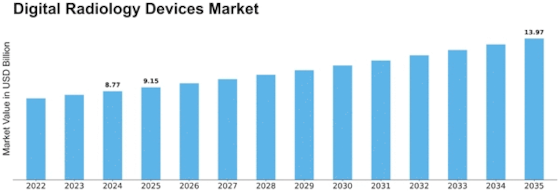

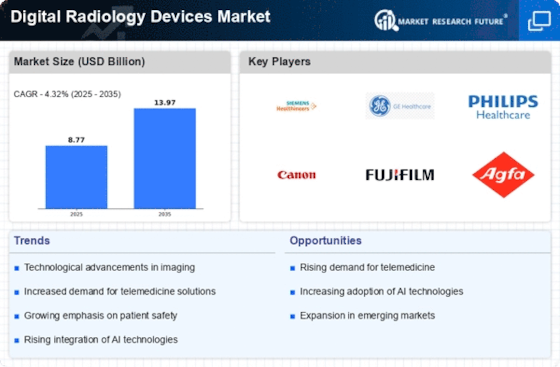

Digital Radiology Devices Size

Digital Radiology Devices Market Growth Projections and Opportunities

The global market for portable diagnostic devices is experiencing a robust growth trajectory, propelled by a confluence of factors that underscore its significance in the healthcare landscape. Technological advancements, a surge in chronic diseases, and substantial investments from both public and private entities are the driving forces behind this expansion. However, amidst the promising prospects, the market faces a notable impediment in the form of a knowledge gap, hindering the full realization of its growth potential. One of the primary drivers fueling the ascent of the global portable diagnostic devices market is the relentless march of technological progress. The continuous evolution and innovation in diagnostic technologies have led to the development of portable devices that offer convenience, efficiency, and improved patient outcomes. These devices empower healthcare professionals to conduct diagnostic tests at the point of care, facilitating swift and accurate assessments. The increasing prevalence of chronic diseases is another pivotal factor contributing to the market's growth. Conditions such as diabetes, cardiovascular diseases, and respiratory ailments are on the rise globally. Portable diagnostic devices play a crucial role in the early detection, monitoring, and management of these chronic conditions. The ability to conduct diagnostic tests outside traditional healthcare settings is particularly advantageous in managing diseases that require frequent monitoring and prompt intervention. Furthermore, the global portable diagnostic devices market is buoyed by substantial funding and investment pouring in from both public and private organizations. Recognizing the transformative potential of these devices in enhancing healthcare accessibility and outcomes, various entities are channeling resources into research, development, and deployment. This influx of financial support has fueled the innovation pipeline, leading to the creation of advanced, user-friendly, and cost-effective portable diagnostic solutions. Despite the optimistic outlook, a notable challenge impedes the seamless growth of the market – the lack of knowledge to operate portable diagnostic devices. While these devices are designed to be user-friendly, the healthcare landscape comprises diverse professionals with varying levels of technological proficiency. The successful integration of portable diagnostic devices into routine healthcare practices requires a concerted effort to bridge this knowledge gap. Addressing the knowledge barrier involves targeted training programs, educational initiatives, and awareness campaigns aimed at healthcare professionals. Manufacturers and stakeholders in the portable diagnostic devices market need to collaborate with healthcare institutions and educational bodies to ensure that users are well-equipped to harness the full potential of these devices. This proactive approach not only enhances the adoption rate but also contributes to the effective utilization of portable diagnostic devices in diverse healthcare settings. The global portable diagnostic devices market stands at the crossroads of tremendous growth opportunities and critical challenges. The synergistic impact of technological advancements, the rising prevalence of chronic diseases, and substantial investments paints a promising picture for the market's future. However, the need to address the knowledge gap among healthcare professionals is an imperative task that requires collective efforts from industry players, healthcare institutions, and educational bodies. As the market continues to evolve, overcoming this challenge will be pivotal in unlocking the full potential of portable diagnostic devices and ensuring their widespread adoption in the global healthcare ecosystem.

Leave a Comment