Market Share

Diaphragm Pumps Market Share Analysis

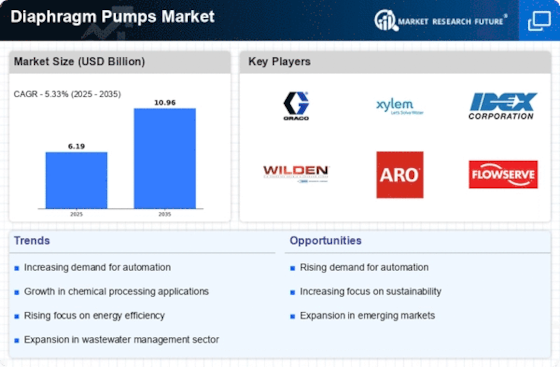

The global market for air-operated double diaphragm pumps exhibits a nuanced landscape, segmented based on various criteria such as material composition, pressure capabilities, size dimensions, and industry applications. These delineations shed light on the diverse factors influencing the growth trajectories of different segments within the air-operated double diaphragm pumps market.

One key aspect of segmentation revolves around the material used in the construction of these pumps, with choices including aluminum, cast iron, stainless steel, and others. The stainless steel segment stands out as a pivotal player, poised to experience the most rapid growth during the forecast period. In 2019, stainless steel held a substantial market share, accounting for 40.12% of the overall air-operated double diaphragm pumps market.

The pressure capabilities of air-operated double diaphragm pumps form another crucial segmentation criterion, classified into up to 5 bar, 5 bar–10 bar, and above 10 bar categories. Among these, the up to 5 bar segment is anticipated to demonstrate the swiftest growth throughout the forecast period. Notably, in 2019, the up to 5 bar segment commanded a significant market share, amounting to 44.84% of the global air-operated double diaphragm pumps market.

Furthermore, the size dimensions of these pumps play a pivotal role in their applications, prompting a segmentation into categories such as up to 1”, 1” to 2”, and above 2”. The 1” to 2” segment emerges as the frontrunner in terms of growth prospects during the forecast period. In 2019, this segment held a noteworthy market share of 46.89% within the global air-operated double diaphragm pumps market.

The industry applications of air-operated double diaphragm pumps contribute significantly to their market dynamics, categorizing them into sectors like chemical, water & wastewater, oil & gas, pharmaceutical, marine, paper & pulp, food & beverage, electronics, and others. Notably, in 2019, the water & wastewater segment staked its claim as a major player, securing an 18.89% share of the global air-operated double diaphragm pumps market.

This intricate segmentation of the air-operated double diaphragm pumps market reflects the multifaceted nature of the industry, acknowledging the diverse requirements and preferences of end-users across various sectors. As stainless steel gains prominence, and specific pressure and size categories see accelerated growth, the market continues to evolve to meet the nuanced demands of industries ranging from chemicals to electronics. This granular understanding of segmentation enhances the strategic decision-making process for stakeholders within the air-operated double diaphragm pumps market, facilitating a comprehensive approach to market dynamics and trends.

Leave a Comment