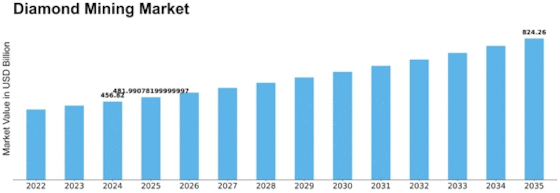

Diamond Mining Size

Diamond Mining Market Growth Projections and Opportunities

The diamond mining market is driven by a vast range of factors which determine its trends and the general course. Principally, the emerging markets are very central to maintaining this demand. As the middle class in China and India increases, so does their consumption of diamond also thus contributing to thediamond mining industry growth. Another significant market driver is the discovery and usage of many diamond deposits. Production and supply can also change accordingly because of the new discoveries, which in turn influence the market prices. On the other hand, drained deposits can lead to a decrease in the supply which is likely to make the prices increase. The accessibility of the diamond deposits is also affected by the technological advancements in exploration and mining techniques, which have a great impact on market dynamics. Diamond industry in the producing countries is driven by the government policies and laws. Several countries apply harsh rules regarding the diamond mining in order to preserve the nature and maintain the balance of justice. In addition, the adherence to such rules affects the cost of production and ultimately determines the global prices for diamonds. Secondly, geopolitical stability in the areas where diamonds are being mined is also very vital because political instability can greatly affect the mining activities and disrupt the supply chains. Market variables are also affected by the environmental and ethical issues related to the diamond mining. However, a greater understanding of how the mining impacts the environment has made demand for ethical diamonds rise. The consumers want to be sure that the diamonds are mined and traded in an ethical way without resulting into any conflicts or degradation of the environment. This change has led the industry to embrace sustainable and ethical practices whose ripples have spread through market trends. The diamond mining market is subject to the currency rate fluctuations, which have a very strong impact on it. Because diamonds are universally traded commodities, the fluctuations in currency values can impact greatly on the competitiveness of diamond-producing nations. There is no doubt that a weaker local currency would make the diamond exports more competitive in the market, which could lead to increasing sales and revenues for the producers from those regions. Technological developments pertaining to the diamond processing and manufacturing are also key influences in the market. Supply-demand balance can be affected by the innovations in cutting and polishing techniques as well as the production of synthetic diamonds. Finally, consumer trends and preferences are the dynamic aspects of the market for diamond mining. Various types of diamond’s many consumer preferences are also influenced by the changes in fashion trends, changing consumers' taste and the marketing strategies adopted by the industry players. For instance, the rising demand for coloured diamonds or specific cuts would influence this market due to the unique choices that provide a personalization aspect.

Leave a Comment