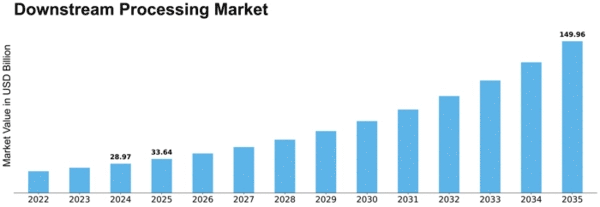

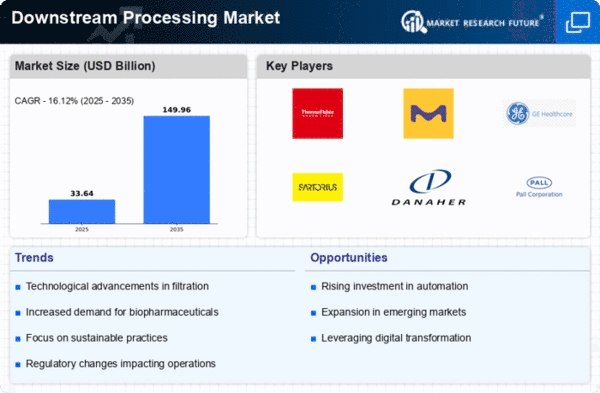

Downstream Processing Size

Downstream Processing Market Growth Projections and Opportunities

The downstream processing market is pushed by the growing biopharmaceutical industry. As the interest for biologics, including monoclonal antibodies and immunizations, keeps on rising, downstream processing becomes vital for the filtration and limitation of biotherapeutic items, driving market development. The pattern towards single-use innovations in downstream processing is a huge market factor. Single-use systems offer practical and adaptable arrangements, lessening the requirement for cleaning and approval, and improving the proficiency of downstream cycles, prompting expanded reception by biopharmaceutical makers. The business' attention on consistent assembling processes emphatically impacts the downstream processing market. Constant processing offers benefits, for example, decreased creation time, expanded efficiency, and better cycle control, lining up with the business' journey for productivity and cost-viability. The extension of bioproduction offices overall adds to the interest for downstream processing advancements. Expanded assembling limits require versatile and effective downstream cycles to deal with bigger volumes of biopharmaceutical items, cultivating market development. The rise of customized medication, including cell and quality treatments, influences downstream processing. These creative treatments frequently require concentrated cycles to refine and focus novel natural items, driving the advancement of custom-made downstream processing arrangements. The interest for high-throughput advancements in downstream processing is driven by the requirement for quicker and more effective bioproduction. High-throughput techniques empower the processing of bigger volumes in a more limited time, meeting the business' necessities for expanded efficiency and decreased time-to-market. The pattern in the biopharmaceutical business impacts the downstream processing market. Contract manufacturing organisations (CMOs) and contract development and manufacturing associations (CDMOs) look for cutting edge downstream processing capacities to offer far reaching bioproduction administrations, driving the reception of creative advances.

Leave a Comment