Digital Breast Tomosynthesis Market Summary

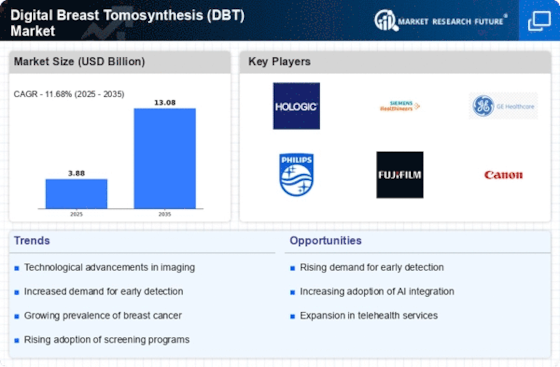

As per MRFR analysis, the Digital Breast Tomosynthesis Market (DBT) Market Size was estimated at 3.88 USD Billion in 2024. The Digital Breast Tomosynthesis industry is projected to grow from 4.333 USD Billion in 2025 to 13.08 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.68 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Digital Breast Tomosynthesis Market (DBT) market is poised for substantial growth driven by technological advancements and increasing awareness.

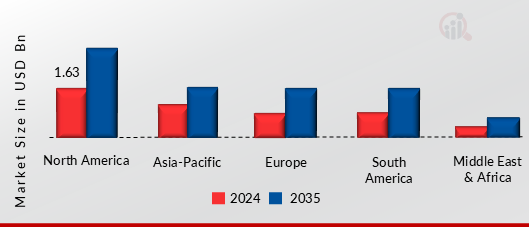

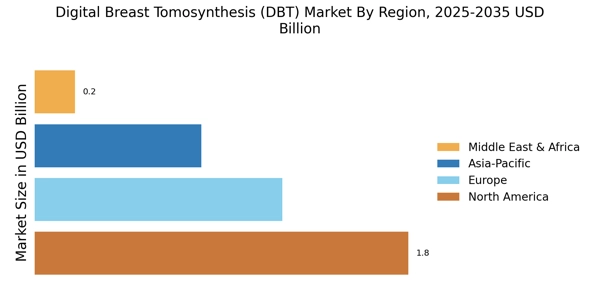

- Technological advancements in imaging are enhancing the accuracy of breast cancer detection, particularly in North America.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rising healthcare investments and awareness initiatives.

- The 3D-Only segment remains the largest, while the 2D/3D Combo segment is experiencing rapid growth due to its versatility.

- Key market drivers include the rising incidence of breast cancer and regulatory support for advanced imaging technologies.

Market Size & Forecast

| 2024 Market Size | 3.88 (USD Billion) |

| 2035 Market Size | 13.08 (USD Billion) |

| CAGR (2025 - 2035) | 11.68% |

Major Players

Hologic (US), Siemens Healthineers (DE), GE Healthcare (US), Philips (NL), Fujifilm (JP), Canon Medical Systems (JP), Carestream Health (US), Konica Minolta (JP), Agfa HealthCare (BE)

Leave a Comment