Market Trends

Key Emerging Trends in the Diabetic Neuropathy Treatment Market

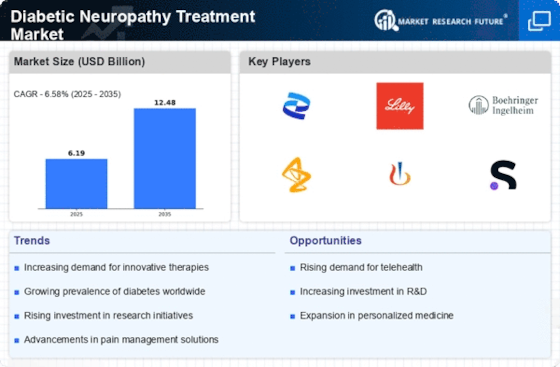

The market for Diabetic Neuropathy Treatment is witnessing a full-size surge because of the escalating prevalence of diabetes globally. With diabetes turning into a large health difficulty, the prevalence of Diabetic Neuropathy, a commonplace trouble, is also on the upward thrust. With ache being a primary symptom of Diabetic Neuropathy, there's a growing demand for effective ache management solutions. Analgesic pills, topical treatments, and nerve pain medicines are gaining traction within the market as patients are looking for alleviation from neuropathic aches related to diabetes. The Diabetic Neuropathy Treatment market is regularly shifting towards personalized medicine methods. Tailoring treatment plans primarily based on male or female patient traits, genetic factors, and response to remedies is gaining prominence. This trend reflects a growing knowledge of the heterogeneity of Diabetic Neuropathy and the want for custom-designed remedy strategies. Complementary and opportunity remedies, inclusive of physical therapy, acupuncture, and lifestyle changes, are gaining attention in the Diabetic Neuropathy Treatment landscape. These non-pharmacological interventions aim to complement conventional scientific tactics, supplying holistic care and enhancing standard patient consequences. Research collaborations among pharmaceutical companies, instructional establishments, and healthcare corporations are fostering innovation in Diabetic Neuropathy Treatment. Such partnerships facilitate the pooling of resources, know-how, and statistics, accelerating the development of novel therapeutic processes and bringing them to market extra successfully. Recognizing the importance of early detection and control, there is a developing emphasis on patient training and consciousness programs. These initiatives goal to empower people with diabetes to proactively manage their condition, lessen the threat of growing neuropathy, and search for timely medical intervention while essential. The Diabetic Neuropathy Treatment market is experiencing global growth, driven by using multiplied focus, improved healthcare infrastructure, and growing disposable incomes in rising economies. This widening geographic footprint provides possibilities for market players to tap into new patient populations and cope with numerous healthcare needs. Stringent regulatory frameworks and hints are shaping the Diabetic Neuropathy Treatment market. The approval methods for new capsules and healing procedures, in conjunction with adherence to protection and efficacy standards, are important elements influencing market dynamics. Keeping abreast of regulatory tendencies is critical for industry stakeholders to navigate this evolving landscape.

Leave a Comment