Digital Railway Market Summary

As per MRFR Analysis, the Digital Railway Market is projected to grow from USD 83.32 billion in 2025 to USD 201.39 billion by 2034, with a CAGR of 10.30% during the forecast period. The market was valued at USD 75.54 billion in 2024. Key drivers include increasing urbanization, the need for enhanced railway safety and efficiency, and growing environmental sustainability awareness.

Key Market Trends & Highlights

The market is witnessing significant trends driven by safety and efficiency improvements.

- The railway operation management segment generated the most revenue due to increased demand for effective and safe operations.

- North America dominated the market in 2022 with a share of 45.80%, driven by the need for modernization.

- The Asia-Pacific region is expected to grow at the fastest CAGR from 2023 to 2032, fueled by rapid urbanization.

- Digital technologies like Positive Train Control (PTC) and European Train Control System (ETCS) are crucial for enhancing safety.

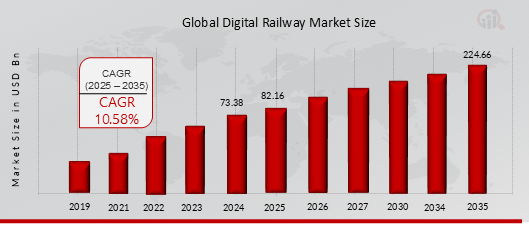

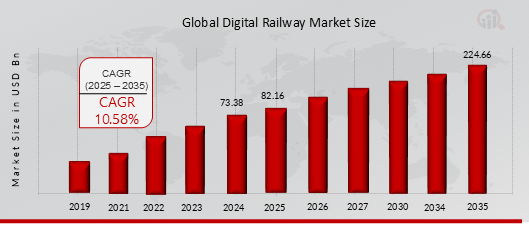

Market Size & Forecast

2025 Market Size: USD 82.16 Billion

2035 Market Size: USD 224.66 Billion

CAGR: 10.58%

2024 Market Size: USD 73.38 Billion.

Major Players

Major players include Siemens, Wabtec, Cisco, ABB, Huawei, Thales, IBM, Alstom, Bombardier, and Tego.

The government investment in smart infrastructure and rail modernization (e.g., EU TEN-T, INDIA'S PM Gati Shakti) and increased demand for sustainable transport solutions and technological advancements in IOT and AI are driving the growth of the digital railway market.

As per the Analyst at MRFR, the digital railway sector is propelled by a blend of strategic drivers, emerging opportunities, and notable restraints. Key drivers include government-backed infrastructure modernization programs (e.g., EU TEN-T, India’s PM Gati Shakti), global decarbonization goals, and the adoption of 5G and cloud technologies, alongside operational needs such as real-time monitoring, cost reduction, and improved passenger experiences.

However, progress is tempered by restraints like high upfront costs, regulatory fragmentation, cybersecurity concerns, and integration challenges with legacy systems—further compounded by a skills gap and organizational resistance to change. Despite these hurdles, significant opportunities exist in AI/ML-driven autonomous operations, digital twins, IoT-based condition monitoring, and cloud-native OT platforms.

FIGURE 1: DIGITAL RAILWAY MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Digital Railway Market Opportunity

EXPANSION OF HIGH-SPEED RAIL NETWORKS

The expansion of high-speed rail (HSR) networks presents a significant long-term opportunity for the growth of the digital railway market. High-speed rail is not only a symbol of technological progress but also a key enabler of regional economic development, environmental sustainability, and inter-city connectivity. As countries invest heavily in building or upgrading HSR lines, the integration of digital technologies—such as smart signaling systems, IoT-enabled maintenance, AI-driven traffic control, real-time passenger information, and automated operations—becomes essential for ensuring safety, optimizing performance, and enhancing passenger experience. The synergy between high-speed rail expansion and digital railway adoption will have wide-reaching impacts in the short (2025–2027), medium (2028–2031), and long term (2032–2035), as recent examples from countries like China, India, and Spain illustrate.

Short-Term Impact (2025–2027): Launchpad for Digital Infrastructure Investment

In the short term, from 2025 to 2027, the construction and commissioning of high-speed rail networks act as a catalyst for rapid digital infrastructure investment. HSR projects are technologically demanding from the outset, requiring advanced signaling systems like the European Train Control System (ETCS), automated train operation (ATO), and robust communication infrastructure such as GSM-R or LTE-R. These requirements create immediate demand for digital solutions and foster public-private collaborations in areas such as system integration, data analytics, and cyber-physical safety systems.

Medium-Term Impact (2028–2031): Network Optimization and Passenger-Centric Innovations

As high-speed rail corridors become operational in the medium term (2028–2031), their impact on the digital railway market expands beyond infrastructure to include operational efficiency and enhanced passenger services. With trains running at speeds above 300 km/h, real-time data becomes vital to monitor track conditions, rolling stock integrity, and passenger safety. Digital twins of trains and infrastructure, powered by IoT sensors and cloud analytics, enable predictive maintenance that minimizes downtime and extends asset life.

Long-Term Impact (2032–2035): Fully Integrated Smart Mobility Ecosystems

By the long term (2032–2035), high-speed rail systems evolve into core components of fully integrated, smart mobility ecosystems. These ecosystems rely heavily on digital railway technologies to ensure ultra-reliable, energy-efficient, and autonomous rail operations. HSR corridors become data-rich environments where every asset—from overhead wires to wheelsets—is continuously monitored and optimized through AI and machine learning. Centralized control centers orchestrate traffic across vast regions, balancing passenger and freight flows in real-time.

Digital Railway Market Segment Insights

Digital Railway by Component Insights

Based on Component, this segment includes Hardware (Networking Connectivity Devices, Control and Maintenance Devices, Video Surveillance Cameras, Multimedia Infotainment Devices, Other Hardware), Software, Services (Consulting Services, System Integration Deployment, Support Maintenance). The Services segment dominated the global market in 2024, while the Software segment is projected to be the fastest–growing segment during the forecast period.

The services component of the digital railway market is the largest among all segments, underscoring the critical role of expertise, integration, and ongoing support in deploying and maintaining advanced rail technologies. Valued at USD 33,001 million in 2024, the services segment is projected to surge to USD 103,796 million by 2035, expanding at a compound annual growth rate (CAGR) of 10.85% from 2025 to 2035. This robust growth reflects the expanding scale and complexity of digital railway deployments worldwide, the growing reliance on cloud-based and AI-driven platforms, and the increasing adoption of outsourced, as-a-service delivery models.

Digital Railway by Solution Insights

Based on Solution, this segment includes Smart Ticketing System, Rail Communication Networking System, Advanced Security Monitoring System, Passenger Information System, Rail Analytics System, Freight Information System, Track Monitoring and Maintenance, Signalling Control System, Infrastructure Maintenance Services, Train Control Management System, Safety Security Solutions, Others. The Rail Communication Networking System segment dominated the global market in 2024, while the Passenger Information System segment is projected to be the fastest–growing segment during the forecast period.

The Rail Communication Networking System segment is the largest in the digital railway market, reflecting its foundational role in enabling smart, connected, and safe railway operations. In 2024, the segment was valued at USD 13,764 million, and it is projected to reach USD 42,818 million by 2035, registering a CAGR of 10.74% during the forecast period from 2025 to 2035. This steady growth is being driven by global efforts to digitalize railway infrastructure, increase system interoperability, and enhance real-time communication between train control centers, operators, and rolling stock. Regionally, Europe leads the way in deploying advanced rail communication systems, largely underpinned by EU mandates for seamless cross-border operations and the deployment of the European Rail Traffic Management System (ERTMS).

Nations like Germany, France, Spain, and Italy are at the forefront of implementing GSM-R and upgrading to LTE-R and 5G-based Future Railway Mobile Communication Systems (FRMCS). These technologies are crucial in ensuring real-time control and management of high-speed rail systems, reducing the risk of collisions and enabling automated train operations.

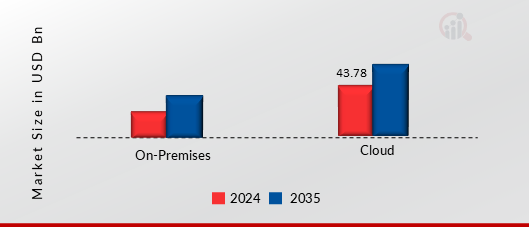

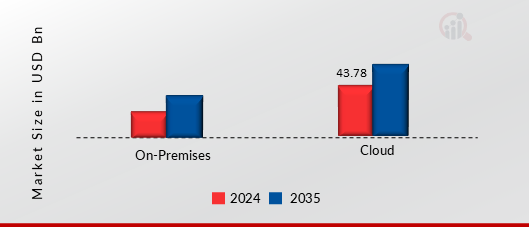

Digital Railway by Deployment Insights

Based on Deployment, this segment includes On-Premises, Cloud. The Cloud segment dominated the global market in 2024, while the Cloud segment is projected to be the fastest–growing segment during the forecast period. Cloud deployment has emerged as a transformative force in the Digital Railway Market, driven by the growing need for scalable, flexible, and cost-efficient digital infrastructure. Unlike on-premises systems that require extensive local hardware and IT resources, cloud deployment enables railway operators to access software, platforms, and processing power via remote data centers managed by third-party providers.

This model facilitates real-time data access, centralized control, remote diagnostics, and the rapid deployment of digital services across extensive rail networks. Between 2019 and 2024, cloud-based solutions grew from a supplementary option to a mainstream strategy, and their dominance is expected to solidify over the forecast period through 2035.

FIGURE 2: DIGITAL RAILWAY MARKET SHARE BY DEPLOYMENT 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

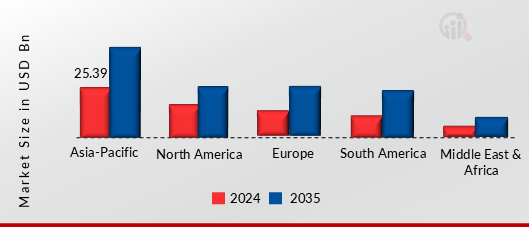

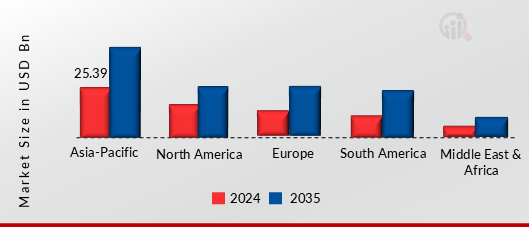

Digital Railway Regional Insights

Based on the Region, the global Digital Railway is segmented into North America, Europe, Asia-Pacific, South America and Middle East & Africa. The Asia-Pacific dominated the global market in 2024, while the Asia Pacific is projected to be the fastest–growing segment during the forecast period. Major demand factors driving the Asia-Pacific market are the Asia-Pacific region leads the global growth trajectory, with the digital railway market valued at USD 25,390.8 million in 2024, projected to hit USD 28,616.5 million in 2025 and USD 83,417.7 million by 2035, reflecting the highest CAGR among all regions at 11.29%. Massive urbanization, government-backed infrastructure projects, and rapid adoption of advanced technologies are the major drivers here.

China and India are investing heavily in high-speed rail and metro networks, under initiatives like the Belt and Road Initiative and Smart Cities Mission. Japan and South Korea, known for their technological innovation, are not only advancing domestic railway systems but also exporting their technologies globally. Emerging economies in Southeast Asia are also upgrading rail networks for better intercity and cross-border connectivity.

FIGURE 3: DIGITAL RAILWAY MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, the UK, Russia, Spain, Italy, Rest of Europe, China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Turkey, GCC Countries (e.g., Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain), South Africa, Rest of Middle East & Africa and others.

Digital Railway Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Digital Railway Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are Siemens Mobility, Hitachi Rail, Alstom, Cisco Systems Inc, ABB, Huawei Technologies, Thales Group, IBM, Wabtec Corporation, Trimble Inc are among others. The Digital Railway Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Digital Railway Market include

- Siemens Mobility

- Hitachi Rail

- Alstom

- Cisco Systems Inc

- ABB

- Huawei Technologies

- Thales Group

- IBM

- Wabtec Corporation

- Trimble Inc

Digital Railway Market Industry Developments

Mar-25: Announced the acquisition of Dellner Couplers, a leader in train connection systems, enhancing Wabtec's portfolio in passenger rail systems.

Jul-24: Announced the debut of a combined partner program in early 2025, aimed at expanding capabilities for managed service providers (MSPs).

Aug-24: Celebrated global winners of the 2024 IBM Partner Plus Awards, recognizing outstanding expertise and innovation among its partners.

Sep-24: Announced the 2024 Ovation Award winners for excellence in transportation and logistics, highlighting innovative use of Trimble technology.

Digital Railway Market Segmentation

Digital Railway by Component Outlook

-

Hardware

- Networking Connectivity Devices

- Control and Maintenance Devices

- Video Surveillance Cameras

- Multimedia Infotainment Devices

- Other Hardware

- Software

-

Services

- Consulting Services

- System Integration Deployment

- Support Maintenance

Digital Railway by Solution Outlook

- Smart Ticketing System

- Rail Communication Networking System

- Advanced Security Monitoring System

- Passenger Information System

- Rail Analytics System

- Freight Information System

- Track Monitoring and Maintenance

- Signalling Control System

- Infrastructure Maintenance Services

- Train Control Management System

- Safety Security Solutions

- Others

Digital Railway by Deployment Outlook

Digital Railway Regional Outlook

-

North America

-

Europe

- Germany

- France

- UK

- Russia

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- Turkey

- GCC Countries (e.g., Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain)

- South Africa

- Rest of Middle East & Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 73.38 Billion

|

|

Market Size 2025

|

USD 82.16 Billion

|

|

Market Size 2035

|

USD 224.66 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

10.58% (2025-2035)

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Historical Data

|

2019-2023

|

|

Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

By Component, By Solution, By Deployment

|

|

Geographies Covered

|

North America, Europe, Asia Pacific, South America, Middle East & Africa

|

|

Countries Covered

|

The US, Canada, Mexico, Germany, France, the UK, Russia, Spain, Italy, Rest of Europe, China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Turkey, GCC Countries (e.g., Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain), South Africa, Rest of Middle East & Africa

|

|

Key Companies Profiled

|

Siemens Mobility, Hitachi Rail, Alstom, Cisco Systems Inc, ABB, Huawei Technologies, Thales Group, IBM, Wabtec Corporation, Trimble Inc

|

|

Key Market Opportunities

|

· Expansion of High-Speed Rail Networks

· Growth of Freight and Logistics Solutions and Smart City Initiatives

|

|

Key Market Dynamics

|

· Government investment in smart infrastructure and rail modernization (e.g., EU TEN-T, India's PM Gati Shakti)

· Increased Demand for Sustainable Transport Solutions

|

Digital Railway Market Highlights:

Frequently Asked Questions (FAQ) :

USD 73.38 Billion is the Digital Railway Market in 2024

The Cloud segment by Deployment holds the largest market share and grows at a CAGR of 10.88% during the forecast period.

Asia-Pacific holds the largest market share in the Digital Railway Market.

Siemens Mobility, Hitachi Rail, Alstom, Cisco Systems Inc, ABB, Huawei Technologies, Thales Group, IBM, Wabtec Corporation, Trimble Inc are prominent players in the Digital Railway Market.

The Rail Communication Networking System segment dominated the market in 2024.