Market Analysis

In-depth Analysis of Ductile Iron Pipes Market Industry Landscape

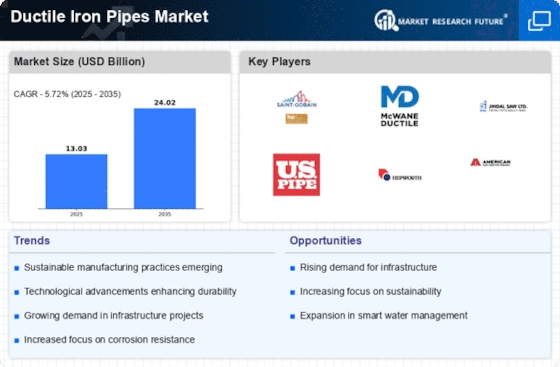

The Ductile Iron Pipes market is influenced by dynamic factors that shape the production, demand, and applications of these robust piping solutions widely used in water and wastewater systems. Ductile iron pipes, known for their durability, strength, and corrosion resistance, play a crucial role in water supply, sewerage, and various industrial applications. The market dynamics are intricately linked to factors such as urbanization trends, infrastructure development, regulatory standards, technological advancements, and the need for reliable and long-lasting piping solutions.

On the basis of application, the segment is divided into– irrigation and water and wastewater. The water and wastewater segment is expected to show maximum growth during the forecast period. The proliferating population and economic growth are factors that are expected to increase the demand for water. This opportunity has been met with various beneficial government and non-government initiatives in terms of policies and regulations.

One of the key drivers of the Ductile Iron Pipes market is the global emphasis on water infrastructure development. As cities expand and urban populations grow, the demand for efficient water distribution and sewage systems increases. Ductile iron pipes are favored for their ability to withstand high pressures, provide long-term reliability, and resist external factors such as soil movement and corrosion, making them a preferred choice for water-related infrastructure projects.

Infrastructure development significantly contributes to the market dynamics of Ductile Iron Pipes. The versatility and performance characteristics of ductile iron pipes make them suitable for various applications, including potable water distribution, wastewater conveyance, and industrial fluid transportation. The demand for these pipes is closely tied to the growth of infrastructure projects, emphasizing the need for resilient and durable piping solutions.

Urbanization trends play a pivotal role in shaping the market dynamics of Ductile Iron Pipes. As more people migrate to urban areas, the demand for reliable and sustainable water and sewerage systems rises. Ductile iron pipes, with their ability to handle heavy loads, resist corrosion, and provide long-term service, are essential in meeting the demands of modern urban infrastructure projects.

Technological advancements in ductile iron pipe manufacturing contribute to the market dynamics, allowing for the development of pipes with improved performance characteristics. Innovations in casting technology, lining materials, and protective coatings enhance the strength, durability, and corrosion resistance of ductile iron pipes. Manufacturers invest in research and development to incorporate the latest technologies, making ductile iron pipes more resilient and adaptable to various applications.

Regulatory standards and certifications play a vital role in shaping the market dynamics of Ductile Iron Pipes. Quality standards related to material composition, pipe dimensions, and performance characteristics influence the manufacturing and specification processes. Compliance with these standards is essential for manufacturers to ensure that their ductile iron pipes meet the necessary requirements for construction projects, water supply systems, and environmental safety.

Supply dynamics in the Ductile Iron Pipes market are influenced by factors such as the availability and cost of raw materials (iron and alloying elements), manufacturing capabilities, and regional demand patterns. The iron and steel industry, key suppliers for ductile iron pipe production, play a significant role in determining the overall supply chain dynamics. Additionally, global trade dynamics, including tariffs and transportation costs, impact the availability of ductile iron pipes in different regions.

Global trade dynamics are significant in the Ductile Iron Pipes market, with many countries involved in both the production and consumption of these piping solutions. Trade agreements, tariffs, and regional economic conditions can impact the flow of ductile iron pipes across borders. The market is also influenced by competition among manufacturers to offer innovative pipe solutions with enhanced features, including larger diameters, improved corrosion resistance, and innovative jointing systems.

Environmental considerations are increasingly shaping the market dynamics of Ductile Iron Pipes. While the production of iron and steel involves energy-intensive processes, ductile iron pipes are considered environmentally friendly due to their long service life, recyclability, and resistance to corrosion, reducing the need for frequent replacements. The industry is responding to the demand for sustainable solutions by implementing eco-friendly practices in manufacturing and promoting the recyclability of ductile iron pipes.

Price volatility is a common factor in the Ductile Iron Pipes market, driven by fluctuations in raw material prices, manufacturing costs, and market demand. Companies in this dynamic market must implement effective pricing strategies and risk management practices to navigate the uncertainties associated with price variations.

Leave a Comment