- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Digital Forensics Market Size Snapshot

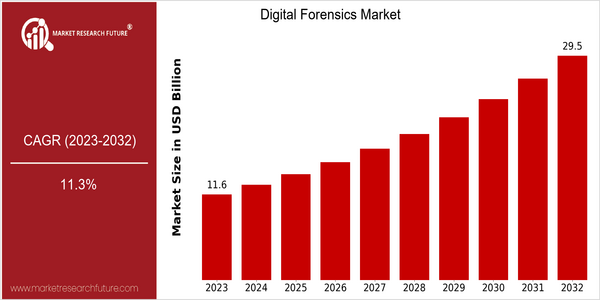

| Year | Value |

|---|---|

| 2023 | USD 11.6 Billion |

| 2032 | USD 29.5 Billion |

| CAGR (2024-2032) | 11.3 % |

Note – Market size depicts the revenue generated over the financial year

In 2023, the digital forensics market is expected to reach $ 11.6 billion and to grow to $ 29.5 billion by 2032. CAGR from 2024 to 2032 is expected to be 11.3%. The increase in the use of digital technology in all areas of activity and the increase in the number of cyber-attacks will increase the demand for digital forensics. Consequently, the growing number of companies investing in digital forensics tools to ensure the security and integrity of information is reflected in the upward trend of the market. Several factors contribute to the growth of this market, such as the spread of mobile devices, the development of the Internet of Things (IoT) and the complexity of cyber-attacks. The awareness of organizations and individuals of the risks associated with digital data is growing, which in turn increases the demand for effective forensic tools and incident response methods. The main market players, such as AccessData, Guidance Software and Magnet Forensics, are actively implementing strategic initiatives, such as associations and product innovations, to strengthen their positions and increase market share. The integration of artificial intelligence into forensic tools is expected to facilitate the process of examining evidence and increase the efficiency of forensic activities, which will lead to the growth of the market.

Regional Deep Dive

The digital forensics market is gaining traction across regions, mainly due to the increasing need for security, the rise in cybercrime, and the rising adoption of digital technology. North America is characterized by a highly developed technological base and a high concentration of key players, while Europe is characterized by strict regulations that are shaping the compliance landscape. The Asia-Pacific region is characterized by a rapid increase in digital data generation and a growing focus on law enforcement capabilities. Middle East and Africa are seeing a rise in investments in cybersecurity, while Latin America is slowly adopting digital forensics solutions to combat the growing threat from cybercrime.

North America

- IT security is an important part of national security. The CISA initiative stresses the importance of digital forensics to national security and incident response.

- Several companies, such as FireEye and Guidance Software, are introducing new forensic tools based on artificial intelligence, which will increase the speed and accuracy of investigations.

- The remote work trend has increased the collection of digital evidence from personal devices, which has prompted companies to adapt their forensic strategies accordingly.

Europe

- The General Data Protection Regulation (GDPR) has prompted companies to make investments in digital forensics to ensure compliance and reduce risks.

- In this field the European Agency for Network and Information Security (ENISA) is very active, and it is a major player in the development of forensic science in the digital environment. It encourages the sharing of knowledge and experience between the Member States in order to enhance cyber security.

- Chainalysis, for example, is working on the forensic use of blockchain technology.

Asia-Pacific

- In response to the increasing cybercrime, the digital forensics capabilities of countries like India and China are being strengthened by government-supported training and research.

- In the Middle East, the use of e-commerce and digital payments has soared, resulting in an increase in the number of fraud cases, which has increased the demand for advanced digital forensics solutions.

- A good example of the kind of partnership that has developed between the police and the IT industry is the Australian program between the Cyber-Safety Foundation and the local police.

MEA

- The UAE has launched the National Strategy for Information Security, which includes a focus on the development of digital forensics skills to combat cybercrime effectively.

- DarkMatter is a local company developing forensics solutions to address the specific needs of businesses in the Middle East.

- The increasing number of cyber-attacks in the region has led to a rise in the number of forensic courses for police officers.

Latin America

- Brazil, with the new cyber-security laws, is putting a premium on the importance of forensics in legal proceedings, thereby fostering the growth of the market.

- The rise of organized cybercrime in the region has increased the collaboration between private companies and the law enforcement agencies.

- Cloud forensics solutions are being used by local firms, which enable scalability and greater efficiency.

Did You Know?

“By 2022 it was estimated that some 70 per cent of companies had been subjected to a cyber-attack, highlighting the need for a powerful digital forensics capability.” — Cybersecurity Ventures

Segmental Market Size

The Digital Forensics Market is growing at a steady pace, driven by the growing need for cyber security and data recovery solutions. The demand for digital forensics is increasing with the rise in the number of cyber attacks and the stricter regulatory frameworks. The need for advanced forensics capabilities is increasing with the rise in the number of cyber attacks. Stringent data protection regulations such as the General Data Protection Regulation (GDPR) are compelling the organizations to maintain data integrity and compliance.

The mobile forensics market has been in a state of maturity for a while now, with leaders like Cellebrite and AccessData offering comprehensive forensic tools. There are a number of different applications in criminal investigations, the detection of fraud, and the investigation of data breaches, where digital forensics plays an important role in gathering evidence and analyzing it. The growing sophistication of cyberattacks and the increasing importance of data privacy are driving the market. Artificial intelligence and cloud-based forensics solutions are driving the development of the market.

Future Outlook

The digital forensics market is projected to grow significantly from 2023 to 2032, with a CAGR of 11.3% from $ 11.6 billion to $29.5 billion. The growth of this market is due to the escalating need for information security, the increasing amount of digital data and the increasing frequency of cybercrime. Various industries are now realizing the importance of digital forensics in securing their assets and ensuring regulatory compliance. This is causing a significant increase in the use of advanced forensic tools and services. Enterprises will be able to respond to incidents more effectively by integrating digital forensics into their security strategies by 2032.

Artificial intelligence and machine learning are set to revolutionize the digital forensics landscape. These tools will enable faster data analysis, improved threat detection, and more efficient investigation processes. Moreover, as data privacy regulations such as the General Data Protection Regulation (GDPR) and the Californian Consumers’ Pro-tection Act (CCPA) come into force, digital forensics will be called on to ensure compliance and to reduce the risk of data breaches. Cloud forensics and the integration of blockchain technology to secure data verification will also shape the market’s dynamics, presenting new opportunities for growth and innovation.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 11.6 billion |

| Growth Rate | 11.30% (2024-2032) |

Digital Forensics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.