- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

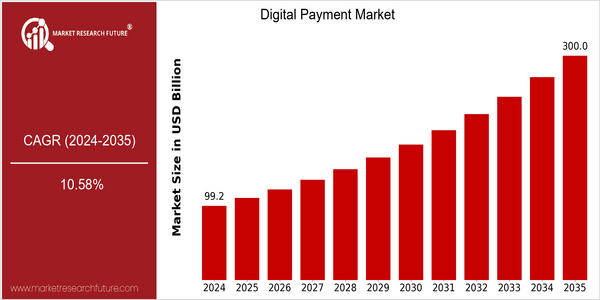

| Year | Value |

|---|---|

| 2024 | USD 99.21 Billion |

| 2035 | USD 300.0 Billion |

| CAGR (2025-2035) | 10.58 % |

Note – Market size depicts the revenue generated over the financial year

The digital payment market is expected to reach $ 99.21 billion in 2024, with the potential to reach $ 300 billion by 2035. This represents a strong CAGR of 10.58 percent from 2025 to 2035. The increasing use of digital payment solutions in various industries, mainly driven by the spread of smart phones and Internet access, is the main driver of this market. Also, the transition to cashless payments, accelerated by the pandemic of COVID 19, has further increased the demand for safe and convenient payment methods. In addition, technological developments such as the use of the block chain, artificial intelligence and contactless payment methods are also expected to play an important role in shaping the digital payment landscape. The companies at the forefront of this revolution are PayPal, Square and Stripe, which are constantly developing their products through strategic alliances and investments in new technologies. The recent initiatives of PayPal to enhance its mobile payment capabilities and Square to launch a cryptocurrency payment platform are just two examples of how dynamic this market is. As consumer preferences evolve and businesses seek to optimize their payment processes, the digital payment market is expected to continue to grow in the coming years.

Regional Market Size

Regional Deep Dive

The digital payment market is growing significantly in many regions of the world, driven by technological advances, the proliferation of smart phones and the growing inclination towards cashless transactions. North America is characterised by the high take-up of digital wallets and contactless payments, while Europe is seeing a proliferation of regulations that support secure, digital transactions. The Asia-Pacific region stands out in terms of the rapid digitalisation and the large number of unbanked people, which offers considerable opportunities for mobile payment solutions. In the Middle East and Africa, new fintech solutions are emerging that address specific challenges, while Latin America is benefiting from the growth in e-commerce, which is bolstering digital payments.

Europe

- The European Union's strong regulatory framework, including the General Data Protection Regulation (GDPR), is shaping how digital payment companies handle consumer data, promoting trust and security.

- Innovations in blockchain technology are being explored by companies like Revolut and TransferWise, aiming to streamline cross-border payments and reduce transaction costs.

Asia Pacific

- Countries like China and India are leading the charge in mobile payments, with platforms such as Alipay and Paytm driving widespread adoption among consumers and merchants.

- Government initiatives, such as India's Digital India program, are promoting financial inclusion and encouraging the use of digital payment methods in rural areas.

Latin America

- The rapid growth of e-commerce in Latin America is driving the adoption of digital payment solutions, with companies like MercadoPago leading the way.

- Government programs aimed at increasing financial literacy and access to banking services are encouraging the shift towards digital payments in the region.

North America

- The rise of fintech companies like Square and PayPal has revolutionized the digital payment landscape, offering innovative solutions that cater to both consumers and businesses.

- Regulatory changes, such as the implementation of the Payment Services Directive 2 (PSD2) in the U.S., are enhancing security and fostering competition among payment service providers.

Middle East And Africa

- The rise of mobile money services, such as M-Pesa in Kenya, has transformed the digital payment landscape, providing financial services to millions of unbanked individuals.

- Regulatory bodies in the region are increasingly supporting fintech innovation, with initiatives aimed at fostering a conducive environment for digital payment solutions.

Did You Know?

“As of 2023, over 2.1 billion people worldwide are expected to use mobile payment services, highlighting the growing trend towards cashless transactions.” — example.com

Segmental Market Size

The digital payments market is growing rapidly, driven by the increasing popularity of cashless transactions and the shift to e-commerce. There are many reasons for this, including a growing demand for convenience and speed of transactions, and the regulatory environment which favours the development of digital finance. Such initiatives as the European Payment Services Directive (PSD2) encourage competition and innovation in payment services and stimulate market activity. There are already well-established leaders in the digital payments market, such as PayPal, Square, and fintech start-ups in North America and Asia-Pacific. The main applications of digital payments include e-payments, mobile wallets and P2P payment services. Various trends, such as the COVID-09 pandemic, have accelerated the shift to digital payments, as consumers and businesses seek more secure ways of transferring funds. The emergence of new technologies, such as blockchain and artificial intelligence, is also affecting the digital payments market.

Future Outlook

From 2024 to 2035, the digital payment market is expected to grow at a CAGR of 10.26%, from USD 109.21 billion to USD 301.89 billion. This growth will be driven by the growing demand for digital payment solutions in different sectors, driven by the convenience, speed and security of transactions. By 2035, it is estimated that more than 70% of the global payment will be made through digital payment, which is a major shift in consumer behavior and payment preferences. The integration of artificial intelligence and blockchain technology is expected to enhance the efficiency and security of digital payment systems. The emergence of supportive regulatory policies and government initiatives to promote cashless economies will further promote the development of the market. The rise of mobile wallets and the growing popularity of cryptocurrencies will also play an important role in the development of the market. The more consumers and businesses adopt these innovations, the more efficient the digital payment system will become.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 97.15 Billion |

| Growth Rate | 15.08% (2024-2032) |

Digital Payment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.