Digestible Sensors Size

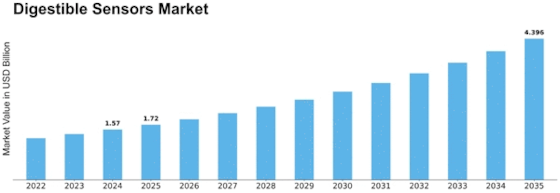

Digestible Sensors Market Growth Projections and Opportunities

The universality of persistent infections is a critical market factor. Digestible sensors offer a proactive way to deal with overseeing persistent conditions by continuously observing vital signs and giving significant pieces of knowledge to healthcare professionals. This has prompted an expanded reception of these sensors for conditions like diabetes, cardiovascular illnesses, and gastrointestinal problems. The developing pattern of telehealth and remote patient observing is driving the interest for digestible sensors. These sensors empower healthcare suppliers to remotely follow patient health, guaranteeing appropriate mediations and diminishing the requirement for successive in-person visits. The comfort and effectiveness offered by digestible sensors line up with the advancing scene of healthcare delivery. The convergence of interests in healthcare innovation, including advanced health arrangements like digestible sensors, is impelling market growth. Investment subsidizing and organizations between innovation organizations and healthcare suppliers are driving examination, advancement, and market extension of these imaginative sensor advances. The inclination for non-invasive checking arrangements is a key element impacting the reception of digestible sensors. Patients and healthcare professionals are progressively choosing advancements that limit distress and interruption. Digestible sensors, ingested like a pill, give a non- intrusive method for social occasion vital health information. The maturing worldwide population is adding to expanded healthcare requests, especially for constant illness management. Digestible sensors offer a proactive way to deal with address the special healthcare needs of a maturing population, making them a resource in the more extensive setting of geriatric healthcare. The joining of digestible sensors into the more extensive healthcare ecosystem is an urgent market factor. Consistent network with electronic health records (EHRs) and other health data frameworks improves the utility of these sensors. Combination works with productive information dividing between healthcare suppliers, advancing cooperative and thorough patient consideration.

Leave a Comment