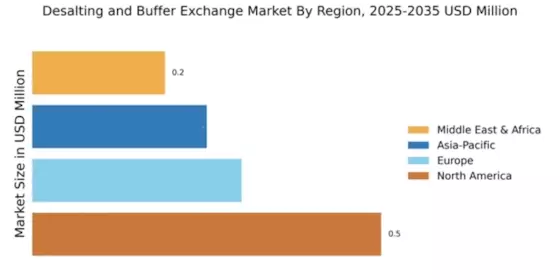

The Global Desalting and Buffer Exchange Market Industry is experiencing growth due to rising water scarcity in various regions. As populations expand and climate change exacerbates drought conditions, the demand for alternative water sources intensifies. Desalination technologies provide a viable solution, converting seawater into potable water. For instance, countries like Saudi Arabia and Australia have invested heavily in desalination plants to secure water supply. This trend is expected to drive the market, with projections indicating a market value of 0.53 USD Billion in 2024, reflecting the urgent need for sustainable water solutions.

Technological Advancements

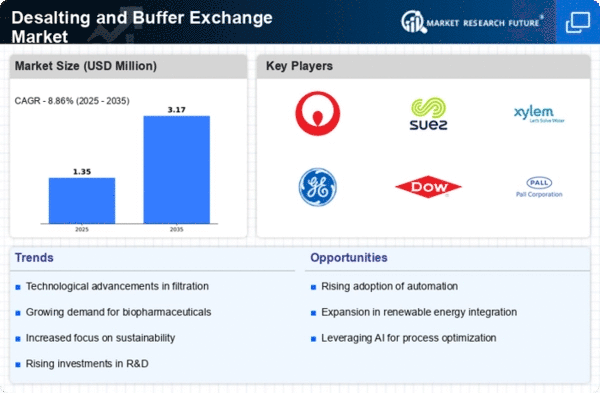

Innovations in desalination technologies significantly influence the Global Desalting and Buffer Exchange Market Industry. Advances such as reverse osmosis and forward osmosis have improved efficiency and reduced costs, making desalination more accessible. For example, the development of energy recovery devices has enhanced energy efficiency in desalination processes. These technological improvements not only lower operational costs but also expand the applicability of desalination in various regions. As a result, the market is poised for growth, with a projected compound annual growth rate (CAGR) of 12.25% from 2025 to 2035, indicating a robust future for the industry.

Government Initiatives and Funding

Government initiatives play a crucial role in the expansion of the Global Desalting and Buffer Exchange Market Industry. Many governments are recognizing the importance of securing water resources and are investing in desalination projects. For instance, the United States has allocated funding for research and development in desalination technologies, aiming to enhance water supply resilience. Such initiatives not only provide financial support but also promote collaboration between public and private sectors. This trend is expected to contribute to the market's growth, with the industry projected to reach 1.87 USD Billion by 2035, reflecting the increasing commitment to sustainable water management.

Environmental Concerns and Sustainability

Environmental concerns regarding freshwater resource depletion are increasingly influencing the Global Desalting and Buffer Exchange Market Industry. As awareness of sustainable practices grows, desalination is viewed as a necessary alternative to traditional water sources. The process, while energy-intensive, is being optimized to minimize environmental impacts. For instance, advancements in renewable energy integration into desalination plants are being explored to reduce carbon footprints. This shift towards sustainable desalination practices aligns with global sustainability goals, potentially attracting investments and driving market growth. The industry's evolution towards environmentally friendly solutions may play a pivotal role in shaping its future.