Market Trends

Key Emerging Trends in the Drone Package Delivery System Market

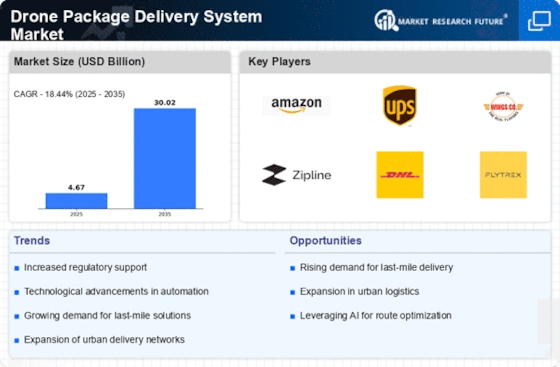

The drone package delivery system market is experiencing rapid growth and transformative trends driven by technological advancements, regulatory developments, and increasing demand for fast and efficient last-mile delivery solutions. One prominent trend in this market is the proliferation of drone delivery services by e-commerce companies, logistics providers, and technology firms seeking to revolutionize the way goods are transported and delivered. Drones offer a cost-effective and environmentally friendly alternative to traditional delivery methods, enabling companies to reach customers in remote or congested areas more quickly and efficiently. As a result, the drone package delivery system market is witnessing widespread adoption and investment, with companies exploring innovative use cases and scaling up drone delivery operations.

Moreover, technological advancements in drone design, propulsion systems, and autonomous navigation capabilities are driving innovation and expanding the capabilities of drone package delivery systems. The development of long-range drones with extended flight endurance, payload capacity, and advanced sensors enables drones to deliver larger packages over longer distances, opening up new opportunities for commercial applications in urban and rural areas. Additionally, advancements in sense-and-avoid technology, AI-powered route planning, and real-time airspace management systems enhance the safety, reliability, and efficiency of drone delivery operations, enabling drones to navigate complex environments and avoid collisions with obstacles and other airspace users.

Furthermore, regulatory developments and policy initiatives are shaping the landscape of the drone package delivery system market, with governments around the world working to establish clear guidelines and regulations for drone operations. Regulatory frameworks governing drone operations, airspace integration, and safety standards play a crucial role in enabling the safe and responsible deployment of drone delivery services. Regulatory agencies are working closely with industry stakeholders to develop standards for drone certification, pilot training, and operational procedures, ensuring compliance with aviation regulations and mitigating safety risks associated with drone operations in populated areas.

Additionally, the COVID-19 pandemic has accelerated the adoption of drone package delivery systems as companies seek contactless and socially distant delivery solutions to meet changing consumer preferences and address disruptions in supply chains. Drones offer a contactless delivery option that minimizes human contact and reduces the risk of virus transmission, making them well-suited for delivering essential goods, medical supplies, and food items during public health emergencies. As a result, there has been increased interest and investment in drone delivery services by governments, healthcare providers, and retailers seeking to leverage drones for rapid response and emergency logistics operations.

Moreover, the drone package delivery system market is witnessing the emergence of new business models and partnerships aimed at unlocking the full potential of drone delivery technology. Collaborations between e-commerce platforms, drone manufacturers, and logistics companies enable end-to-end delivery solutions that seamlessly integrate drone delivery with existing supply chain networks and fulfillment processes. Additionally, partnerships with regulatory authorities, academic institutions, and local communities facilitate pilot programs, test flights, and demonstrations to validate the feasibility and safety of drone delivery operations in diverse environments and use cases.

However, despite the opportunities and advancements in the drone package delivery system market, several challenges remain, including airspace congestion, public acceptance, and infrastructure limitations. Managing airspace congestion and ensuring the safe integration of drones into existing airspace infrastructure require coordination among regulators, air traffic control agencies, and drone operators to implement effective traffic management systems and avoid conflicts with manned aircraft. Additionally, addressing public concerns about privacy, noise pollution, and safety risks associated with drone operations is essential for gaining public acceptance and support for drone delivery initiatives.

Leave a Comment