Top Industry Leaders in the Drone Transponders Market

Strategies Adopted:

Product Innovation: Key players focus on developing advanced transponder solutions that meet regulatory standards and address the evolving needs of drone operators.

Strategic Partnerships: Collaborations with UAV manufacturers, airspace regulators, and technology providers help expand market reach and enhance product offerings.

Acquisitions: Companies may acquire smaller firms to gain access to innovative technologies and expand their market presence.

Geographic Expansion: Key players may explore new markets and regions to capitalize on emerging opportunities and increase market share.

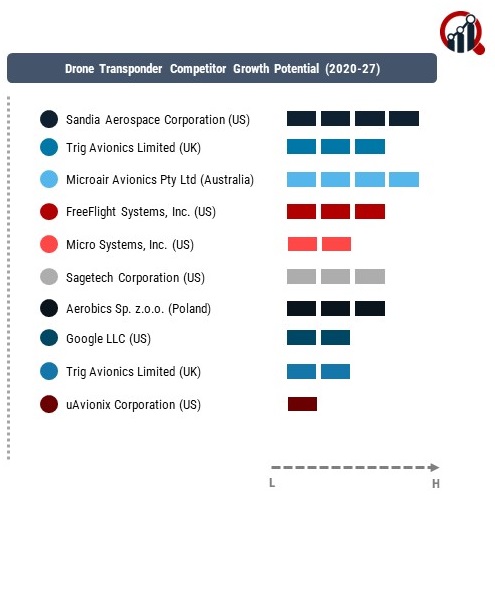

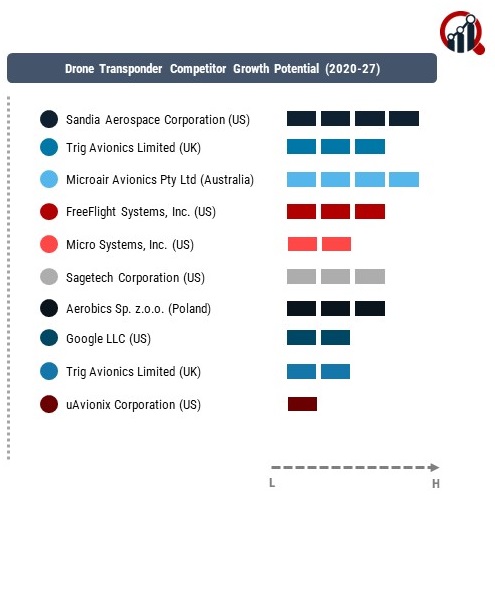

Key Players:

Sandia Aerospace Corporation (US)

Trig Avionics Limited (UK)

Microair Avionics Pty Ltd (Australia)

FreeFlight Systems, Inc. (US)

Micro Systems, Inc. (US)

Sagetech Corporation (US)

Aerobics Sp. z.o.o. (Poland)

Google LLC (US)

Trig Avionics Limited (UK)

uAvionix Corporation (US)

L3Harris Technologies, Inc. (US)s

Factors for Market Share Analysis:

Product Reliability: The reliability and performance of transponder solutions significantly influence market share, with operators preferring products that meet regulatory standards and offer robust performance.

Regulatory Compliance: Adherence to regulatory requirements, such as FAA regulations in the US and EASA standards in Europe, is crucial for gaining market acceptance and maintaining a competitive edge.

Integration Capabilities: Transponders that seamlessly integrate with existing UAV platforms and airspace management systems are preferred by operators for their ease of use and compatibility.

Customer Support: Effective customer support services play a vital role in building brand loyalty and sustaining market share by addressing customer inquiries and resolving issues promptly.

New and Emerging Companies:

Altitude Angel

Peregrine UAS

Current Company Investment Trends:

Research and Development: Investments in R&D to enhance transponder functionality, reliability, and compliance with evolving regulations.

Product Certification: Funds allocated for obtaining certifications and approvals from regulatory authorities to ensure market readiness and compliance.

Market Expansion: Investments in market expansion initiatives, including sales and marketing efforts, strategic partnerships, and geographic expansion to tap into new market segments and regions.

Overall Competitive Scenario:

Intense Competition: The drone transponder market is highly competitive, with key players vying for market share through product differentiation, innovation, and strategic collaborations.

Innovation: Continuous innovation is key to staying competitive, with companies focusing on developing next-generation transponder solutions that address the evolving needs of the UAV industry.

Regulatory Compliance: Adherence to regulatory standards and proactive engagement with regulators are essential for maintaining market leadership and ensuring long-term success in the drone transponder market.

Industry News:

Regulatory Approvals: Updates on regulatory approvals for new transponder technologies and standards.

Technological Advancements: News related to advancements in ADS-B, Mode S, and collision avoidance systems.

Market Trends: Insights into emerging trends, such as the integration of UTM solutions and the adoption of remote ID technologies.