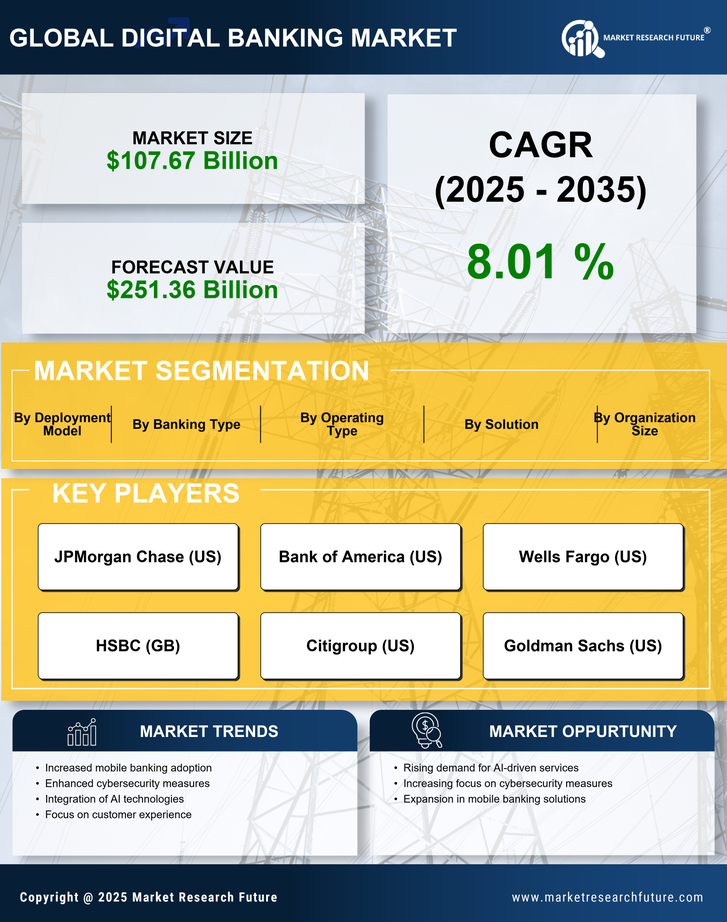

The Digital Banking Market is moderately fragmented, with global banks focusing on platform innovation, partnerships, and bank digital marketing company collaborations. Institutions such as JPMorgan Chase and HSBC are strengthening customer engagement through advanced digital marketing for banking industry initiatives. Strategic investments in AI, automation, and digital banking marketing services are enabling banks to differentiate offerings and expand market reach. Competitive advantage increasingly depends on analytics-driven decision-making and scalable digital platforms. Major players such as JPMorgan Chase (US), HSBC (GB), and Goldman Sachs (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. JPMorgan Chase (US) emphasizes innovation through significant investments in fintech partnerships, aiming to streamline customer experiences and expand its digital offerings. Meanwhile, HSBC (GB) focuses on regional expansion, particularly in Asia, where it seeks to leverage its The Digital Banking opportunities. Goldman Sachs (US), on the other hand, is concentrating on digital transformation, particularly through its Marcus platform, which aims to attract a younger demographic seeking accessible banking solutions. Collectively, these strategies contribute to a competitive environment that is increasingly defined by technological prowess and customer-centric approaches..The market structure appears moderately fragmented, with a blend of established banks and emerging fintech firms vying for market share. Key players are employing various business tactics, such as localizing services to meet regional demands and optimizing their digital infrastructures to enhance operational efficiency. This competitive structure allows for a diverse range of offerings, catering to different consumer segments and preferences, thereby intensifying the competition among incumbents and new entrants alike.

In September JPMorgan Chase (US) announced a strategic partnership with a leading fintech firm to enhance its mobile banking capabilities. This collaboration is poised to integrate advanced AI-driven features into its app, potentially revolutionizing user engagement and personalization. Such a move underscores the bank's commitment to staying ahead in the digital race, as it seeks to provide tailored financial solutions that resonate with tech-savvy consumers.

In August HSBC (GB) launched a new digital platform aimed at small and medium-sized enterprises (SMEs) in Asia. This initiative is strategically significant as it not only addresses the unique banking needs of SMEs but also positions HSBC as a key player in the rapidly growing digital banking sector in the region. By focusing on this underserved market, HSBC is likely to enhance its customer base and drive revenue growth in a competitive landscape.

In July Goldman Sachs (US) expanded its Marcus platform to include cryptocurrency trading options. This strategic pivot reflects the bank's recognition of the growing interest in digital assets among consumers. By diversifying its offerings, Goldman Sachs aims to attract a broader audience, particularly younger investors who are increasingly inclined towards innovative financial products. This move may also signal a shift in traditional banking paradigms, as established institutions adapt to the evolving financial landscape.

As of October the Digital Banking Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming increasingly pivotal, as companies collaborate to enhance their technological capabilities and expand their service offerings. Looking ahead, competitive differentiation is likely to evolve, with a pronounced shift from price-based competition to a focus on innovation, technological advancement, and supply chain reliability. This transition suggests that the future of digital banking will hinge on the ability of institutions to leverage technology to create unique value propositions for their customers.